In the realm of financial trading, two popular strategies that have gained significant traction are option trading and swing trading. Both offer distinct approaches to investment, each with its unique advantages and potential pitfalls. This article delves into the nuances of each strategy, comparing option trading vs. swing trading to provide a comprehensive understanding.

Image: www.vectorvest.com

**Option Trading: A Flexible Adventure into Risk and Reward**

Option trading involves trading options contracts, which are financial instruments that provide the right, but not the obligation, to buy or sell an underlying asset (such as a stock, bond, or commodity) at a specific price on a specified date. Options can be bought or sold, and their prices are influenced by various factors including the underlying asset’s price, volatility, time to expiration, and interest rates.

Option trading offers immense flexibility, allowing traders to customize their positions and manage risk. They may choose to buy call options (to bet on a price increase) or put options (to bet on a price decrease) based on their market outlook. However, option trading can be complex, requiring a solid understanding of risk management strategies and a comprehensive view of the underlying asset’s movements.

**Swing Trading: Capturing the Rhythms of Market Swings**

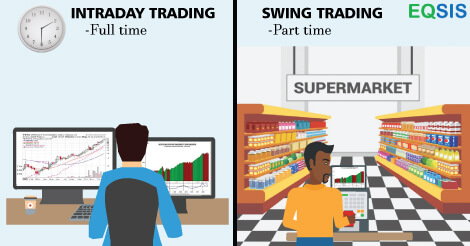

Swing trading focuses on identifying short-term price swings in the market and profiting from them by holding positions for several days to weeks at a time. Swing traders aim to capitalize on price corrections, retracements, and reversals that occur within established uptrends or downtrends.

Swing trading often involves technical analysis techniques, such as charting and identifying support and resistance levels. Swing traders typically use stop-loss orders to limit potential losses and take-profit orders to lock in gains. They may also incorporate fundamental analysis to identify companies with strong growth prospects or sectors with tailwinds that could drive price momentum.

**Key Differences and Similarities**

1. Time Horizon: Option trading positions typically expire within a few weeks or months, while swing trading positions can last for several days to a few weeks.

2. Leverage: Options offer leverage, allowing traders to control a larger position than their account size; swing trading typically involves a lower level of leverage.

3. Focus: Option trading centers on predicting price movements and creating specific trading strategies, while swing trading focuses on identifying market trends and capturing price swings.

4. Potential Returns: Both option trading and swing trading have the potential for high returns, but they also carry the risk of significant losses.

Image: www.eqsis.com

**Tips and Expert Advice for Navigating the Trading Landscape**

1. Know Your Risk Tolerance: Determine your comfort level with potential losses before venturing into any trading strategy.

2. Educate Yourself: Invest time in learning about the markets, trading strategies, and risk management techniques; consider seeking guidance from experienced traders or mentors.

3. Start with Small Positions: Avoid putting all your eggs in one basket; start with small trading positions until you gain confidence and experience.

4. Use Technology to Your Advantage: Utilize trading platforms and tools that provide real-time data, charting capabilities, and risk management features.

5. Stay Disciplined: Adhere to your trading plan and avoid emotional decision-making; take calculated risks and manage your emotions.

**FAQ on Option Trading vs. Swing Trading**

Q: Which strategy is better for beginners?

A: Swing trading may be more suitable for beginners due to its shorter time horizon and less complex strategies.

Q: Can you trade both options and swings?

A: Yes, some traders combine option trading and swing trading to diversify their portfolios and capture market opportunities.

Q: Can I get rich quick through option trading or swing trading?

A: While trading can offer the potential for high returns, it also carries significant risk; aiming to get rich quick through trading is not a realistic expectation.

Option Trading Vs Swing Trading

**Conclusion**

Option trading vs. swing trading presents diverse paths for financial traders, each with its own distinct characteristics and potential rewards. Thoroughly understanding these strategies, their risk-reward dynamics, and the market conditions in which they excel will empower traders to make informed decisions and navigate the trading landscape with greater success.

As you continue your exploration into the world of trading, I invite you to engage further by asking questions, sharing your experiences, and exploring other resources to expand your knowledge and enhance your trading journey.