Introduction

In the realm of financial markets, the decision between swing trading stocks and options presents a fundamental choice for discerning investors seeking to harness price fluctuations and capture returns. Both strategies offer distinct advantages and drawbacks, demanding a comprehensive understanding before embarking on your trading journey.

Swing Trading: A Brief Overview

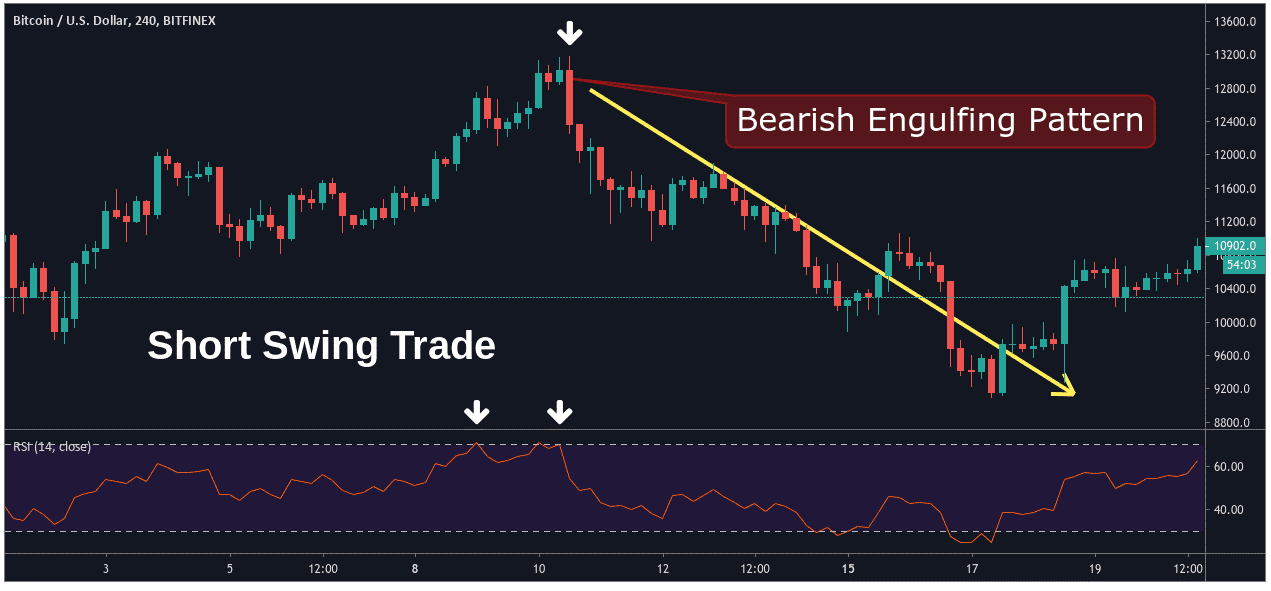

Swing trading involves profiting from short-term price swings in financial instruments, typically spanning days to several weeks. As a technical trading approach, it relies heavily on charting and technical analysis to identify trading opportunities based on price patterns and market indicators. By carefully timing entry and exit points, swing traders aim to ride the wave of price fluctuations and accumulate gains.

Stocks vs. Options: The Distinctive Attributes

Understanding the fundamental differences between stocks and options is crucial for making an informed decision in swing trading. Stocks represent ownership in a publicly traded company and confer voting rights, while options grant the holder the right, but not the obligation, to buy (in the case of call options) or sell (for put options). Moreover, stocks provide exposure to the underlying company’s performance, whereas options offer limited liability and the potential for leveraged returns but come with time decay and other risk factors.

Navigating the Benefits and Drawbacks

**Stocks**

**Advantages:**

* Direct ownership in the underlying company

* Potential for significant capital appreciation over the long term

* Relatively simple to trade and understand

Disadvantages:

Image: www.economiafinanzas.com

- Subject to market volatility and potential declines in value

- Require a larger capital outlay

- Limited potential for leveraged returns

Options

Advantages:

- Offer the potential for high returns with limited capital

- Flexibility in terms of trading strategies

- Can be used to hedge against risk or enhance returns

Disadvantages:

- Time decay is a factor that diminishes the value of options as they approach expiration

- More complex to trade and understand

- Limited liability means potential losses are capped

Emerging Trends in Swing Trading

Stay attuned to the latest advancements shaping the swing trading landscape to optimize your trading strategies. The rise of artificial intelligence and algorithmic trading has introduced enhanced predictive capabilities, enabling traders to identify and analyze price patterns with increased precision. Additionally, the growing accessibility of online trading platforms and mobile apps has democratized trading, making it more accessible to aspiring swing traders.

Expert Tips and Guidance

* **Define your trading plan:** Establish clear objectives, identify appropriate markets, and determine entry and exit strategies before initiating any trades.

* **Manage risk effectively:** Limit exposure to manageable levels, set stop-loss orders to protect against significant losses, and diversify your portfolio to mitigate risk.

* **Continuous education:** Regularly update your knowledge and skills by reading industry publications, attending webinars, and seeking guidance from experienced traders.

Image: www.asktraders.com

Swing Trading Stocks Vs Options

Conclusion

In the dynamic world of swing trading, a thorough understanding of the nuances between stocks and options is essential for making informed decisions. By carefully considering the distinct advantages and drawbacks, staying abreast of emerging trends, and following expert advice, you can tailor a trading strategy that aligns with your risk tolerance and financial goals.

As you embark on this exciting journey, remember that the financial markets are ever-evolving, and a continuous learning mindset will position you for success.

Are you interested in delving deeper into the world of swing trading stocks vs. options? Join our exclusive online community of like-minded traders where you can share insights, ask questions, and stay up-to-date on the latest market developments. Together, let’s navigate the financial markets with confidence and achieve our trading aspirations.