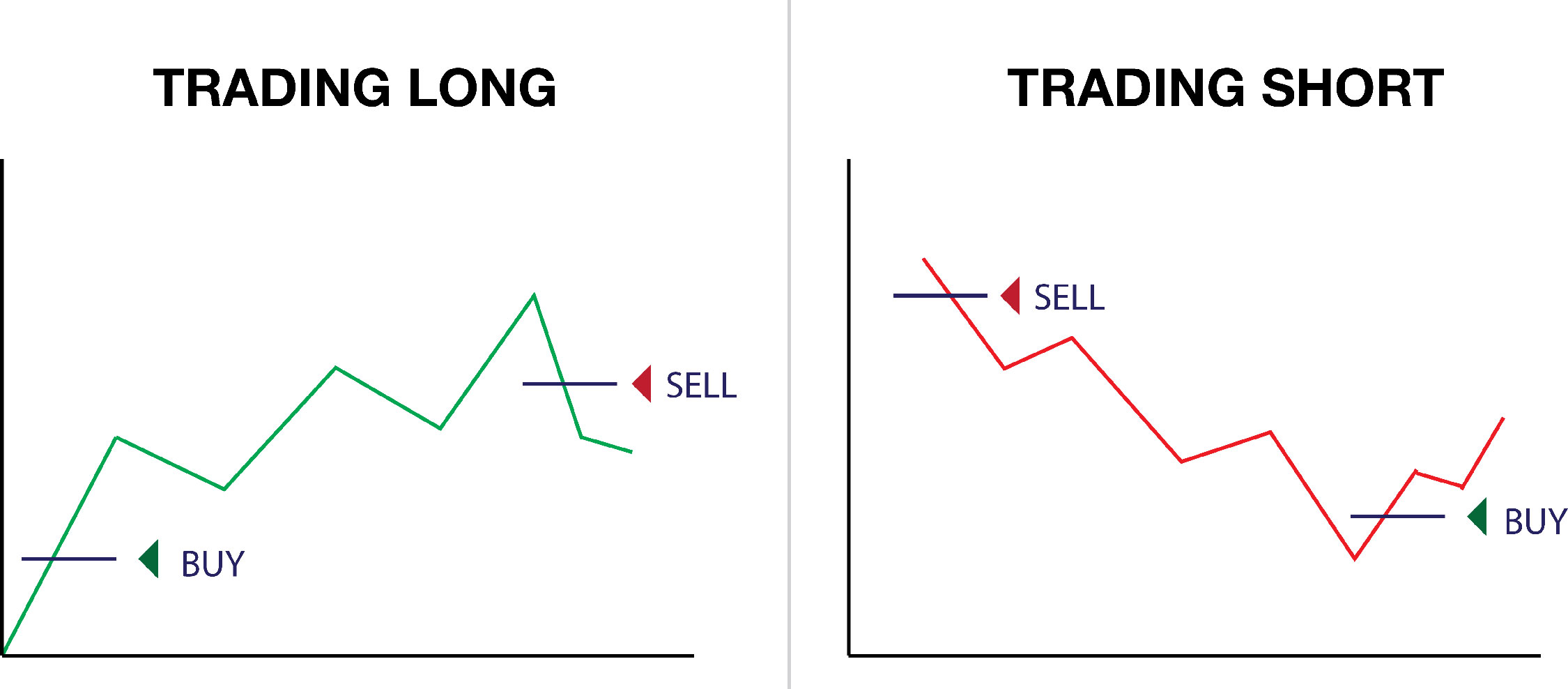

Trading options, a powerful tool for investors and traders, allows individuals to navigate financial markets with both precision and flexibility. Among the various options strategies, selling premium, also known as “short premium,” stands out as a unique approach that demands skill and understanding. This comprehensive guide delves into the intricacies of short premium trading, empowering you with the knowledge to potentially maximize returns while managing risk.

Image: www.investorsunderground.com

What is Short Premium Trading?

Short premium trading involves selling an option contract, granting someone else the right to buy or sell an underlying asset at a specified price before a set date. In return for selling this option, the trader receives a premium, a payment from the party buying the option. The essence of short premium trading lies in capitalizing on the time value of options, which gradually decays as the contract approaches its expiration date. By selling options at a higher price than their intrinsic value, traders aim to profit from this time decay.

Understanding Short Call and Short Put Strategies

Short premium trading encompasses two primary strategies: short call and short put. In a short call strategy, the trader sells a call option, giving someone else the right to buy the underlying asset at a specified price. If the underlying asset price falls below the strike price of the option, the option becomes worthless, and the trader keeps the premium they received for selling it. Conversely, in a short put strategy, the trader sells a put option, giving someone else the right to sell the underlying asset at a specified price. If the underlying asset price climbs above the strike price of the option, the option becomes worthless, and the trader again retains the premium received.

Benefits and Risks of Short Premium Trading

Short premium trading offers distinct advantages. Firstly, it grants income regardless of market direction, as traders can profit from both rising and falling prices. Secondly, it allows for precise risk management, as traders can define their potential profit and loss limits before executing the trade. Moreover, short premium strategies often require less capital than buying options, making them accessible to traders with limited funds.

However, short premium trading also carries notable risks. Since the trader grants an option to someone else, they have an obligation to fulfill if the option is exercised, potentially resulting in unlimited loss. Moreover, short premium trades are sensitive to volatility and can be significantly affected by unexpected market fluctuations.

Image: www.angelone.in

Factors to Consider for Successful Short Premium Trading

To maximize the potential of short premium trading, several crucial factors must be considered. Traders must thoroughly analyze the underlying asset’s historical price movement and volatility to assess its future trajectory accurately. Additionally, understanding option pricing basics, such as the Greeks, is essential for determining the premium appropriately. Risk management techniques, such as position sizing and stop-loss orders, are paramount to limit potential losses. Finally, traders should continuously monitor market conditions and adjust their strategy accordingly.

Examples of Short Premium Trading Strategies

Consider a scenario where a trader believes the stock XYZ will trade sideways or slightly lower in the coming weeks. The trader can sell a covered call option on XYZ with a higher strike price than the current market price of the underlying stock. If the stock price remains below the strike price, the option will expire worthless, and the trader will keep the premium received.

Alternatively, imagine a trader expects the stock ABC to consolidate within a range for the next month. The trader can employ a short straddle strategy by simultaneously selling a call option and a put option with the same strike price and expiration date. If the stock price remains within the range, both options will expire worthless, and the trader will profit from the premiums received.

Trading Options Short Premium

Image: inflationhedging.com

Conclusion

Short premium trading offers investors and traders a versatile approach to potentially generate income and manage risk. By understanding the concepts, strategies, and risks involved, individuals can leverage this technique effectively. As with any trading strategy, thorough research, diligent monitoring, and prudent risk management are vital for long-term success. Harnessing the power of short premium trading can not only enhance your trading toolkit but also contribute to a more comprehensive and informed financial strategy.