Introduction

In the realm of finance, futures and options trading play a pivotal role, offering traders a unique set of instruments to manage risk and seize opportunities. These sophisticated financial contracts have revolutionized the way investors navigate the intricate landscape of global markets. But what exactly are futures and options, and how can you navigate their complex dynamics? Delve into this comprehensive guide as we unravel the intricacies of these essential trading instruments.

Image: www.indiratrade.com

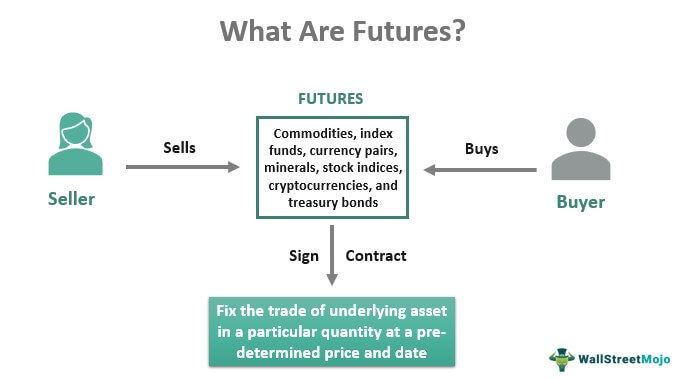

Understanding Futures: A Glimpse into Time Travel

Futures contracts are agreements to buy or sell an underlying asset at a predetermined price on a specific future date. These contracts, traded on futures exchanges, act as a form of time travel, allowing traders to lock in a price today for a transaction that will occur in the future. Futures offer price protection against potential market fluctuations, enabling businesses to hedge against price risks associated with the production or purchase of commodities.

Diving into Options: The Power of Choice

Options, on the other hand, grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price. Traders utilize options strategies to speculate on future price movements or protect against downside risk. Options provide flexibility and leverage, allowing traders to tailor their risk-reward profile according to their specific investment goals.

Unveiling the Differences: Futures vs. Options

Futures and options, while both derivatives, differ significantly in their characteristics and underlying mechanics. Futures contracts are binding agreements, requiring the buyer to purchase or the seller to deliver the underlying asset on the settlement date. Options, however, confer the right, but not the obligation, to exercise the option contract. Additionally, futures contracts are standardized and traded on exchanges, while options can be customized to meet specific investor needs.

Image: www.wallstreetmojo.com

Exploring the Applications: Embracing the Versatility

Futures and options offer a multifaceted suite of applications, ranging from risk management to speculative trading. By utilizing these instruments, traders can hedge against price fluctuations, lock in profits, and express directional market views. Corporations leverage futures and options to manage supply chain risks and secure stable pricing for raw materials or finished goods.

Mastering the Market: Strategies for Success

To succeed in futures and options trading, a strategic approach is paramount. Successful traders develop a comprehensive understanding of market dynamics, risk management techniques, and trading strategies. They continuously monitor market trends, analyze price charts, and employ cutting-edge trading platforms to gain an edge in the competitive financial arena.

Expert Insights: Wisdom from the Masters

“The ability to predict the future is not necessary for success in futures and options trading. Rather, it is the ability to adapt to changing circumstances and position oneself accordingly.” – Jesse Livermore, legendary futures trader

“Options are like a set of tools, and the more you learn about them, the more you can do with them.” – Mark Douglas, renowned options trading expert

What Is Futures And Options In Trading

Image: fadukuvo.web.fc2.com

Conclusion: Unveiling the Path to Financial Mastery

Embarking on the journey of futures and options trading unveils a world of opportunities and challenges. By delving into the intricate mechanics, employing strategic thinking, and harnessing the wisdom of experts, traders can equip themselves with the knowledge and skills necessary to navigate the dynamic terrain of financial markets. Remember, the pursuit of financial success is not a sprint but a marathon, requiring dedication, perseverance, and a commitment to continuous learning.