Navigating the Complexities of Financial Derivatives

In the realm of financial instruments, futures and options stand as two prominent derivative products. While both share a close association with underlying assets, their mechanisms and implications diverge significantly. This article delves into the intricacies of these two derivatives, shedding light on their key distinctions, applications, and the nuances that set them apart.

Image: www.5paisa.com

1. Futures Trading: A Commitment for the Future

Futures contracts constitute agreements to buy or sell a specified quantity of an underlying asset at a predetermined price on a specific date in the future. Participants in futures trading assume an obligation to fulfill the contract when it matures, regardless of any subsequent price fluctuations. Essentially, this tool allows investors to lock in a future price for an asset, hedging against potential price volatility.

1.1 Key Characteristics of Futures Contracts

- Standardization: Futures contracts are standardized, meaning they adhere to established specifications pertaining to the underlying asset, quantity, delivery date, and trading terms.

- Obligation: Participants in futures trading assume a binding obligation to buy or sell the underlying asset upon contract maturity.

- Margin Trading: Futures trading typically involves margin trading, where investors deposit a portion of the contract’s value as collateral to gain exposure to a larger position.

2. Options Trading: The Right, Not the Obligation

Options contracts confer upon their holders the right, but not the obligation, to buy or sell an underlying asset at a predefined price within a specified timeframe. This flexibility empowers traders with the ability to speculate on future price movements without the inherent commitment of futures contracts.

Image: www.pinterest.com

2.1 Key Characteristics of Options Contracts

- Rights-Based: Options provide the holder with the right, but not the obligation, to exercise the contract at their discretion.

- Expiration Date: Options contracts have an expiration date beyond which the right to exercise the option expires.

- Premium: Traders pay a premium to acquire options contracts, representing the cost of purchasing the option’s right.

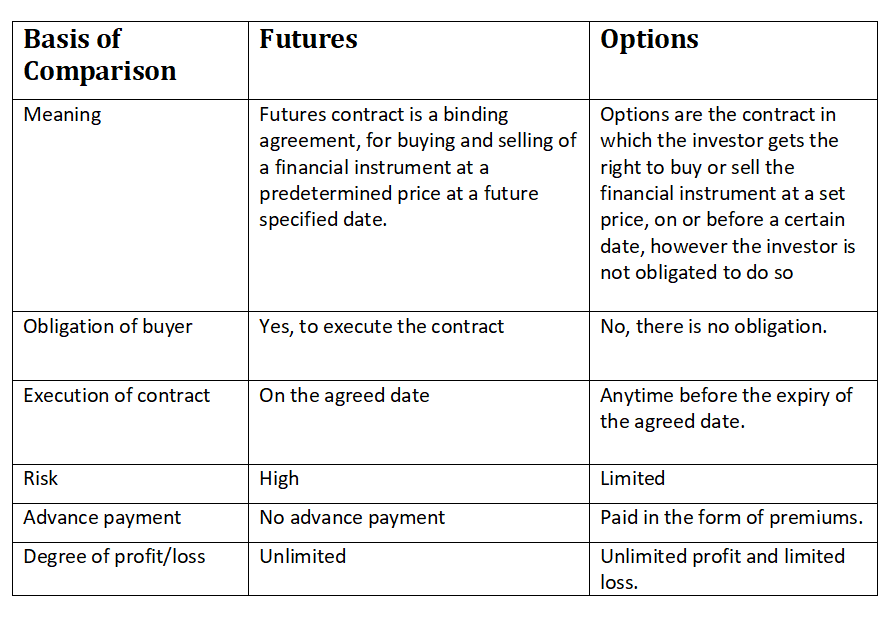

3. Comparative Analysis: Futures vs. Options

Understanding the differences between futures and options is crucial for informed decision-making in financial trading. The following comparison highlights their key distinctions:

3.1 Underlying Asset

Both futures and options derive their value from underlying assets, such as commodities, stocks, or currencies. However, futures contracts obligate the holder to buy or sell the physical asset, while options contracts grant the right to do so.

3.2 Obligation vs. Right

Futures contracts impose a binding obligation on the parties involved, whereas options contracts provide the holder with a right to exercise the option but do not obligate them to do so.

3.3 Margin Trading

Futures trading often entails margin trading due to the inherent obligation to buy or sell the underlying asset. Options trading, on the other hand, may or may not involve margin requirements, depending on the trading strategy employed.

3.4 Profit Potential

Futures contracts offer the potential for both profits and losses, as traders bet on the future direction of the underlying asset’s price. Options trading, while providing limited profit potential on the upside, also limits potential losses to the premium paid for the contract.

What Is The Difference Between Future And Options Trading

Image: www.pinterest.com

4. Application of Futures and Options

The choice between futures and options depends on the specific investment goals and risk tolerance of the trader. Futures contracts serve as a versatile tool for hedging against price risk or speculating on future price movements. Options contracts, on the other hand, are suitable for various strategies, including speculative trading, income generation, and portfolio protection.