In the dynamic world of finance, where time and opportunity intertwine, the concept of rollover holds immense significance. Rollover, in the context of option trading, refers to the transfer of an existing option contract to a contract with a different expiration date or strike price. This strategic move allows traders to adjust their positions based on changing market conditions, risk tolerance, and investment objectives.

Image: libertex.com

Understanding the Rollover Process

When an option contract is approaching its expiration date, traders have the choice to either exercise it or roll it over to a contract with a later expiration. Exercising an option means buying or selling the underlying asset at the strike price. Rolling over an option, however, involves selling the existing contract and simultaneously buying a new contract with a different expiration date or strike price.

There are several reasons why traders may choose to roll over an option. One reason is to extend the life of the option and gain more time to potentially profit from the underlying asset’s price movement. Another reason is to adjust the strike price, allowing traders to target a different profit or loss potential.

Benefits of Rolling Over Options

The rollover strategy offers several benefits to traders:

- Flexibility: Rollover provides traders with the flexibility to adjust their positions as market conditions change without incurring a hefty cost, unlike closing and reopening a position.

- Profit Potential: Rolling over an option to a contract with a longer duration or a more favorable strike price can increase the potential for profit if the underlying asset’s price moves in the anticipated direction.

- Risk Management: By rolling over an option to a contract with a later expiration date, traders can reduce the risk of the option expiring worthless if the underlying asset’s price does not move as expected.

Types of Rollover Strategies

There are various types of rollover strategies, each with its own unique advantages and disadvantages. Some common rollover strategies include:

- Calendar Spread Rollover: Involves rolling over the near-term option contract to a later-term option contract with the same strike price.

- Butterfly Rollover: Entails selling one at-the-money option and buying two out-of-the-money options with different strike prices, then rolling over the entire butterfly spread to a later expiration date.

- Iron Condor Rollover: Similar to the butterfly rollover, but involves selling two out-of-the-money options and buying two at-the-money options.

Image: www.trading.it

Expert Insights on Rollover Strategies

“Rolling over options can be a powerful tool for traders who want to manage their risk and maximize their profit potential,” says John Carter, a renowned option trading expert. “By understanding the different rollover strategies and their applications, traders can enhance their trading strategies and increase their chances of success.”

“The key to successful rollover strategies is to have a clear understanding of your risk tolerance and investment goals,” advises Jane Brian, an experienced option trader. “Don’t hesitate to consult with a financial advisor or conduct thorough research before implementing rollover strategies into your trading plan.”

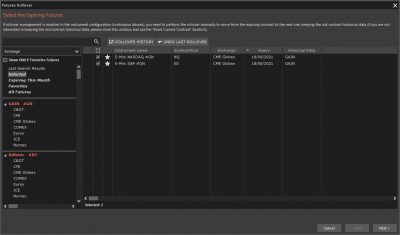

What Is Rollover In Option Trading

Image: www.overcharts.com

Conclusion

Rollover in option trading is a valuable technique that empowers traders to adapt to changing market conditions and optimize their positions. By understanding the benefits, types, and expert insights associated with rollover strategies, traders can leverage this strategic move to increase their profit potential, manage risk, and enhance their overall trading experience.

Remember, as with any financial undertaking, it is crucial to approach rollover strategies with a thorough understanding of the risks involved. Always consult with a financial advisor or conduct your own due diligence before making any investment decisions.