In the high-stakes world of stock trading, uncertainty looms like a shadow, threatening to erode your hard-earned gains. One powerful tool to mitigate this risk is the enigmatic put option, a financial instrument that empowers you to protect your investments. Let’s embark on a journey to uncover what a put option is and explore its invaluable role in safeguarding your financial future.

Image: changehero.io

Understanding Put Options: A Haven for Security

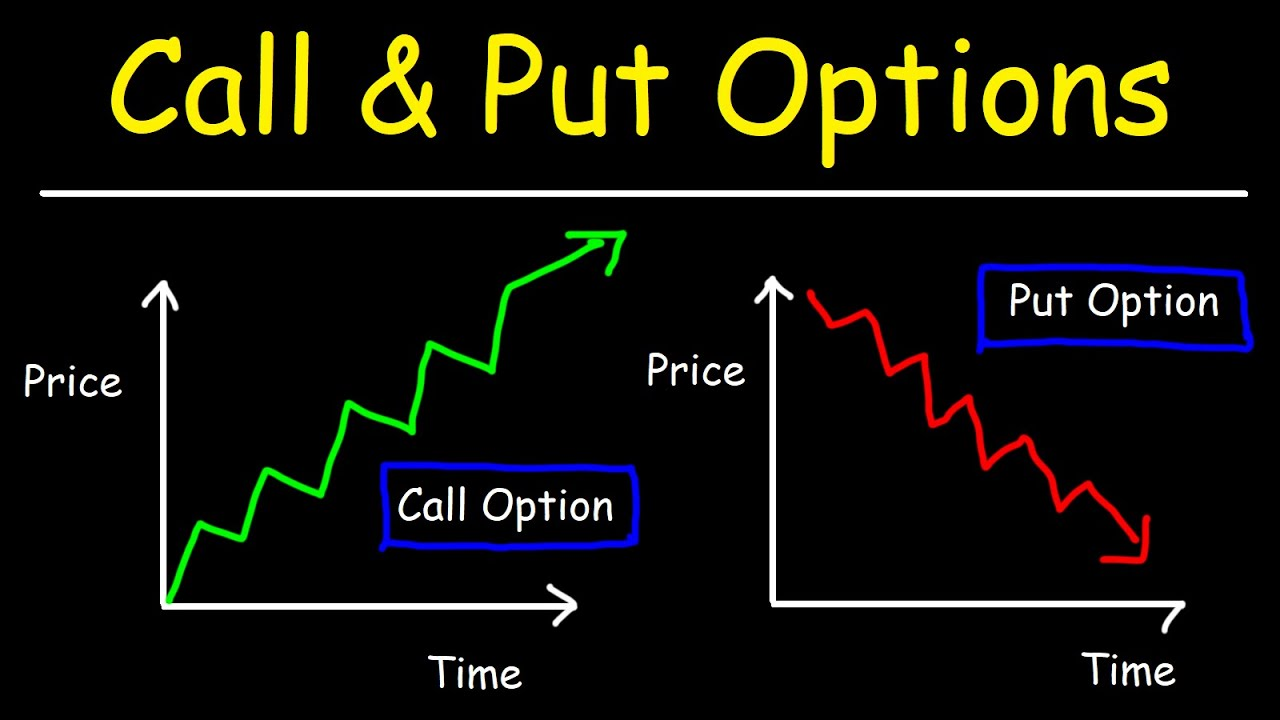

A put option, simply put, is a contract that grants you the right, but not the obligation, to sell a specific number of shares of a particular stock at a predetermined price (known as the strike price) on or before a specified date (the expiration date). By purchasing a put option, you effectively create a safety net, a contingency plan that protects you from potential market downturns.

Imagine this scenario: you’re holding a promising batch of 100 shares of XYZ Corporation, a tech giant that’s been soaring to new heights. However, a recent tech industry dip has you worried about potential losses. Purchasing a put option with a strike price of $100 and an expiration date of 6 months gives you the assurance that you can sell your shares at $100 apiece, regardless of their market value.

In a nutshell, put options act as insurance policies for your stock investments. Should the stock price plummet, you can exercise your option to sell your shares at the strike price, limiting your losses and shielding you from market volatility.

Harnessing the Power of Put Options: Strategies for the Savvy

Now that you grasp the essence of put options, let’s delve into the ingenious strategies you can employ to optimize their use:

– Portfolio Hedging: Fear not, long-term investors! Put options are your allies in protecting your precious stock portfolio from market turbulence. Use them to mitigate risk while maintaining market exposure.

– Income Generation: Who says you can’t turn market downturns into opportunities? With put options, you can sell them at a premium (the price paid to acquire an option), potentially generating income while speculating on stock price declines.

– Volatility Hedging: In the world of options, volatility is another name for uncertainty. Put options provide a haven from this uncertainty, allowing you to cap potential losses even when the market swings wildly.

Expert Insights: Voices of Wisdom in the Trading Realm

“Put options are invaluable tools for managing risk in stock trading,” advises renowned investor Warren Buffett. “They empower investors to limit their downside and enhance their peace of mind.”

“The beauty of put options lies in their flexibility,” adds financial guru Peter Lynch. “Whether you’re a seasoned trader or a novice investor, there’s a strategy tailored to your needs.”

Image: tradewithmarketmoves.com

What Is A Put Option In Stock Trading

Conclusion: Empowering Investors with Knowledge and Security

In the ever-evolving landscape of stock trading, put options stand tall as beacons of security, empowering investors to navigate market storms with confidence. Whether you’re a seasoned trader or just starting your investment journey, understanding and utilizing put options is an essential step towards protecting your financial well-being. So, embrace the wisdom of the experts, equip yourself with this invaluable knowledge, and unlock the full potential of put options in your trading strategy.