Trading options is a powerful way to amplify your returns and hedge against unforeseen risks. By leveraging options spreads, you can create tailored strategies that align with your financial goals and risk tolerance. In this comprehensive guide, we delve into the complexities of trading options spreads within your IRA authorization agreement, empowering you to unlock the true potential of this versatile investment tool.

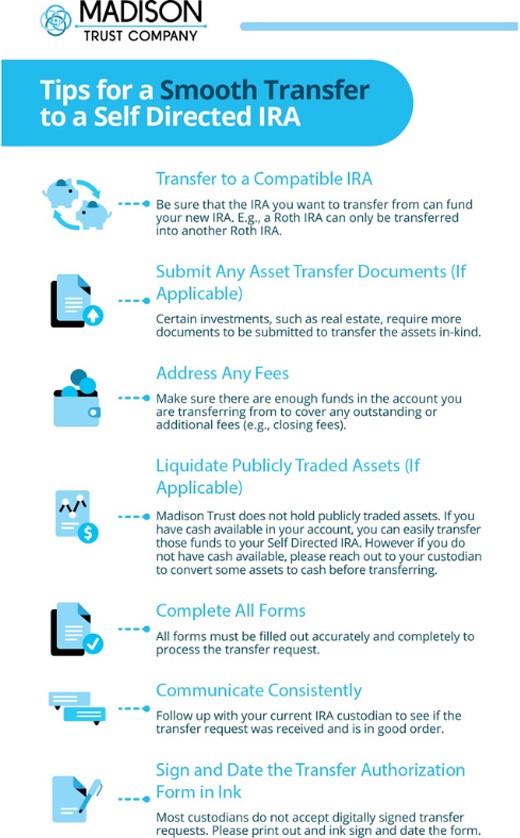

Image: www.madisontrust.com

Empowering Your Retirement Portfolio with Options Spreads

An individual retirement account (IRA) is designed to help you save for your golden years. Beyond traditional investments like stocks and bonds, you can unlock even more profit opportunities by incorporating options spreads into your IRA strategy. Options spreads allow you to combine multiple options contracts to create a custom position with defined risk and reward parameters. By skillfully executing these strategies, you can enhance your returns, protect your investments, and navigate market volatility more effectively.

Demystifying Options Spreads: A Journey into Profitable Strategies

Options spreads involve a combination of two or more options contracts related by the same underlying asset but with different strike prices or expiration dates. This intentional merge generates a wide spectrum of strategies, each tailored to specific market conditions and investor objectives. For instance, a bull call spread offers a leveraged play on a stock’s upward movement, while a bear put spread hedges against potential market downturns. Understanding these strategies empowers you to adapt your investment approach to diverse market scenarios.

A Case Study: Unlocking Profits with Bull Call Spreads

Imagine a promising tech company whose stock, ABC, is currently trading at $50. You anticipate a stock surge in the coming months. Enter the bull call spread. You purchase one call option with a strike price of $55 for $3 (premium), and you sell one call option with a strike price of $60 for $1 (premium). This strategy effectively locks in a potential profit if ABC’s stock surpasses $58 ($60 strike price minus $55 strike price minus $3 premium plus $1 premium). If the stock falls short of your prediction, your maximum loss is limited to the net premium you paid ($3 minus $1 = $2). This calculated risk-reward ratio allows you to capitalize on upside potential while shielding your portfolio from substantial losses.

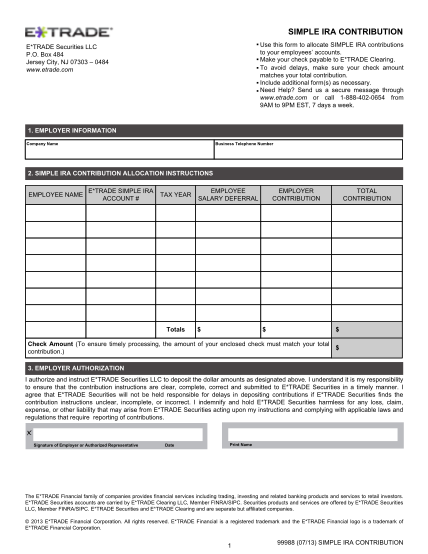

Image: cocodoc.com

Understanding the Regulatory Framework: Unlocking Options Spreads in IRAs

Trading options spreads within IRAs requires authorization from the IRA custodian. Ensure your IRA agreement explicitly permits such strategies and review any specific guidelines or restrictions imposed. Before venturing into options spreads, a comprehensive understanding of the associated risks is crucial. Seek guidance from a qualified financial advisor who can illuminate the nuances of these strategies and help you craft a prudent investment plan.

Trading Options Spreads In Your Ira Authorization Agreement

Image: www.pdffiller.com

Conclusion: Unlocking Your IRA’s True Potential

Trading options spreads within your IRA authorization agreement unlocks a world of profit opportunities, empowering you to enhance returns and navigate market volatility. Thorough research, a clear understanding of the strategies, and prudent risk management are indispensable keys to success. By leveraging the power of options spreads, you can unlock the full potential of your IRA, paving the way for a brighter financial future.