Introduction

As an active trader, I’ve often wondered about implications and tax consequences involving wash sales. It was stressful not being able to take advantage of lucrative opportunities due to unfavorable regulations and potential penalties. However, after extensive research, I’m confident in the knowledge I’ve gained on the topic and eager to share it with you.

Image: tradingvector.com

What is a Wash Sale?

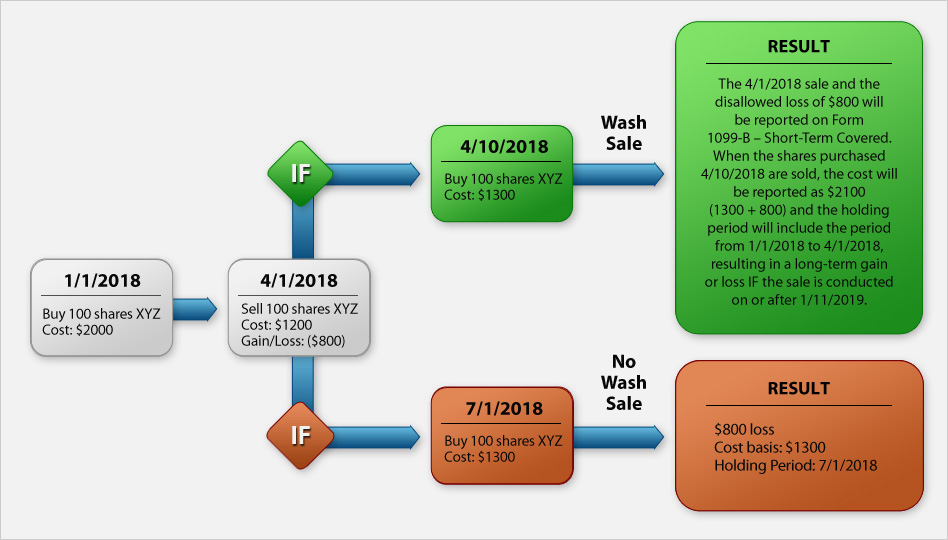

A wash sale occurs when you sell a security with a loss and within 61 calendar days you buy (or contract to buy) the same security, the equivalent security, or a substantially similar security.

A substantially similar security means any security that is interchangeable with another security.

Consequences of a Wash Sale

In case of a wash sale, the loss realized on the sale will be disallowed. The disallowed loss is added to the cost basis of the new stock acquired, thus deferring but not eliminating the recognition of the loss.

Exceptions to the Wash Sale Rule

There are a few exceptions to the Wash Sale Rule. They include:

- Losses or gains incurred while closing a position.

- Creation or termination of a hedge.

- Settlement of a short sale.

- Loss due to option expiration.

- Convertible securities.

- Securities held in an IRA or qualified plan.

Image: www.interactivebrokers.com

Trading Strategies to Avoid Wash Sales

Knowing the wash sales rules and exceptions allow for adopting strategies such as:

- Completely selling a position before buying back the stock, ensuring more than 61 days have passed.

- Acquire call options and put options in an open trade with different strike prices or expiration dates.

Wash Sale Loss For Options Trading

Image: www.tradelogsoftware.com

Conclusion

Understanding wash sale rules is key for traders participating in the options markets. The material contained herein covers a lot of technical content, and we discussed this complex topic as clearly as possible. Working knowledge of the wash sale rule can improve your decision-making and eliminate unintended tax consequences. Please seek further clarification if needed. Was this article helpful? Let us know in the comments below.