Filling out Form 8949, Sales and Other Dispositions of Certain Properties, is a crucial step in reporting your option trading activities to the IRS. This form is designed to capture details of your option transactions and helps determine your tax liability. Navigating the complexities of Form 8949 can be overwhelming, but with this comprehensive guide, you’ll learn how to fill it out accurately and efficiently.

Image: moneyinc.com

Understanding the Importance of Form 8949

Form 8949 is an essential document for taxpayers who have engaged in option trading. It provides the IRS with a detailed record of your option transactions, including the sale, exchange, or termination of options. The information on this form helps the IRS calculate your capital gains or losses and ensures you comply with tax laws. Failing to file Form 8949 correctly could lead to penalties and inaccuracies in your tax return.

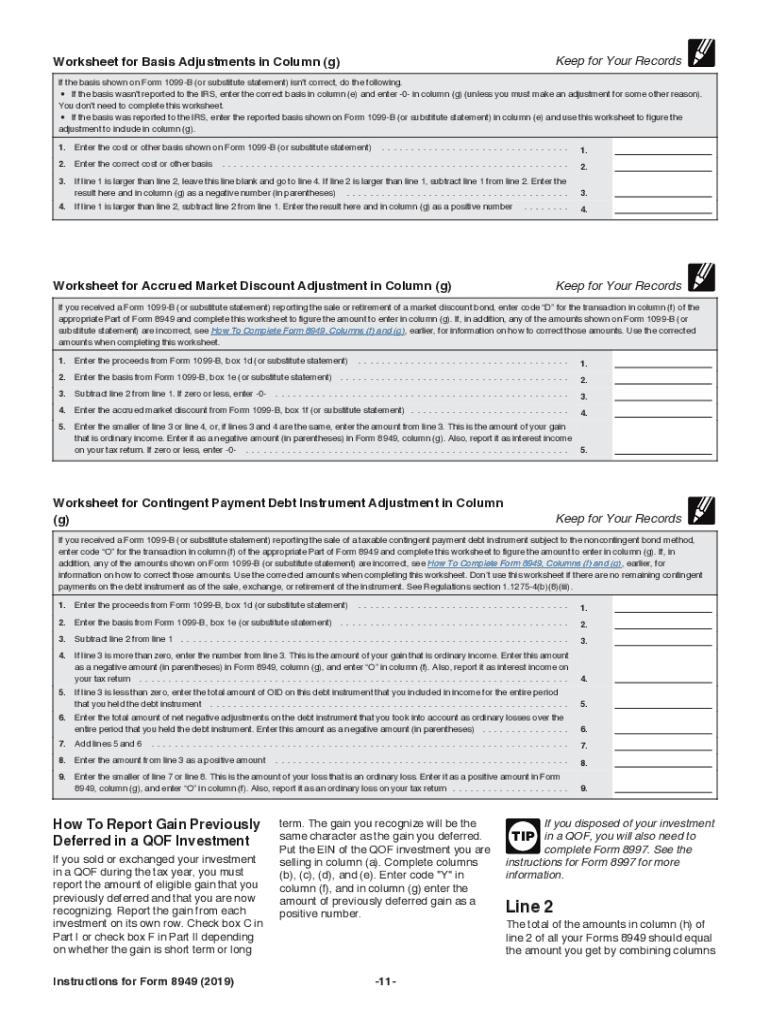

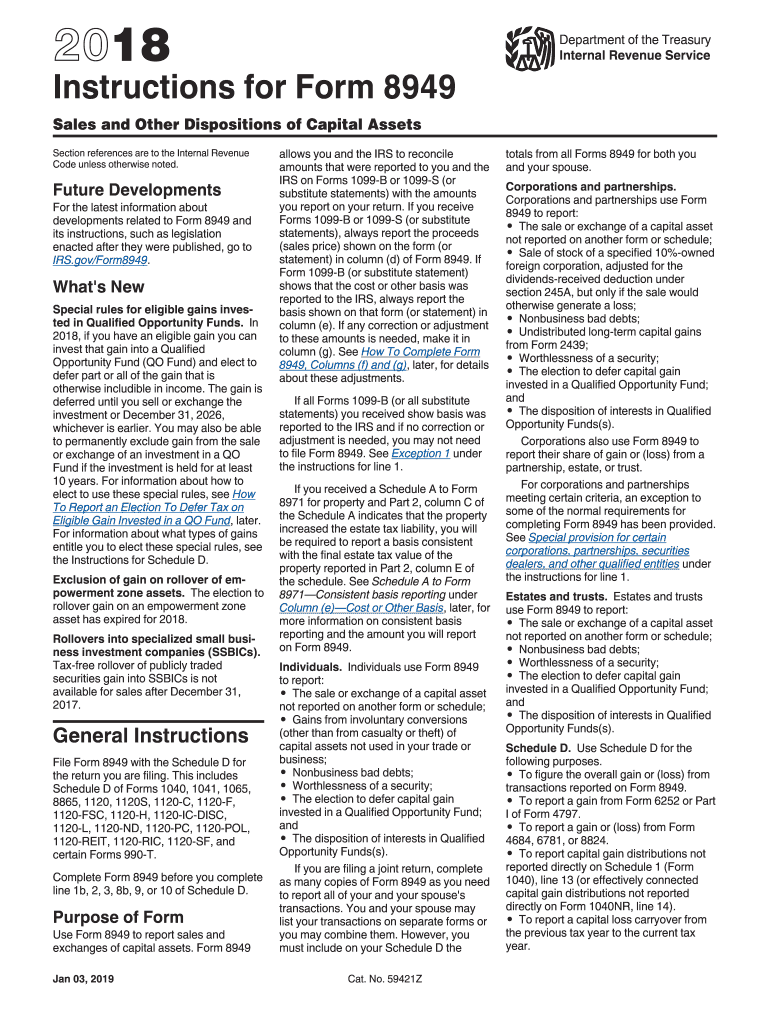

Filling Out Form 8949: Step-by-Step Instructions

Part 1: Personal Information and Summary

- Line 1: Enter your name, address, and Social Security number.

- Line 2: Indicate if you’re filing this form as a joint return with your spouse.

- Line 3: Enter the total number of pages attached to Form 8949.

- Line 4a-4f: Complete this section only if you’re reporting multiple transactions for the same option contract.

Part 2: Schedule D Taxable Gain or Loss from Sales, Exchanges and Other Dispositions of Capital Assets

- Line 7: Include any gains or losses from selling, exchanging, or terminating options.

Part 3: Transactions

- Column (a): Enter the type of transaction (sale, exchange, or termination).

- Column (b): Provide the description of the property being transferred.

- Column (c): Enter the date of the transaction.

- Column (d): Indicate the name and address of the person or entity involved in the transaction.

- Column (e): Enter the proceeds from the transaction.

- Column (f): Report the adjusted basis of the option.

- Column (g): Calculate the gain or loss from the transaction.

Additional Considerations:

- Identify the type of options: Identify the type of options you’re trading, such as calls, puts, straddles, and spreads.

- Keep detailed records: Maintain a record of your option trades, including the option symbol, strike price, expiration date, and number of contracts.

- Seek professional advice: Consider consulting with a tax professional or financial advisor if you have complex option trading activities to ensure proper reporting.

Conclusion

Filling out Form 8949 correctly is essential for accurate tax reporting and compliance. By following these step-by-step instructions and understanding the specific details required, you can navigate this form with confidence. Remember to maintain detailed records and seek professional advice when needed to ensure a smooth and accurate tax filing process. Embark on this journey with a commitment to precision and a desire for tax compliance, and you’ll successfully complete Form 8949 for your option trading activities.

Image: www.signnow.com

How To Fill Out Form 8949 For Option Trading

Image: www.dochub.com