Delving into the world of options trading can be both thrilling and daunting. To navigate this multifaceted landscape successfully, selecting the right exchange-traded funds (ETFs) is paramount. In this article, we’ll explore the dynamic realm of affordable ETFs specifically tailored for options trading, empowering you with the knowledge to make informed decisions and unlock the potential of this lucrative market.

Image: blog.seedly.sg

Unveiling Low-Cost ETF Options

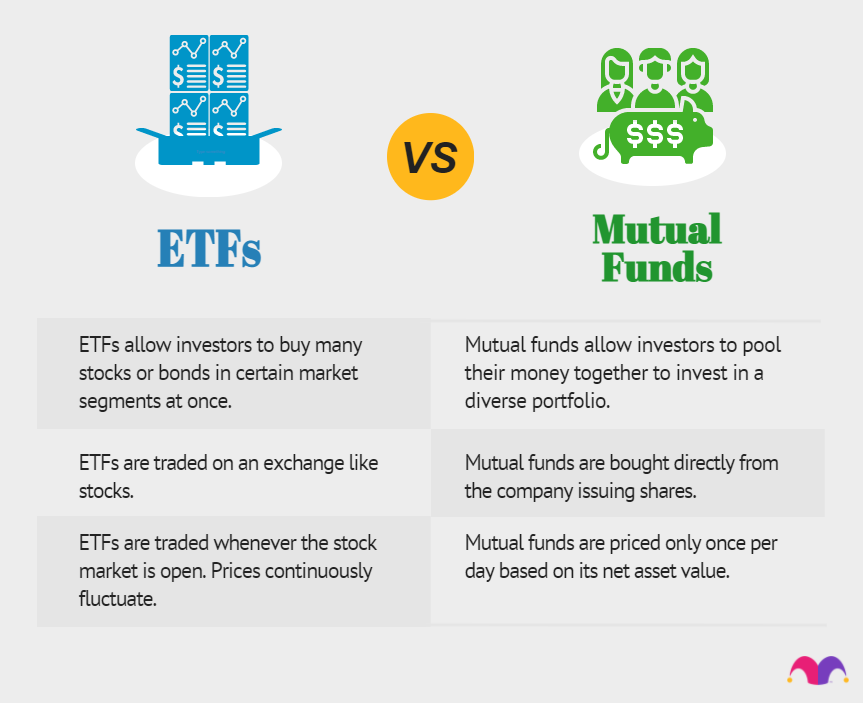

The accessibility of ETFs has revolutionized the trading landscape, providing investors with diversified portfolios that track a wide range of underlying assets. When it comes to options trading, cost-effective ETFs offer a gateway to enhance returns without breaking the bank. These ETFs offer the following advantages:

- Lower expenses: Compared to traditional mutual funds, ETFs typically incur lower fees, such as expense ratios, saving you significant costs over time.

- Liquidity: ETFs are traded on exchanges like stocks, providing liquidity and enabling you to enter and exit positions swiftly.

- Transparency: ETF holdings are transparent and easily accessible, allowing you to monitor your investments closely.

Choosing the Right Cheap ETF for Options Trading

Selecting an appropriate low-cost ETF for options trading hinges on several key factors:

- Underlying asset: Determine the underlying asset that aligns with your trading strategy, whether it’s stocks, commodities, currencies, or indices.

- Liquidity: Assess the ETF’s average daily trading volume and bid-ask spread to ensure sufficient liquidity for seamless trading.

- Option premia: Consider the implied volatility and premium prices of the ETF’s options to gauge potential profit margins.

- Expense ratio: Compare the expense ratios of different ETFs to choose one that minimizes ongoing costs.

Explore the Latest ETF Trends for Options Traders

The ETF landscape is constantly evolving, with new products and strategies emerging to meet the evolving needs of options traders. Here are some current trends to watch:

- Leveraged ETFs: Leveraged ETFs amplify the movement of an underlying asset, providing increased potential returns but also amplifying risks.

- Inverse ETFs: Inverse ETFs move in the opposite direction of the underlying asset, creating opportunities for short-selling and downside protection.

- Thematic ETFs: ETFs that track a specific theme or sector can provide targeted exposure to emerging industries or investment trends.

Image: www.fool.com

Expert Tips for Success with Cheap ETFs

Harnessing the power of low-cost ETFs for options trading requires a strategic approach. Consider the following tips from experts:

- Manage risk effectively: Develop a thorough understanding of risk management techniques and implement stop-loss orders to limit potential losses.

- Monitor market conditions: Keep abreast of market news and economic data that can impact ETF performance and options pricing.

- Choose liquid ETFs: Prioritize ETFs with ample liquidity to facilitate timely entry and exit from trades.

- Consider technical analysis: Utilize technical analysis tools to identify trends, chart patterns, and potential trading opportunities within ETFs.

- Stay informed: Continuously seek knowledge and stay updated on the latest ETF trends and market developments to make informed trading decisions.

Frequently Asked Questions on Cheap ETFs for Options Trading

Q: Are cheap ETFs suitable for beginner options traders?

A: While ETFs can provide cost-effectiveness, options trading strategies carry inherent risks. It’s advisable for beginners to gain experience in vanilla options before venturing into ETF options trading.

Q: How do I analyze ETF options for trading?

A: Assess the underlying asset, liquidity, option premia, and implied volatility. Consider technical analysis techniques to identify trends and potential entry and exit points.

Q: Can I use ETFs for both long and short option strategies?

A: Yes, ETFs can be used for a variety of strategies, including long calls, short puts, and spreads, providing diverse opportunities for income generation or hedging.

Cheap Etfs For Options Trading

Image: meventum.com

Conclusion

The advent of low-cost ETFs has opened up the world of options trading to investors of all levels. By carefully selecting ETFs that align with their trading strategy and risk tolerance, traders can leverage the power of cost-effectiveness and enhance their earnings potential. Whether you’re a seasoned pro or just starting your options trading journey, exploring affordable ETFs is a strategic move that can unlock new dimensions in this dynamic and rewarding market. Are you ready to dive into the realm of cheap ETFs for options trading today?