Introduction

In the ever-changing world of finance, finding reliable streams of passive income has become a top priority for many. Options trading presents an enticing opportunity to generate an additional income source with the potential for significant returns. By effectively utilizing this powerful financial tool, you can supplement your primary income and attain long-term financial stability.

Image: www.youtube.com

Options Trading: An Overview

Options contracts are derivative financial instruments that derive their value from the underlying asset, such as stocks, commodities, or indices. They confer upon the holder the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). By leveraging these contracts, you can capitalize on market fluctuations or hedge against potential risks.

Generating Monthly Income through Options

One of the most compelling benefits of options trading lies in its ability to generate monthly income. The strategy involves selling options premium, which represents the price you receive in exchange for granting the option contract to another party. Unlike buying options, where you pay a premium to acquire the contract, selling options allows you to collect this payment upfront.

Strategies for Selling Options Premium

Various strategies exist for selling options premium to generate monthly income:

- Covered call: Sell a call option while owning the underlying asset. This strategy allows you to profit from moderate price increases while limiting potential losses.

- Cash-secured put: Sell a put option while holding cash to purchase the underlying asset if the option is exercised. This strategy provides downside protection and the potential for a premium payment.

- Naked put: Sell a put option without owning the underlying asset. This strategy involves higher risk but offers the potential for larger returns.

- Collar: Combine a covered call and a protective put option to hedge against potential losses. This strategy limits both your upside and downside risk.

Image: www.beyond2015.org

Maximizing Returns and Managing Risks

To maximize returns and effectively manage risks while options trading, consider the following tips:

- Proper risk management: Assess your risk tolerance and allocate capital accordingly.

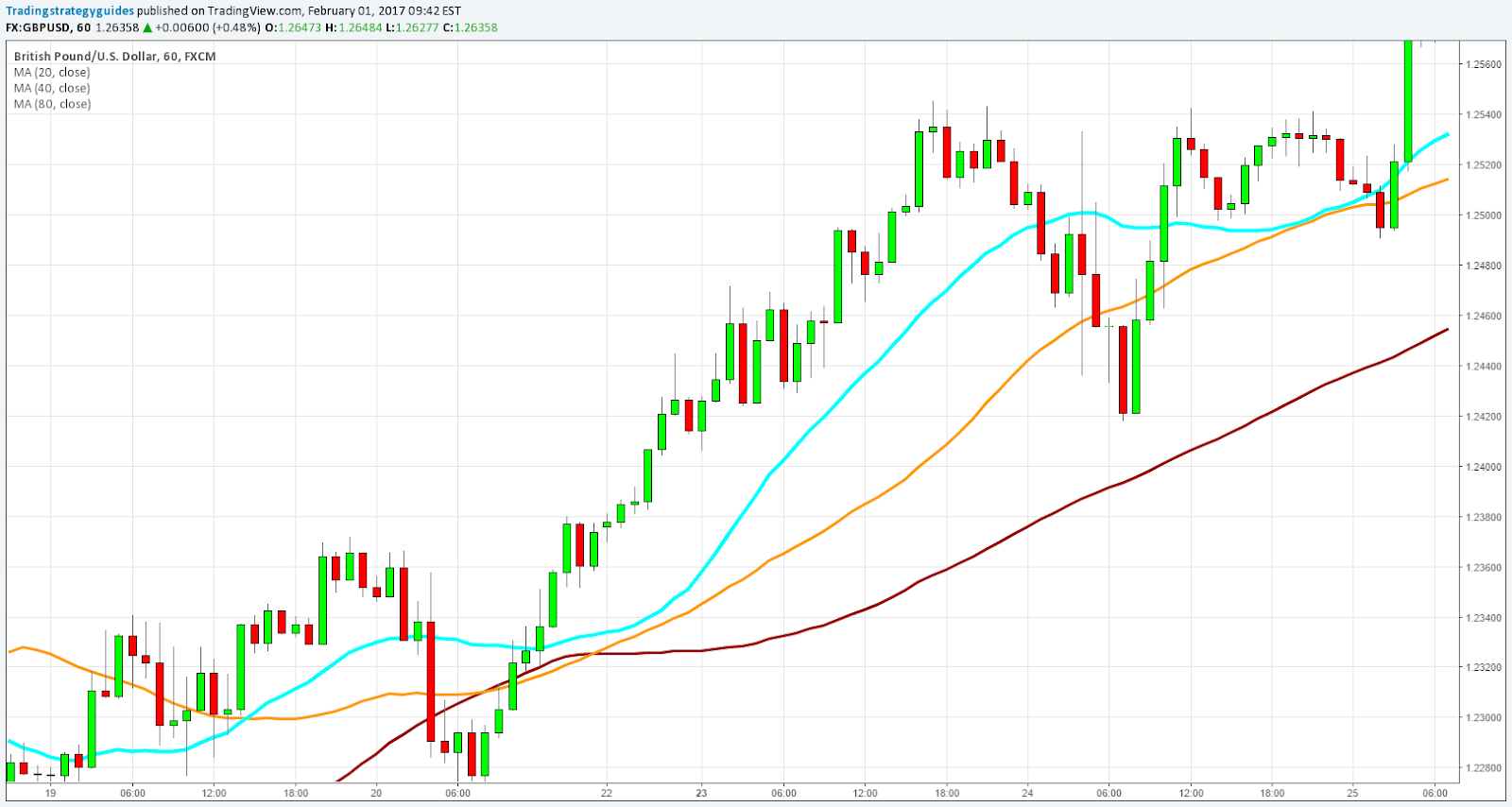

- Technical analysis: Study market trends and indicators to identify potential trading opportunities.

- Fundamental analysis: Understand the underlying factors that drive asset prices, such as economic conditions and company fundamentals.

- Diversification: Spread your investments across multiple options strategies and underlying assets.

Trading Options For Monthly Income

https://youtube.com/watch?v=W_pfsNzsI7A

Conclusion

Options trading offers a powerful avenue for generating monthly income, providing you with an additional revenue stream and the possibility of securing your financial future. By mastering the intricacies of this financial instrument, you can unlock the potential for significant returns and gain greater control over your financial well-being. As with any investment, thorough research, sound strategy, and disciplined risk management are paramount to achieving sustainable success in options trading. So, embark on this exciting financial adventure, and let the allure of passive income guide you towards long-term prosperity.