I remember my first foray into option trading like it was yesterday. The thrill of watching my trades fluctuate, the anticipation of potential gains, and the adrenaline rush of placing an order… it was all intoxicating. But as I delved deeper, I realized that success in option trading required more than just a dash of luck or gut feeling. It demanded a systematic approach, a strategy that could navigate the complexities of the market and increase my chances of profitability. Enter the Option Trading Wheel Strategy.

Image: optionstradingiq.com

The Wheel of Fortune for Option Traders

The Option Trading Wheel Strategy is a versatile and time-tested approach that allows traders to potentially generate income and manage risk using options contracts. By selling options at specific intervals, traders aim to collect premiums while positioning themselves to profit from various market conditions. It’s like spinning a wheel of fortune, where each outcome has the potential to yield a positive outcome.

Harnessing the Power of Options

Options are financial contracts that give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price on or before a certain date. In the Option Trading Wheel Strategy, traders focus on selling options rather than buying them. By doing so, they collect premiums upfront, which can potentially generate income and offset potential losses.

The beauty of the Option Trading Wheel Strategy lies in its adaptability. It can be employed in various market conditions and on different underlying assets, such as stocks, indices, or ETFs. The strategy involves a series of steps that can be repeated, creating a continuous “wheel” of trading opportunities.

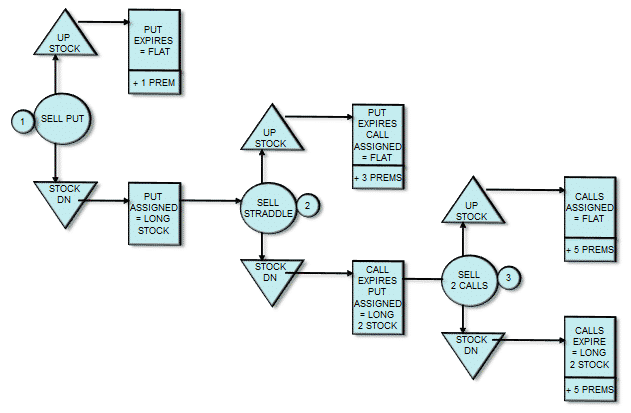

The Mechanics of the Wheel

The Option Trading Wheel Strategy typically begins with selling a cash-secured put option. This means the trader owns the underlying asset and is obligated to sell it at a specified strike price if the option is exercised. The premium received from selling the put option provides immediate income and offsets potential losses if the underlying asset price declines.

If the underlying asset price remains above the strike price of the sold put option, the trader retains both the asset and the premium. If the asset price falls below the strike price, the trader may have to sell the asset at a loss, but the original premium received can mitigate some of the damage. The strategy also involves selling covered calls or naked calls to potentially generate additional income while managing risk.

Image: moneymorning.com

Keeping the Wheel Turning

The Option Trading Wheel Strategy is not a one-and-done approach. It’s a continuous process that involves monitoring market conditions, adjusting positions, and implementing risk management techniques. Traders need to be prepared to roll options positions to extend their expiration dates or adjust strike prices to maintain their desired risk profile.

Successful implementation of the Option Trading Wheel Strategy requires discipline and a deep understanding of option trading concepts. It’s not a get-rich-quick scheme, but it can be a valuable tool for traders who are willing to put in the time and effort to develop their skills.

Tips for Maximizing Returns

1. Choose Suitable Underlying Assets: Select assets with sufficient liquidity and volatility to provide ample trading opportunities. Consistent trading volume ensures easy order execution and minimizes slippage.

2. Determine Optimal Strike Prices: Strike prices should be carefully chosen based on market conditions and personal risk tolerance. Out-of-the-money options offer higher premiums but also carry greater risk, while at-the-money options provide a balance of risk and reward.

3. Manage Risk Effectively: Risk management is crucial in option trading. Implement stop-loss orders to limit potential losses and consider using protective strategies such as collar trades to hedge against adverse price movements.

4. Monitor Market Conditions: Stay informed about market news and events that can impact the underlying asset’s price. Adjust positions accordingly to position yourself for changing conditions.

5. Practice Patience: Option trading is not a sprint but a marathon. Profits accumulate over time with consistent execution and discipline. Avoid impulsive decisions and adhere to a well-defined trading plan.

FAQs on the Option Trading Wheel

Q: Is the Option Trading Wheel Strategy suitable for beginners?

A: While the Option Trading Wheel Strategy relies on fundamental option trading concepts, it’s generally not recommended for complete beginners. A good understanding of options trading principles is essential.

Q: How much capital do I need to implement the Option Trading Wheel Strategy?

A: The amount of capital required depends on the underlying asset and the specific option strategies employed. It’s important to have足够 capital to cover potential losses.

Q: What are the potential risks associated with the Option Trading Wheel Strategy?

A: As with any option trading strategy, there are risks involved. These include the potential for losses if the underlying asset price moves significantly against the trader’s position.

Option Trading Wheel Strategy

Conclusion

The Option Trading Wheel Strategy is a robust and adaptable approach to potentially generate income and manage risk in option trading. By selling options at strategic intervals, traders can collect premiums and position themselves to profit from different market conditions. However, it’s crucial to remember that successful implementation requires a thorough understanding of options trading, risk management techniques, and constant monitoring of market conditions. If you’re intrigued by the Option Trading Wheel Strategy and eager to delve deeper into the world of option trading, seek guidance from a qualified financial advisor and immerse yourself in educational resources. Embrace the learning curve, engage in practice trades, and you may just find yourself unlocking the wheel of fortune in the world of option trading.

Would you like to know more about the Option Trading Wheel Strategy?