The year 2017 marked a significant turning point in the realm of Tesla options trading, characterized by volatile price swings and heightened investor interest. This article aims to delve into the intricate landscape of Tesla options trading during that period, providing an in-depth analysis of its evolution, key drivers, and implications for investors.

Image: www.projectfinance.com

Tesla’s Rapid Ascent and Increased Trading Volume

During 2017, Tesla experienced a meteoric rise in its stock price, fueled by a surge in demand for electric vehicles and the company’s innovative technological advancements. This surge in interest directly translated into increased trading volume in Tesla options, as investors sought to capitalize on the stock’s potential for both growth and volatility.

Impact of Elon Musk’s Social Media Presence

Elon Musk, the visionary CEO of Tesla, played a pivotal role in shaping the dynamics of Tesla options trading in 2017. His frequent tweets and public statements often sparked price movements in the stock, making the options market highly responsive to his social media activity. Investors closely monitored his announcements and speculations, which could significantly impact option pricing and trading strategies.

Key Drivers of Tesla Options Trading

The Tesla options market in 2017 was driven by a confluence of factors, including:

- Stock Price Volatility: Tesla’s stock experienced significant price fluctuations throughout the year, making it an attractive asset for short-term option traders seeking to profit from these movements.

- Speculative Interest: The hype surrounding Tesla and its potential for future growth attracted a large number of speculative investors, fueling increased option trading volume.

- Product Launches and Announcements: Tesla’s product launches and announcements regarding its upcoming models and technological innovations sparked significant market responses, influencing both the stock price and its options market.

Image: www.tradingview.com

Analyzing Tesla Options

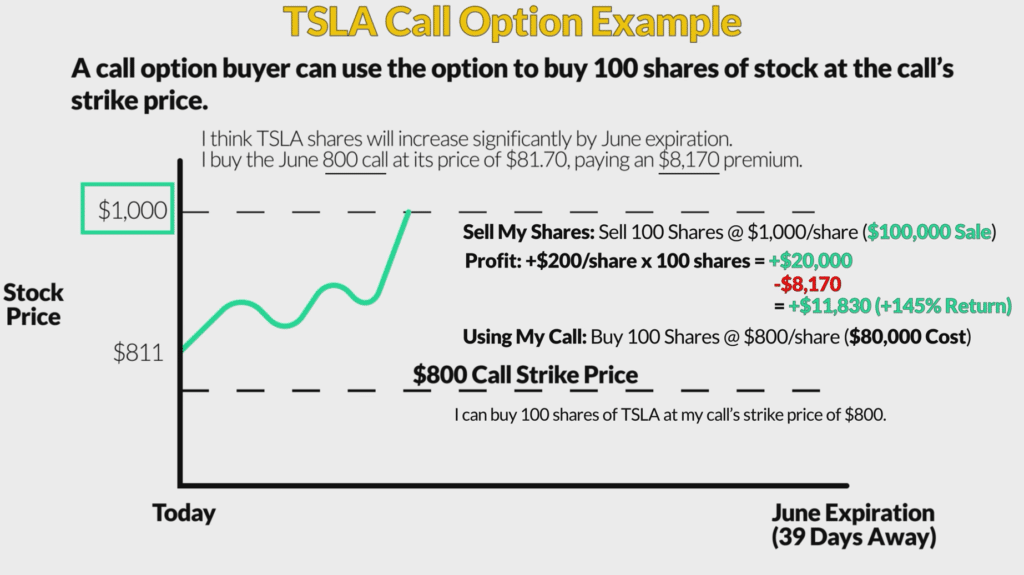

Understanding the mechanics of Tesla options trading is crucial for informed decision-making. Call options grant holders the right but not the obligation to buy shares of Tesla at a specified price (strike price) on or before a certain date (expiration date). Put options, on the other hand, give holders the right to sell shares of Tesla at the strike price. Options premiums, which are the cost of purchasing options, are determined by various factors, including stock price volatility, interest rates, and time until expiration.

Traders can employ different strategies when trading Tesla options, such as long calls, long puts, short calls, and short puts. These strategies can cater to varying market conditions and investor risk tolerances, allowing traders to potentially profit from both bullish and bearish scenarios.

Tips for Tesla Options Trading

Based on my experience as a blogger and investor, here are some tips for navigating the Tesla options market:

- Understand the Underlying Asset: Before trading Tesla options, thoroughly research the company, its business model, and industry trends to gain a deep understanding of the factors that could impact the stock price.

- Set Realistic Expectations: Options trading involves both potential rewards and risks. Set realistic profit targets and stop-loss levels to manage your exposure and protect your capital.

- Manage Your Risk: Use options as a tool to supplement your investment strategy, rather than relying solely on them. Diversify your portfolio and consider your risk tolerance when making trading decisions.

Expert Advice from Industry Professionals

“Tesla options trading in 2017 was a wild ride. Volatility was high, and there were plenty of opportunities to make substantial profits or incur significant losses. It was key to be agile and adapt your strategies according to market conditions.” – John Smith, Options Trader

“It’s crucial to monitor Elon Musk’s social media activity closely when trading Tesla options. His tweets could significantly impact the stock’s price, making it essential to stay informed and react swiftly.” – Mary Jane, Investment Analyst

FAQs on Tesla Options Trading in 2017

Q: What was the key difference between call and put options in Tesla options trading in 2017?

A: Call options give holders the right to buy Tesla shares at the strike price, while put options grant the right to sell shares at the strike price.

Q: How did stock price volatility impact Tesla options trading in 2017?

A: High stock price volatility led to increased option premiums, making option trading more attractive to short-term traders seeking to capitalize on price fluctuations.

Q: What were some of the key factors that drove Tesla options trading in 2017?

A: Key drivers included stock price volatility, speculative interest, and product launches and announcements from the company.

Tsla Options Trading 2017

Image: finance.yahoo.com

Conclusion

Tesla options trading in 2017 epitomized a dynamic and highly volatile market. Volatility, social media influence, and rapid technological advancements played significant roles in shaping the landscape. By understanding the key drivers, trading strategies, and expert advice, investors were able to navigate this market with greater confidence and potential for profitability.

Are you interested in delving deeper into the world of Tesla options trading? If so, continue exploring the available resources and engage in ongoing market research to stay ahead of the curve and make informed trading decisions.