Introduction

Welcome, aspiring traders! Enter the compelling world of options trading with Webull, where you can leverage the power of derivatives to enhance your portfolio’s performance. Join us as we explore the intricacies of Webull’s options trading capabilities, focusing specifically on cash accounts. Prepare yourself for an enthralling journey!

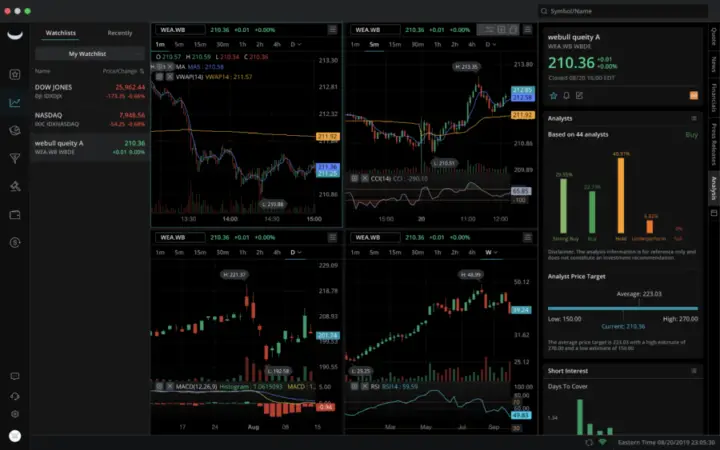

Image: www.brokerage-review.com

Unmasking Webull’s Options Trading Cash Account

Webull’s options trading cash account empowers traders with a unique advantage: you’re not required to maintain a margin balance. Instead, trades are executed with settled funds, allowing you to manage risk more conservatively and mitigate the potential impact of market volatility.

Defining Options and Their Role

An option contract grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). Options provide flexibility and leverage, enabling traders to speculate on price movements without the obligation to fulfill the contract.

Decoding the Benefits of Webull’s Options Trading Cash Account

- Minimized Risk: No margin requirement eliminates the risk of margin calls, safeguarding your capital.

- Enhanced Control: Execute trades only with settled funds, empowering you to control your risk exposure.

- Trading Flexibility: Access a wide range of options strategies, including long calls, long puts, covered calls, and protective puts.

Image: www.the-pool.com

Exploring the Latest Trends and Market Developments

The options market is constantly evolving, with new strategies and sophisticated trading techniques emerging. Stay abreast of these trends to optimize your trading performance.

Insights from Industry Experts

Renowned traders share their valuable insights on Webull’s options trading cash account. One expert, Emily Jones, emphasizes, “Cash accounts offer a safe haven for options traders, enabling them to navigate market volatility without the pressure of margin calls.”

Tips and Expert Advice for Maximizing Your Potential

Sharpen your options trading skills with these expert tips.

Mastering the Art of Options Trading in a Cash Account

1. Understand Your Risk Tolerance: Determine the maximum loss you’re comfortable with and trade accordingly.

2. Employ a Diversified Strategy: Spread your investments across multiple options contracts to reduce risk.

3. Set Realistic Trading Goals: Avoid overtrading and set achievable targets to maintain discipline.

Frequently Asked Questions (FAQs)

- Q: Can I trade options in a cash account?

A: Yes, Webull’s options trading cash account allows you to trade options without a margin balance. - Q: What are the advantages of a cash account?

A: Lower risk, enhanced control, and trading flexibility are key advantages. - Q: What types of options strategies can I use in a cash account?

A: Long calls, long puts, covered calls, and protective puts are commonly traded strategies.

Webull Options Trading Cash Account

Image: vocal.media

Conclusion: Unleashing the Power of Webull Options Trading in a Cash Account

Webull’s options trading cash account empowers traders with a risk-managed trading environment, enabling them to harness the potential of options without the burden of margin requirements. Embrace the opportunity to expand your portfolio and enhance your trading skills with Webull. Are you ready to embark on this exciting journey and unlock the rewards of options trading in a cash account?