Introduction

In the fast-paced world of financial markets, trading options has emerged as a powerful tool for investors seeking to harness risk and leverage potential gains. As technology continues to reshape the trading landscape, Webull has emerged as a leading platform offering cash account options trading, empowering individual investors with unparalleled convenience and access to sophisticated trading strategies.

Image: www.fiverr.com

In this comprehensive guide, we will delve into the fundamentals of Webull cash account options trading, providing you with the knowledge and insights necessary to navigate this complex yet rewarding domain. We’ll explore everything from basic concepts to advanced strategies, equipping you with the skills to make informed decisions and maximize your trading potential.

Demystifying Webull Cash Account Options Trading

Cash account options trading involves buying or selling options contracts—derivatives that grant the buyer the right but not the obligation to buy or sell an underlying asset at a predetermined price within a stipulated time frame. Unlike margin trading, cash account options trading requires the trader to fully fund their trades, eliminating the risk of margin calls and promoting responsible financial management.

How Options Contracts Work

An options contract is characterized by three key parameters: strike price, expiration date, and premium. The strike price represents the price at which the buyer can exercise their right to buy or sell the underlying asset. The expiration date dictates the period during which the option contract is valid. Finally, the premium reflects the cost, paid by the buyer to the seller, for the right to exercise the option.

Basic Option Trading Strategies

Beginners can start with basic options trading strategies such as buying calls or puts. Buying a call option gives the trader the right to buy an underlying asset at a future date, while buying a put option confers the right to sell the asset.

Image: www.the-pool.com

Advanced Option Trading Strategies

As traders gain experience and confidence, they can explore more advanced strategies such as spreads, which involve combining multiple options contracts to mitigate risk and increase the probability of profitability. These strategies require in-depth knowledge and a deep understanding of market dynamics.

Tips for Successful Options Trading

To enhance your options trading success, consider the following tips:

- Educate yourself: Thoroughly research options trading and understand its inherent risks and rewards.

- Start small: Initially, trade with small amounts of capital until you gain proficiency.

- Manage risk effectively: Use strategic techniques such as stop-loss orders and proper position sizing to manage risk and protect your trading capital.

- Seek expert advice: Consult reputable financial professionals or experienced traders for guidance and insights.

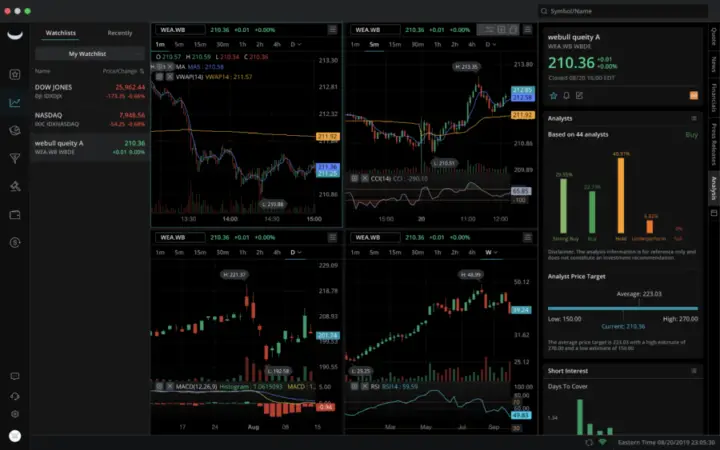

Webull Cash Account Options Trading

Image: themoneyninja.com

Conclusion

Harnessing a combination of knowledge, strategy, and discipline, you can unlock the boundless possibilities of Webull cash account options trading. By delving into this comprehensive guide, you have taken the first step towards mastering this empowering trading technique. Remember, success in options trading is not a destination but an ongoing journey of learning and adaptation. Embrace the challenge, embrace the knowledge, and navigate the markets with confidence and purpose.