Understanding the Profit Potential

Options trading can be a lucrative venture for investors seeking to enhance their portfolio returns. Among the various options strategies, covered calls stand out as a relatively conservative approach that can generate a steady income stream. Understanding the mechanics of covered calls is crucial to unlocking their profit potential. In this comprehensive guide, we delve into the intricate details of this strategy and explore the sources of income it offers.

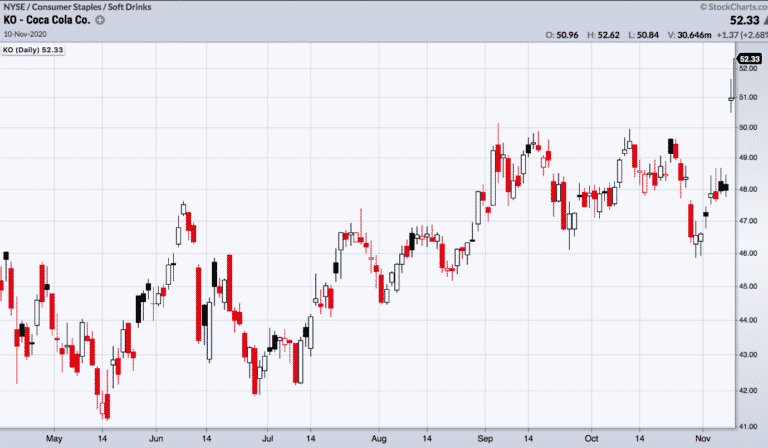

Image: www.pinterest.com

Overview of Covered Calls

Covered calls involve selling (writing) call options while simultaneously holding the underlying asset, typically a stock. Unlike naked options trading, covered calls provide a form of downside protection as the writer owns the underlying asset. The call option grants the buyer the right, not the obligation, to purchase the underlying asset at a predetermined strike price on or before the expiration date. In return for selling the call option, the writer receives a premium, which constitutes the primary source of income.

Income Generation

The income from trading covered calls primarily comes from the premium received when selling the call option. This premium reflects the market’s expectation of the underlying asset’s price movement. If the underlying asset price remains below the strike price at expiration, the call option will expire worthless, and the writer keeps the premium. This scenario is known as an “out of the money” call.

However, if the underlying asset price rises above the strike price before expiration, the call buyer may exercise the option, requiring the writer to sell the asset at the strike price. In this case, the writer will receive the strike price for the asset and keep the premium, along with any appreciation up to the strike price. This scenario is known as an “in the money” call.

Profit Potential

The profit potential of covered calls lies in the combination of premium income and potential asset appreciation up to the strike price. By carefully selecting the strike price and expiration date, writers can optimize their risk-return profile. Higher strike prices yield higher premiums but increase the likelihood of the option being exercised, potentially limiting asset appreciation. Conversely, lower strike prices provide less premium income but allow for greater potential asset appreciation.

Image: optionstradingiq.com

Example

Consider an investor who sells a covered call on a stock with a current price of $50. They sell a call option with a strike price of $55 and an expiration date in two months. The premium received for selling the call is $2.50 per share.

If the stock price remains below $55 at expiration, the call option will expire worthless, and the investor will keep the $2.50 premium per share. However, if the stock price rises above $55, the option may be exercised, and the investor will be obligated to sell the stock at $55. In this case, the investor will have earned a total of $7.50 per share ($2.50 premium + $5 appreciation).

Where Does The Money Come From Trading Options Covered Calls

Image: epsilonoptions.com

Conclusion

Trading options covered calls can provide investors with a valuable source of income by combining premium income with the potential for asset appreciation. By understanding the mechanics of covered calls and carefully selecting strike prices and expiration dates, investors can optimize their risk-return profile and generate a steady income stream from their portfolio. As with any investment strategy, thorough research and a sound understanding of the underlying asset and options market are essential for success.