Options Trading Education: A Guide to Trading OTM Options

Options trading is a powerful way to leverage your capital and potentially generate significant returns. However, many novice traders make the mistake of trading out of the money (OTM) options, which can lead to significant losses. In this article, we will discuss what OTM options are, why you should avoid trading them, and provide tips for successful options trading.

Image: nataniacreates.com

Understanding Out of the Money (OTM) Options

OTM options are options contracts with a strike price that is significantly different from the current market price of the underlying asset. Typically, OTM options have a strike price that is higher (for call options) or lower (for put options) than the current market price. Since the strike price is not likely to be met before the expiration date, OTM options have a low probability of being exercised. Therefore, they are generally considered to be speculative and risky investments.

Why You Should Avoid Trading OTM Options

There are several reasons why you should avoid trading OTM options:

- High Risk: OTM options have a low probability of being exercised, which means there is a high risk of losing your entire investment.

- Time Decay: The value of OTM options erodes over time as the expiration date approaches. This means that even if the underlying asset moves in your favor, you may not make a profit due to time decay.

- Low Liquidity: OTM options are generally less liquid than at-the-money (ATM) or in-the-money (ITM) options, which can make it difficult to enter or exit trades quickly.

Tips for Successful Options Trading

To increase your chances of success in options trading, follow these tips:

- Trade with a Plan: Define your trading strategy before entering any trades. Determine the risk you are willing to take, the return you expect, and the exit strategy you will use.

- Use Proper Risk Management: Never trade with more money than you can afford to lose. Use stop-loss orders to limit your downside risk.

- Trade In-the-Money Options: ITM options have a higher probability of being exercised than OTM options, reducing your risk and increasing your potential for profit.

- Understand the Greeks: The Greeks are a set of metrics that measure the risk and sensitivity of options contracts to various factors. Understanding the Greeks can help you make informed trading decisions.

- Educate Yourself: Options trading is a complex subject. Take the time to educate yourself by reading books, attending seminars, and practicing in a simulated trading environment.

Image: stock-investing-guide.com

FAQ on Options Trading

Q: What are the benefits of options trading?

A: Options trading offers several benefits, including leverage, risk management, income generation, and potential value appreciation.

Q: What are the risks of options trading?

A: Options trading involves significant risks, including the potential for complete loss of capital, time decay, and liquidity risk.

Q: What is the difference between call and put options?

A: Call options give the holder the right (but not the obligation) to buy the underlying asset at a specified price. Put options give the holder the right (but not the obligation) to sell the underlying asset at a specified price.

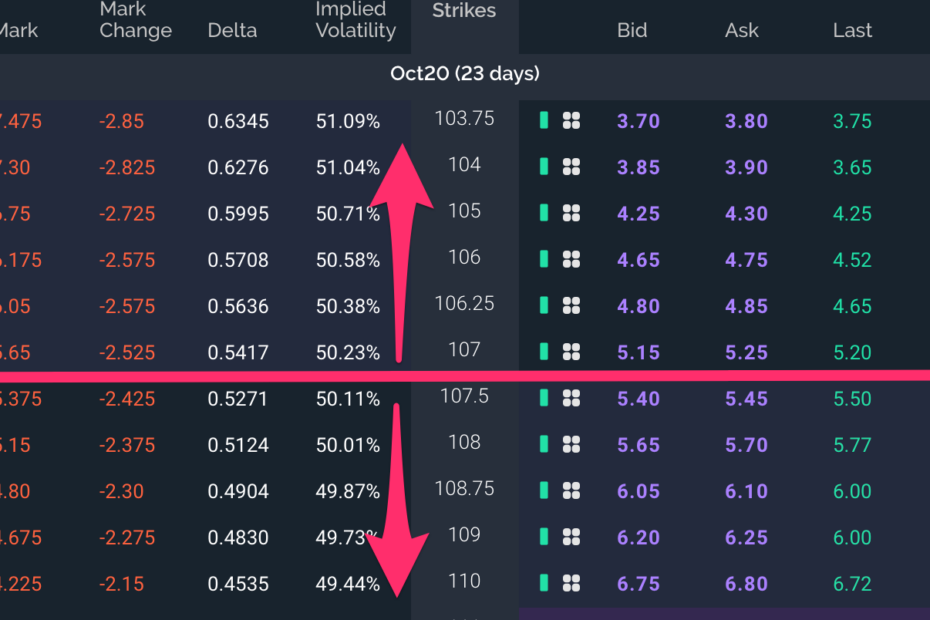

Stop Trading Out Of The Money Options

Image: www.incomementorbox.com

Conclusion

By understanding the risks and benefits of options trading, and by following the tips provided in this article, you can increase your chances of success and avoid the pitfalls of trading OTM options. Remember, options trading is a complex subject and requires constant education and practice. Always consult with a financial professional before making any trading decisions.

Are you ready to take control of your financial future with options trading? Lets learn to trade together and lets make profits consistently, get a mentor today!