Introduction

As an options enthusiast, I am constantly on the lookout for brokers who offer competitive pricing and the best trading tools. Navigating the vast landscape of options brokers can be overwhelming, especially when considering the crucial factor of trading costs that directly impact profitability. In this comprehensive guide, I delve deep into the options trading realm to uncover the brokers who stand apart with their low-cost offerings and exceptional trading platforms.

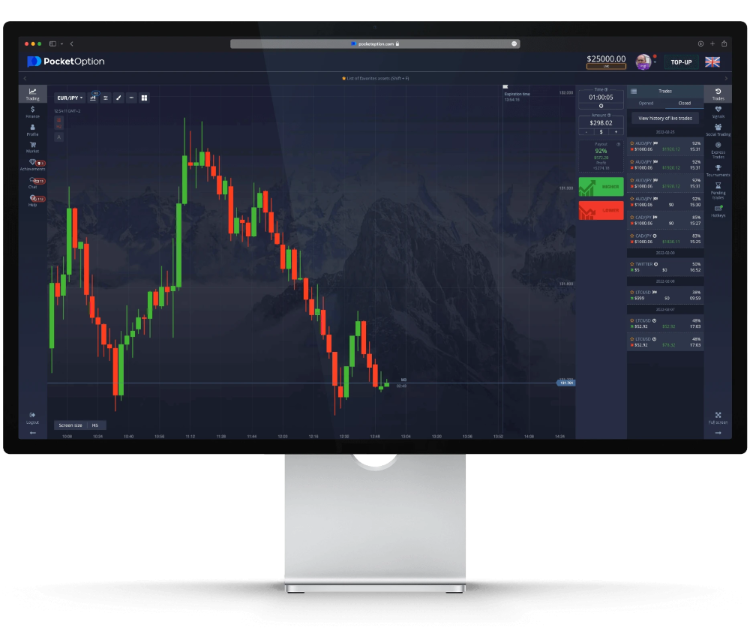

Image: seventrading.net

Brokers with the Lowest Options Trading Fees

Competition among options brokers has intensified over the years, leading to a positive ripple effect for traders. Here are the leading brokers who have slashed their fees and provide some of the most cost-effective trading experiences:

- Interactive Brokers: Renowned for its industry-leading low fees, Interactive Brokers offers tiered pricing based on volume, making it ideal for both novice and experienced options traders.

- TD Ameritrade: Another top player in the low-cost arena, TD Ameritrade provides various commission structures, including a flat-fee option that favors active traders.

- *ETrade:* ETrade caters to high-volume options traders through its Power E*Trade platform, which offers highly competitive rates and advanced trading capabilities.

Factors to Consider When Choosing an Options Broker

Beyond fees, several other factors warrant consideration when selecting an options broker:

- Trading platform: A user-friendly and intuitive platform is essential for smooth and efficient trading. Look for platforms that provide advanced charting tools, real-time data, and easy-to-execute options strategies.

- Education and resources: Choose brokers who invest in providing educational materials, webinars, and tutorials to empower traders with the necessary knowledge.

- Customer support: Opt for brokers with responsive customer support that is available through multiple channels, ensuring timely assistance when needed.

Detailed Comparison of Broker Fees

To help you make an informed decision, here is a table comparing the options trading fees of the brokers we have discussed:

| Broker | Standard Commission | Tiered Pricing | Flat-Fee Option |

|---|---|---|---|

| Interactive Brokers | $0.15 per contract | Yes | No |

| TD Ameritrade | $0.65 per contract | Yes | $1.00 per trade (for 500+ contracts) |

| E*Trade | $0.50 per contract | Yes | Yes ($0.65 per contract for Power E*Trade) |

Image: www.investing.co.uk

Tips for Reducing Options Trading Costs

In addition to selecting a low-cost broker, consider these expert tips to further minimize your options trading expenses:

- Negotiate: Contact the broker directly and inquire if they offer volume discounts or special promotions that could lower your commission rates.

- Use limit orders: Limit orders allow you to specify the maximum price you are willing to pay or receive, potentially saving you on execution fees.

- Avoid trading during peak hours: Trading during less popular times can reduce wait times and result in smaller fills, minimizing the overall cost.

Frequently Asked Questions

Q: Which broker is best for options trading beginners?

A: Interactive Brokers and TD Ameritrade offer low fees and user-friendly platforms suitable for novice options traders.

Q: What is a flat-fee trading option?

A: A flat-fee option allows traders to pay a fixed amount per trade, regardless of the contract volume, which can be beneficial for traders with a high volume of trades.

Q: How can I lower my options trading costs?

A: Consider negotiating with your broker, using limit orders, and avoiding trading during peak hours.

Which Broker Charges Less For Options Trading

Image: financesonline.com

Conclusion

Choosing the right options broker is a crucial decision that can influence your trading profitability. By carefully considering the factors discussed in this article, you can effectively lower your options trading costs and benefit from improved returns. Remember, it is essential to do your research, compare brokerage offerings, and choose the platform that aligns with your specific trading style and preferences.

Are you ready to embark on your options trading journey? Let me know if you have any questions or need further assistance in selecting the right broker for your needs. Together, we can navigate the market and maximize your options trading potential.