Introduction:

Image: templatearchive.com

Imagine a world where you could trade options with unwavering confidence, knowing precisely what you’re doing and what to expect. Enter the options trading template – a comprehensive guide that empowers you to navigate the complexities of options trading with clarity and expertise. Join us as we embark on an illuminating journey into the world of options and unveil the transformative power of this invaluable tool.

What is an Options Trading Template?

An options trading template is a structured framework that outlines the essential elements of an options trade. It encompasses the underlying asset, the strike price, the expiration date, the option type (call or put), and the premium involved. By capturing these critical details in a single, organized format, the template provides a comprehensive snapshot of the trade, enabling informed decision-making and efficient execution.

Benefits of Using an Options Trading Template:

-

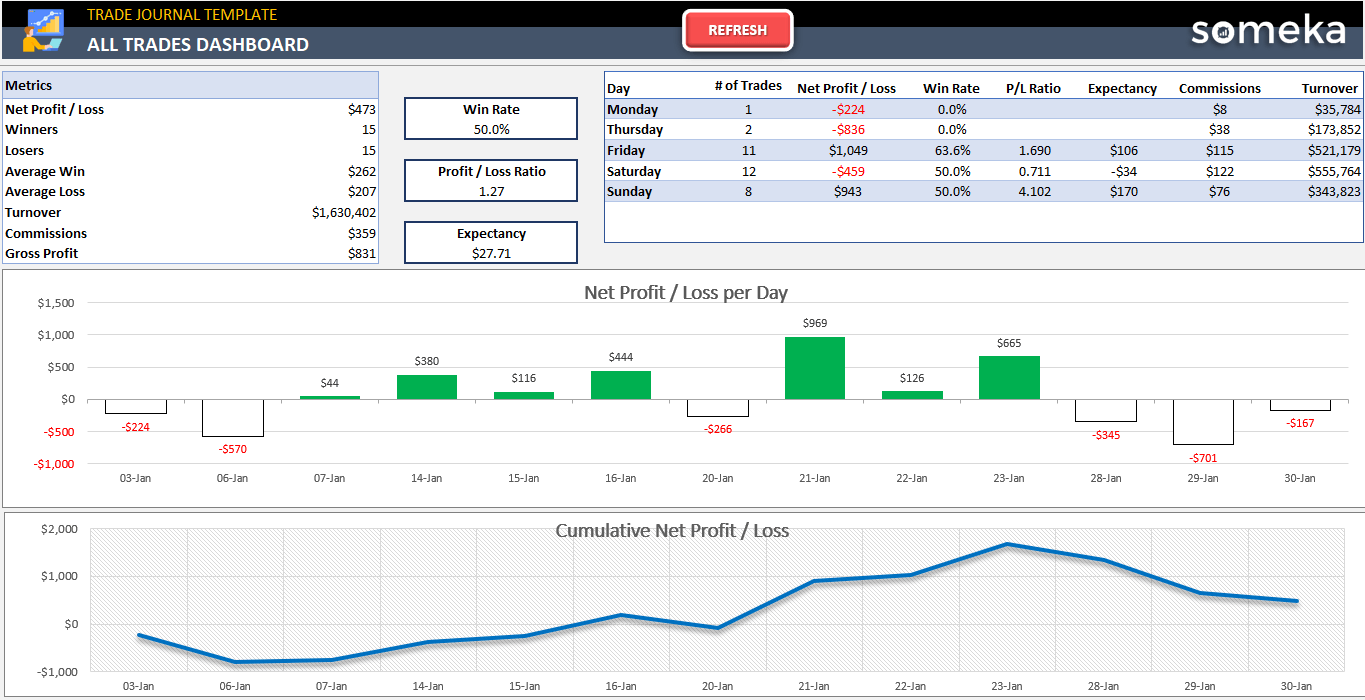

Enhanced Decision-Making: Templates facilitate a systematic approach to options trading, reducing the potential for impulsive choices based on emotions or incomplete information.

-

Time-Saving: By streamlining the planning process, templates save you valuable time, allowing you to analyze more opportunities and stay ahead of the market’s ebb and flow.

-

Improved Accuracy: Templates minimize the risk of errors by ensuring all relevant information is captured and considered before executing a trade.

-

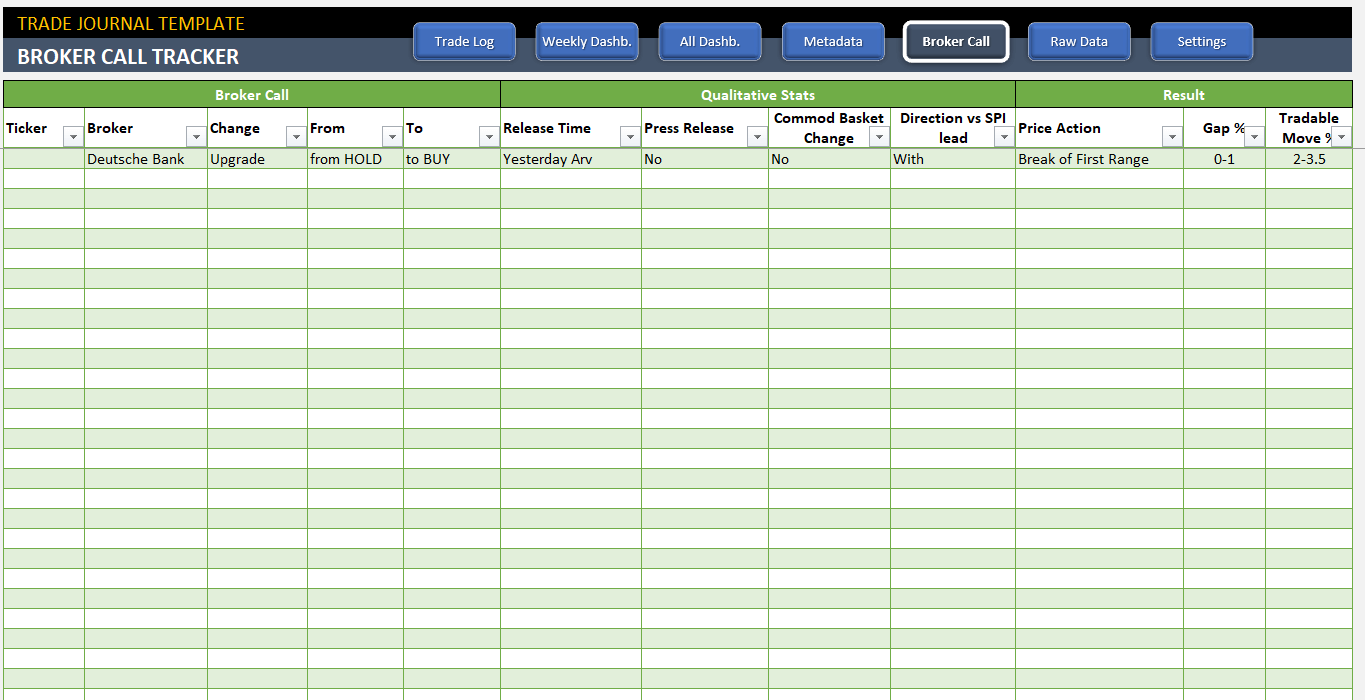

Consistent Tracking: Templates provide a uniform format for recording your trades, enabling you to easily track your performance and identify patterns for continuous improvement.

Creating an Options Trading Template:

-

Underlying Asset: Identify the underlying asset that will be the focus of your trade, such as a stock, commodity, or currency.

-

Strike Price: Determine the strike price at which the option will be exercised. This choice will significantly impact the premium paid and potential profit or loss.

-

Expiration Date: Set the date on which the option expires. This consideration affects the time value of the option and the overall trade strategy.

-

Option Type: Choose between call options, which confer the right to buy the underlying asset at the strike price, or put options, granting the right to sell.

-

Premium: Pay careful attention to the premium, which is the cost associated with acquiring the option. The premium is influenced by market conditions, the time until expiration, and the asset’s volatility.

Empowering Yourself with Expert Insights:

“The options trading template is an indispensable tool for traders seeking a structured approach to maximizing their returns,” says Dr. Mark Stevens, a renowned options trading expert. “By meticulously capturing the essential trade elements, templates empower investors with the clarity and objectivity needed to navigate the complexities of options trading.”

Transforming Your Trading Journey:

With the options trading template as your guide, you can now confidently embark on a transformative trading journey. Experience the power of informed decisions, efficient execution, and consistent performance tracking. Let this tool be your beacon of clarity, leading you to a future of successful options trading.

Call To Action:

The options trading template is your gateway to trading with precision and purpose. Download our free template today and join the ranks of informed investors who embrace the power of knowledge. Let this template be your ally in unlocking the full potential of your financial endeavors.

Image: templates.mist-bd.org

Options Trading Template

Image: mavink.com