In the exhilarating realm of financial markets, where fortunes are forged and aspirations met, a captivating competition awaits traders of all calibers – the TMX Options Trading Competition. This prestigious event offers a unique opportunity to showcase your trading acumen, sharpen your strategies, and claim a slice of substantial prizes. Embrace the challenge and delve into the intricacies of options trading, a powerful tool that can elevate your financial prowess and unlock limitless possibilities.

Image: www.youtube.com

Navigating the Labyrinth of Options Trading: A Beginner’s Guide

Before embarking on this competitive journey, it’s imperative to establish a solid understanding of options trading, an intricate yet rewarding financial instrument. Options, as the name suggests, grant the holder the option but not the obligation to buy or sell an underlying asset at a predetermined price on or before a specified date. They offer traders a versatile toolbox for expressing market views, managing risk, enhancing returns, and maximizing profits.

Understanding the terminology associated with options trading is paramount. Options contracts comprise two fundamental components: the call option and the put option. Call options empower the holder with the right to purchase the underlying asset at the strike price, while put options grant the holder the right to sell the underlying asset at the strike price. The strike price represents the predetermined price at which the underlying asset can be bought or sold.

Mastering the Art of Options Trading: Strategies for Success

To emerge victorious in the TMX Options Trading Competition, cultivating a repertoire of effective trading strategies is essential. Seasoned traders employ a diverse range of approaches, each tailored to specific market conditions and personal risk tolerance. Some of the most commonly deployed strategies include:

Covered Call: This strategy involves selling (writing) a call option while simultaneously owning the underlying asset. It’s ideal for generating additional income while maintaining exposure to potential upside in the underlying asset’s price.

Protective Put: This strategy involves purchasing a put option to hedge against potential downside risk in the underlying asset’s price. It’s commonly employed by investors seeking to protect their existing positions or minimize losses.

Collar: This strategy combines both a covered call and a protective put, creating a defined range within which the underlying asset’s price can fluctuate. It’s a suitable strategy for investors desiring moderate risk and return potential.

Iron Condor: This advanced strategy involves selling (writing) both a call option and a put option at higher and lower strike prices, respectively, while simultaneously purchasing both a call option and a put option at even higher and lower strike prices. It’s often utilized in markets with low volatility to generate income from option premiums.

Deciphering Market Dynamics: Fundamental and Technical Analysis

Success in options trading hinges on the ability to decipher market dynamics, both fundamental and technical. Fundamental analysis delves into economic data, company earnings, and industry trends to assess the intrinsic value of an underlying asset. Technical analysis, on the other hand, examines price action, chart patterns, and indicators to identify trading opportunities. By mastering both fundamental and technical analysis, traders gain a comprehensive view of market forces, enabling them to make informed trading decisions.

Image: www.leaprate.com

Trading Psychology: A Cornerstone of Success

The psychological aspect of trading plays a crucial role in achieving consistent success. Maintaining emotional discipline, managing risk effectively, and cultivating patience are essential attributes of a successful trader. Adopting a structured trading plan, adhering to risk management principles, and embracing a learning mindset can help traders navigate the emotional rollercoaster of the markets. By mastering trading psychology, traders can mitigate the impact of biases, minimize impulsive decisions, and maximize their profit potential.

Embracing the Journey: Continuous Learning and Improvement

The realm of options trading is constantly evolving, presenting traders with a never-ending opportunity for learning and refinement. Staying abreast of market trends, studying successful trading strategies, and seeking mentorship from experienced traders can accelerate your progress and enhance your trading acumen. By embracing continuous learning and improvement, you embark on a lifelong journey of knowledge acquisition, skill development, and financial growth.

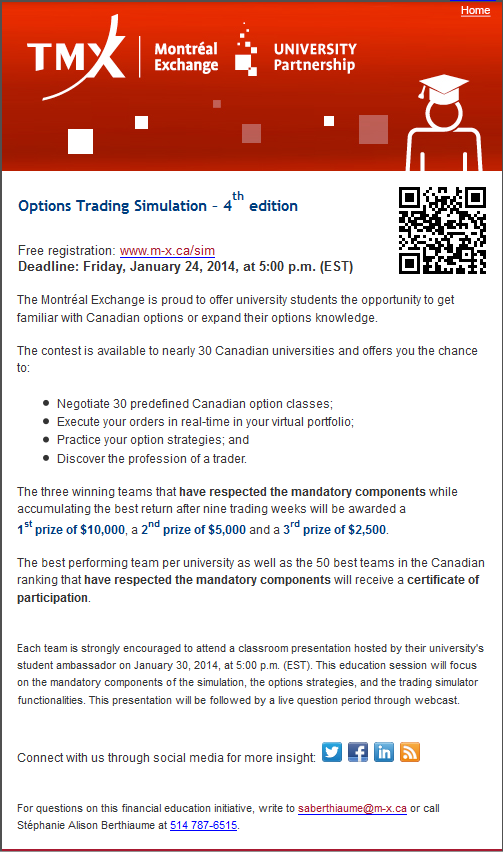

Tmx Options Trading Competition

Image: dan.uwo.ca

Conclusion: Reap the Rewards of Options Trading Mastery

The TMX Options Trading Competition is a testament to the transformative power of financial markets. It offers a platform for traders to test their skills, expand their knowledge, and reap the rewards of options trading mastery. Through a deep understanding of options trading strategies, market dynamics, and trading psychology, coupled with an unyielding commitment to continuous learning and improvement, you can unlock the full potential of this captivating financial instrument. So, seize this opportunity, embrace the challenge, and emerge victorious in the TMX Options Trading Competition, etching your name among the elite traders of the financial world.