Captivating Introduction

Imagine stepping into the exhilarating world of stock options, where strategic decisions have the potential to unlock financial freedom. Among the diverse options available, the premier contract stands out: the Standard & Poor’s 500 (SPX) option. It offers a unique opportunity to sell the option and reap the rewards of the premium. This article will delve into the intricacies of SPX options, empowering you to harness their potential and elevate your trading endeavors.

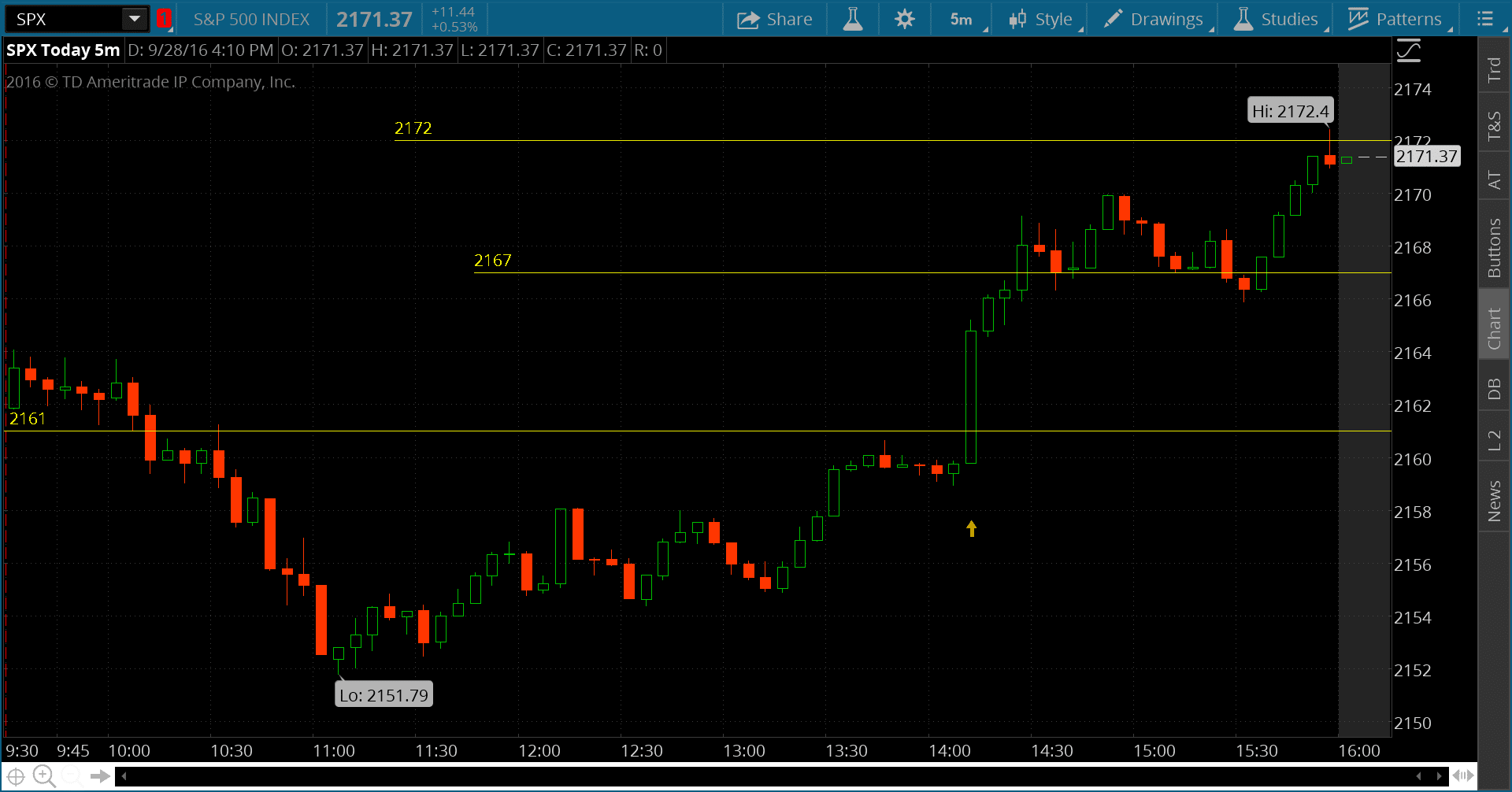

Image: www.reddit.com

Understanding SPX Options: A Beginner’s Guide

SPX options are derivative contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) a specified number of shares of the S&P 500 Index (SPX) at a predetermined price (strike price) on or before a particular date (expiration date). When selling an SPX option, you become the option writer and receive a premium in exchange for granting the buyer these rights.

The Mechanics of Selling SPX Options: A Step-by-Step Guide

Before venturing into the world of SPX options, it’s imperative to establish a foundational understanding of the mechanics involved when selling an option:

-

Option Premium: The premium is the price paid by the option buyer to the option writer in exchange for the right to exercise the option. It represents the intrinsic value of the option, which fluctuates based on factors such as the underlying asset’s price, time to expiration, and volatility.

-

Short Position: When selling an SPX option, you take a short position, meaning that you sell the option to another party with the expectation that it will decrease in value. If your prediction holds true, you profit from the difference between the premium received and the option’s current value. However, if the option increases in value, you may incur a loss.

-

Covered vs. Naked Selling: Two primary approaches to selling options exist: covered selling and naked selling. In covered selling, you own the underlying asset (SPX) and write an option against it. This strategy limits potential losses but also caps potential profits. In contrast, naked selling involves selling an option without holding the underlying asset, which carries greater risk but also offers the potential for higher returns.

Expert Insights and Actionable Tips

To navigate the complexities of SPX options, it’s wise to heed the guidance of seasoned experts in the field. Here are some key insights and actionable tips to enhance your trading strategy:

-

Identify Trading Opportunities: Identify favorable entry points by analyzing the market landscape, including factors such as stock price trends, volatility, and market sentiment.

-

Manage Risk: Implement prudent risk management strategies, such as setting stop-loss orders and maintaining appropriate position sizing.

-

Position Sizing: Calculate the appropriate number of contracts to trade based on your capital and risk tolerance. Avoid trading excessive amounts that could potentially lead to significant losses.

.png?format=1500w)

Image: www.environmentaltradingedge.com

Trading Spx Options Sells The Option To Get The Premium

Image: www.spxoptiontrader.com

Compelling Conclusion

Selling SPX options can be a powerful tool for generating premium income and enhancing your trading strategy. By mastering the fundamentals, embracing expert insights, and utilizing actionable tips, you can unlock the full potential of these contracts and empower yourself to navigate the financial markets with confidence. Remember to approach trading with a well-informed and disciplined mindset to maximize your chances of success.