Introduction

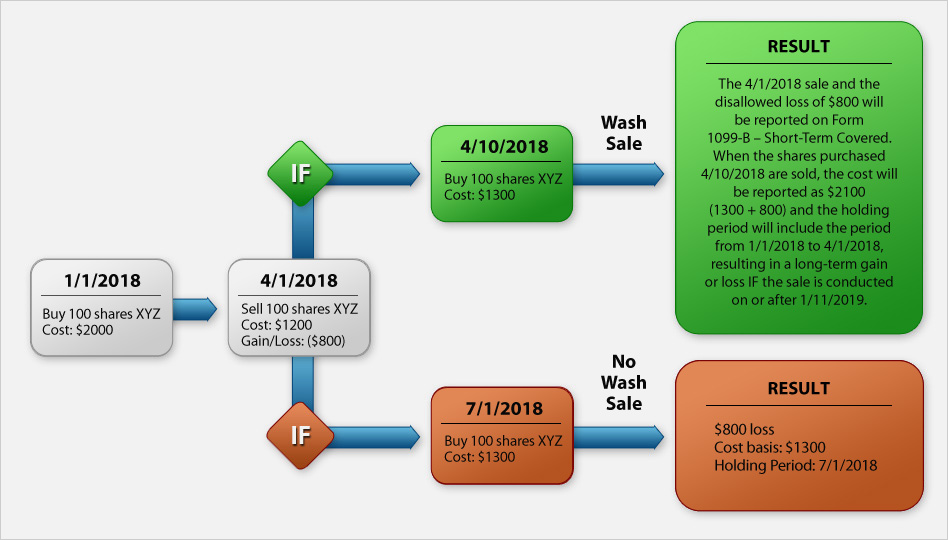

In the intricate world of stock market trading, the wash sale rule stands as a crucial concept that investors navigating the options terrain must fully comprehend. A wash sale occurs when a trader sells a security at a loss and then, within 30 days, repurchases the same or substantially similar security. This seemingly innocuous act triggers the wash sale rule, invalidating the tax loss incurred from the initial sale. The Internal Revenue Service (IRS) employs this regulation to deter taxpayers from artificially inflating their capital losses for tax benefits.

Image: www1.interactivebrokers.com

Understanding the Basics

The wash sale rule applies not only to stocks but also to options contracts. When an investor sells an option contract at a loss and acquires a similar contract within 30 days, the loss is disallowed for tax purposes. This disallowance extends to any transactions involving puts, calls, or other types of options on the same underlying asset.

Substantially Similar Securities

The term “substantially similar” is key in determining whether the wash sale rule applies. The IRS defines substantially similar securities as those with identical rights and privileges, even if they differ in strike prices, expiration dates, or other minor details. For instance, selling an Apple call option with a strike price of $100 and then buying an Apple call option with a strike price of $105 within 30 days would constitute a wash sale.

Avoiding the Wash Sale Rule

To avoid triggering the wash sale rule, investors should carefully monitor their trading activities and adhere to certain guidelines:

- Wait 30 Days: Simply waiting 30 days after selling a security before purchasing a similar one is the most straightforward way to comply with the wash sale rule.

- Sell and Buy Different Underlying Assets: If selling a loss-making option contract, consider purchasing an option on a different underlying asset to avoid the wash sale rule.

- Utilize Straddles and Strangles: Straddles and strangles involve simultaneously buying and selling options with different strike prices or expiration dates. These strategies can help mitigate the wash sale rule’s impact.

Image: www.thesavingdude.com

Consequences of Violating the Rule

Disregarding the wash sale rule can lead to substantial tax implications. The disallowed loss will be added to the trader’s cost basis in the repurchased security. This increased cost basis reduces the potential capital gain or increases the capital loss when the security is eventually sold.

Wash Sale Rule Trading Options

Image: tradingvector.com

Conclusion

The wash sale rule plays a crucial role in ensuring fair and equitable tax practices for investors dealing in options contracts. Understanding the rule’s mechanics and adhering to its guidelines is vital to avoid unintended tax consequences. By carefully planning their trading strategies, investors can navigate the options market effectively while ensuring compliance with the wash sale rule.