Master the Art of Stock Option Trading with Our Beginner-Friendly Course

Learning how to trade stock options can be a daunting task for beginners, but it doesn’t have to be. With the right knowledge and guidance, you can unlock the potential of this financial instrument to boost your investment portfolio. This comprehensive guide will provide you with a firm foundation in stock option trading, empowering you to make informed decisions and seize profitable opportunities. Embark on a journey to financial success with our beginner-friendly course designed to equip you with the necessary skills and insights.

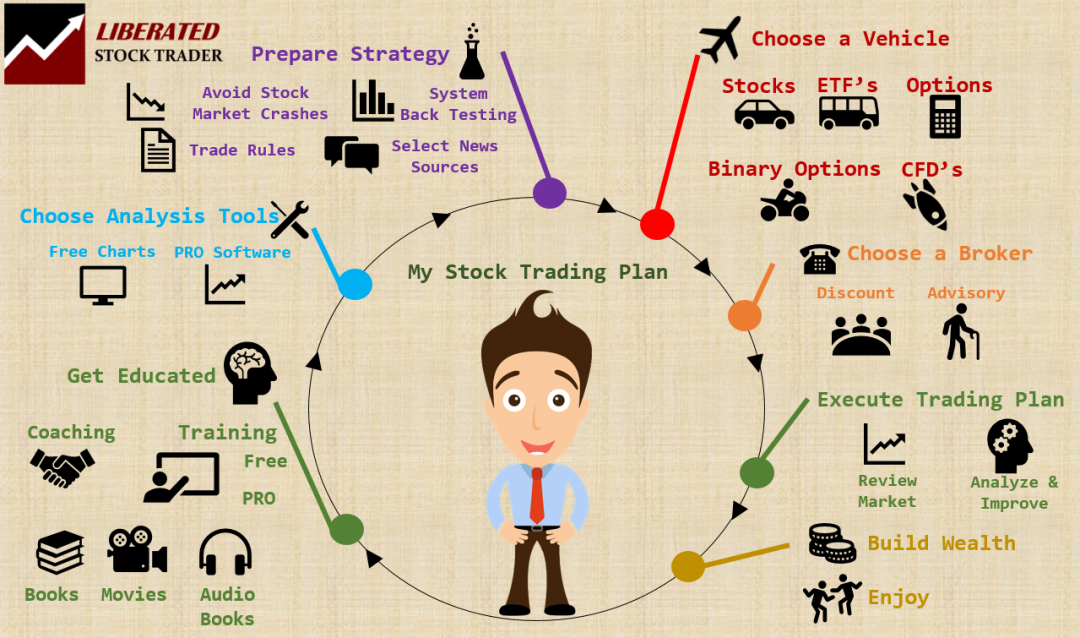

Image: www.reed.co.uk

Understanding Stock Options: A Window into the Financial World

Stock options grant you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. Think of them as contracts that give you the flexibility to take advantage of market movements while limiting your potential losses. Options allow you to strategize your investments, potentially maximizing returns and mitigating risks.

Types of Stock Options: Navigating the Trading Landscape

Step into the world of stock options and discover the two primary types: calls and puts. Call options convey the right to buy an asset at a strike price on or before the expiration date. Conversely, put options bestow the right to sell an asset at the strike price within the same time frame. Understanding these fundamental differences is crucial for effective option trading.

Understanding Option Premiums: Pricing Your Trading Decisions

Option premiums represent the upfront cost of purchasing an option contract. These premiums are influenced by factors such as the underlying asset’s price, time to expiration, and market volatility. Comprehending how premiums fluctuate empowers you to make calculated decisions, maximizing your potential profitability.

Image: riseband2.bitbucket.io

Evaluating Options Strategies: Shaping Your Investment Approach

Option strategies go beyond simple buy and sell orders, opening doors to customized investment approaches. Covered calls, protective puts, and bullish or bearish spreads are just a few examples. Familiarize yourself with these strategies to fine-tune your trading decisions, aligning with your risk tolerance and financial goals.

Day Trading vs. Long-Term Investing: Choosing Your Path

Deciding between day trading and long-term investing is a key consideration. Day traders buy and sell options within a single trading day, profiting from short-term price movements. Long-term investors, on the other hand, hold options for extended periods, seeking to benefit from underlying asset appreciation. Understanding your investment horizon and risk appetite will guide you towards the most suitable approach.

Managing Risks in Option Trading: Protecting Your Investments

Risk management is paramount in stock option trading. Familiarize yourself with potential risks like time decay, volatility, and unlimited losses. Implement protective measures such as stop-loss orders and position sizing to preserve your capital and mitigate potential setbacks.

How To Trade Stock Options For Beginners Stock Trading Courses

Image: liveinsure.in

Conclusion: Empowering Yourself for Stock Market Success

Unlock the possibilities of stock option trading with this beginner-friendly guide. By absorbing these fundamental concepts, practicing trading strategies, and managing risks effectively, you can transform yourself from a novice into a confident investor. Seize the opportunities that stock options offer, and embrace the journey to financial growth and success. As you deepen your knowledge and experience, you will discover the true potential that lies within this dynamic and rewarding financial instrument.