What is the VIX?

The VIX (Volatility Index) is a metric that measures the implied volatility of the S&P 500 index over the next 30 days. It serves as a barometer of investor sentiment and market fear, with higher VIX readings indicating greater uncertainty and a heightened perception of risk.

Image: aeromir.com

How is the VIX Calculated?

The CBOE (Chicago Board Options Exchange) calculates the VIX using the prices of S&P 500 index options with various strike prices and expirations. These options represent the market’s consensus on the level of volatility expected during the coming month.

Why is the VIX Important?

The VIX is a crucial indicator for options traders because it reflects how volatile the underlying market is expected to be. Higher volatility can potentially lead to larger profits but also greater risks. Understanding the VIX can help options traders make informed decisions about strike prices, expiration dates, and risk management strategies.

How to Trade the VIX

Traders cannot directly trade the VIX index but can speculate on its movement through various financial instruments, such as:

- VIX futures and options: These contracts allow traders to bet on the future direction of the VIX.

- VIX ETFs: Exchange-traded funds that track the VIX index or similar volatility measures.

- Volatility-linked notes: Structured products that pay out returns based on the movement of the VIX.

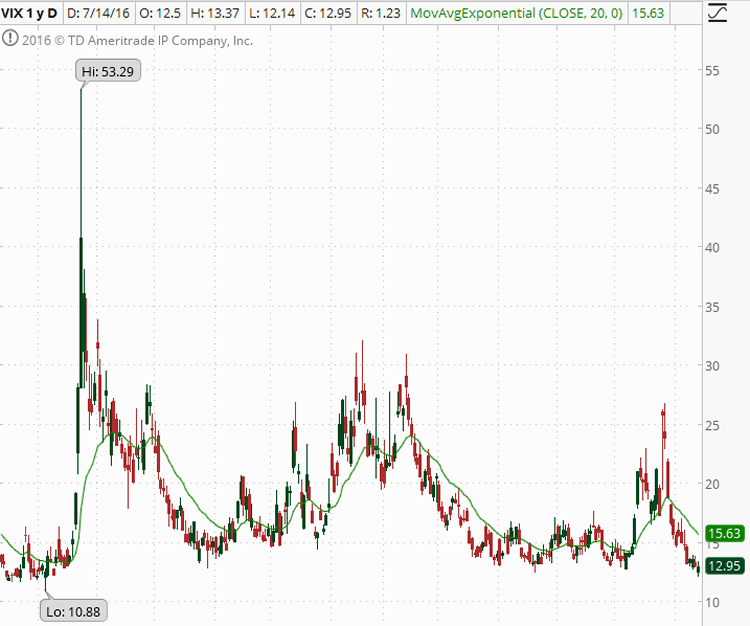

Image: tickertape.tdameritrade.com

Factors that Influence the VIX

Several factors can affect the VIX, including:

- Economic data and events: Surprises or changes in economic indicators can lead to increased or decreased volatility expectations.

- Market sentiment: Negative news, geopolitical tensions, or uncertainty about the future can drive up the VIX.

- Seasonality: Volatility tends to be higher during certain periods, such as the end of quarters or before major market events.

- Technical factors: The VIX can also be affected by technical factors, such as the price action of the S&P 500 index and historical volatility patterns.

Why Should I Care About the VIX?

The VIX provides insights into the market’s perception of risk and can help investors navigate volatile markets. Here’s how:

- Hedge against volatility risk: Trading the VIX or volatility-linked instruments can help investors reduce exposure to market fluctuations.

- Identify market sentiment: The VIX can serve as a “fear gauge,” indicating whether investors are optimistic or pessimistic about the market’s future.

- Explore trading opportunities: High or low VIX readings can signal potential trading opportunities, such as purchasing options on volatile stocks or hedging against downside risk.

What Is Vix In Options Trading

Image: www.quantifiedstrategies.com

Understanding the VIX is crucial for successful options trading. It provides insights into market expectations, helps manage risk, and opens up opportunities for savvy investors. By incorporating the VIX into your trading strategy, you can better navigate market volatility and achieve your financial goals.