Unlock the Potential of Options Trading with Fidelity’s Renowned Platform

In today’s dynamic financial landscape, options trading has emerged as a strategic instrument for investors seeking to enhance returns or hedge risks. Fidelity Investments, a pioneering brokerage firm with a stellar reputation, offers a robust options trading account designed to cater to the diverse needs of traders. This comprehensive guide delves into the intricacies of Fidelity’s options trading account, empowering you to make informed decisions and maximize your trading potential.

Image: pubfasr154.weebly.com

Introduction to Fidelity’s Options Trading Account

Fidelity’s options trading account is a specialized platform that facilitates buying and selling of options contracts. Options are financial instruments that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified expiration date. This flexibility empowers traders to speculate on price movements, hedge against risk, or generate income through premium collection.

The advantages of trading options via Fidelity’s platform are multifaceted:

-

Unparalleled Research and Education: Fidelity provides access to an extensive suite of research tools, including real-time quotes, charts, and market analysis, to aid decision-making.

-

Advanced Trading Platform: Fidelity’s Active Trader Pro (ATP) software offers a customizable trading interface, real-time market updates, and sophisticated charting capabilities.

-

Competitive Commission Structure: Fidelity offers tiered commission rates based on the volume of trades, providing cost savings for active traders.

-

Account Protection: Fidelity is a SIPC member, ensuring up to $750,000 of protection for eligible accounts.

Understanding Options Trading Basics

Before embarking on options trading, it is crucial to grasp its fundamental concepts:

-

Call Options: Grants the buyer the right to purchase an underlying asset at the strike price on or before the expiration date.

-

Put Options: Grants the buyer the right to sell an underlying asset at the strike price on or before the expiration date.

-

Strike Price: Predetermined price at which the underlying asset can be bought (call) or sold (put).

-

Expiration Date: Date on which the option contract expires, rendering it worthless.

-

Premium: Price paid by the buyer to acquire an option contract.

Trading Options with Fidelity

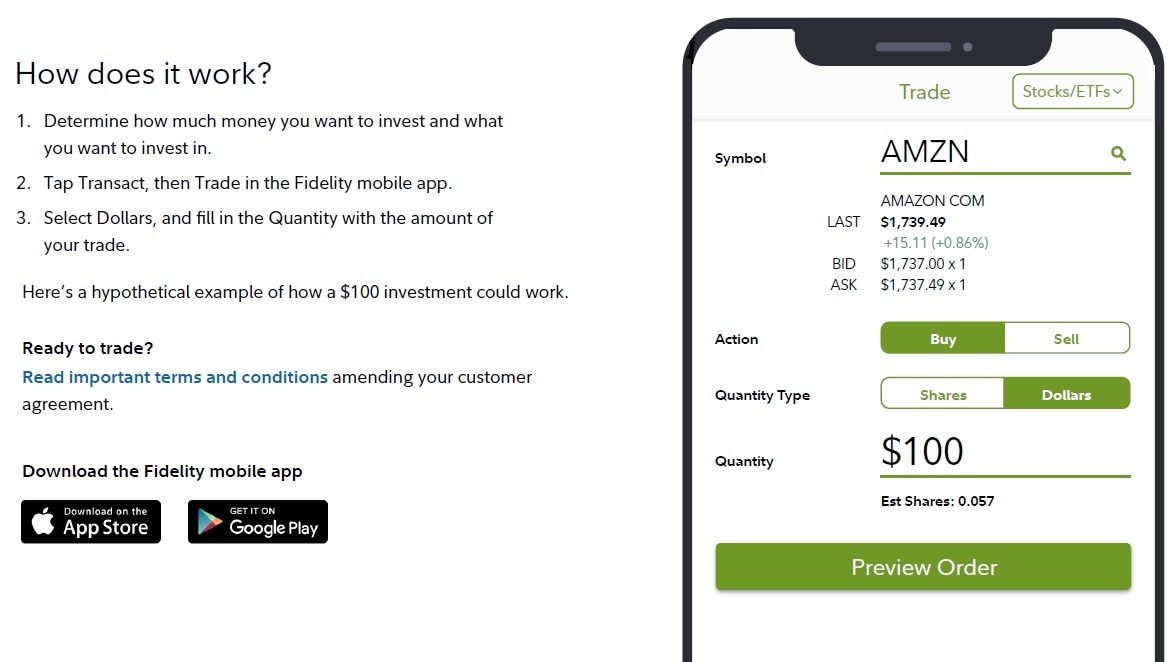

To trade options with Fidelity, follow these steps:

-

Open an Options Trading Account: Apply for an options trading account after undergoing a suitability assessment.

-

Fund Your Account: Deposit funds into your account to begin trading options.

-

Access the Trading Platform: Familiarize yourself with Fidelity’s ATP software and customize the interface to your preferences.

-

Research and Select Options: Conduct thorough research, analyze market trends, and identify suitable options contracts.

-

Place an Order: Enter the option contract details, including quantity, strike price, expiration date, and premium amount.

-

Monitor and Manage Positions: Track the performance of your options positions, adjust strategies as needed, and close trades to realize gains or limit losses.

Image: ykumixyqatala.web.fc2.com

Strategies for Trading Options

Fidelity’s options trading account empowers traders to execute a wide range of strategies, including:

-

Covered Call: Selling a call option against an underlying asset that you own to generate income or reduce risk.

-

Protective Put: Buying a put option to hedge against downside risk in a portfolio containing the underlying asset.

-

Bull Call Spread: Buying one call option at a lower strike price and selling another call option at a higher strike price to profit from a moderate rise in the underlying asset’s price.

-

Bear Put Spread: Buying one put option at a higher strike price and selling another put option at a lower strike price to profit from a moderate decline in the underlying asset’s price.

Fidelity Options Trading Account

Image: www.fondazionealdorossi.org

Conclusion

Fidelity’s options trading account offers a robust platform for traders seeking to enhance returns or manage risks. Its comprehensive research tools, advanced trading platform, and competitive commission structure provide a compelling option for both seasoned and aspiring options traders. By understanding the basics of options trading and implementing prudent strategies, you can leverage Fidelity’s account to unlock new opportunities in the financial markets. Remember to trade responsibly, conduct due diligence, and always consult with a financial advisor if necessary. Embrace the power of Fidelity’s options trading account and elevate your trading to new heights.