Introduction

In the world of financial markets, options trading is often associated with high-risk, high-reward strategies. However, in recent times, a bearish sentiment has pervaded the options market, raising concerns among traders. This article delves into the reasons behind this downturn, providing an in-depth analysis for a deeper understanding.

Image: bullsonwallstreet.com

Understanding Options Trading

Options contracts grant the buyer the right (but not the obligation) to buy or sell an underlying asset at a predetermined price on or before a specific date. This flexibility allows traders to speculate on the future direction of the market, potentially generating significant profits. However, options trading also carries substantial risk, as the value of the contract is directly tied to the underlying asset’s performance.

Reasons for Bearish Options Trading

In general, bearish options trading occurs when traders anticipate a decline in the value of the underlying asset. This expectation stems from various factors, including:

1. Economic Uncertainty: Economic downturns and geopolitical events can lead to reduced demand for goods and services, resulting in lower asset values.

2. Interest Rate Hikes: Increasing interest rates tend to dampen market sentiment, making it more expensive for businesses to borrow and invest, which can impact company earnings and stock prices.

3. Market Volatility: Heightened volatility in the markets often scares away investors, who may opt for safer asset classes, reducing demand for risky options trades.

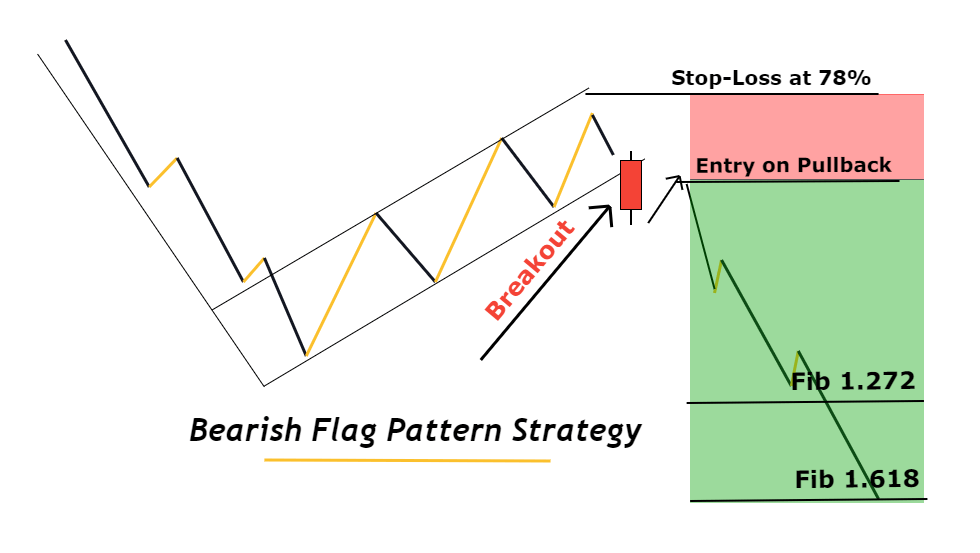

4. Bearish Technical Charts: Technical analysts may identify bearish patterns on charts, indicating a potential reversal or continuation of a downtrend.

Impact of Bearish Options Trading

A dominant bearish sentiment in the options market can have several effects on traders and investors:

1. Increased Implied Volatility: When market participants predict a sharp decline in asset prices, they demand higher premiums for options contracts, leading to increased implied volatility.

2. Lower Options Premiums: Bearish sentiment typically pushes down the premiums on options contracts, offering less profit potential for buyers and higher losses for sellers.

3. Skewed Put-Call Ratio: During bearish periods, the put-call ratio (ratio of put options bought to call options bought) tends to increase, reflecting traders’ increased preference for downside protection.

Image: forexbee.co

Expert Insights on Bearish Options Trading

-

“Options can be a valuable tool for managing risk in uncertain markets, but traders must be aware of the risks involved and employ proper hedging strategies.” – John C. Hull, renowned finance professor

-

“In a bearish market, it’s crucial to focus on preservation of capital. Avoid speculative options trades and opt for more conservative strategies.” – George Fontanills, veteran financial advisor

Navigating Bearish Options Trading

In light of the bearish options trading landscape, traders can consider the following steps for prudent decision-making:

1. Exercise Caution: Bearish conditions demand increased caution and risk management. Avoid speculative trades and focus on carefully considered strategies.

2. Focus on Value: Look for options contracts that are priced below their intrinsic value, offering potential for upside gains.

3. Employ Protective Strategies: Use strategies like covered calls and protective puts to reduce downside risks and enhance capital preservation.

Why Is Options Trading Bearish

Image: atelier-yuwa.ciao.jp

Conclusion

Bearish options trading reflects a cautious market sentiment, often influenced by economic uncertainties, interest rate hikes, and market volatility. Understanding the reasons behind this trend empowers traders to navigate downturns with greater prudence. By exercising caution, focusing on value, and employing protective strategies, traders can better position themselves for success in challenging market conditions. Remember, investing always involves risk, and it’s essential to research thoroughly and consult with financial advisors if needed before making any trading decisions.