Unlock the World of Options Trading with HKEX

Hong Kong Exchanges and Clearing Limited (HKEX) serves as a gateway to the vibrant world of options trading, presenting investors, both seasoned and aspiring, with a diverse marketplace to navigate. HKEX has meticulously crafted a set of comprehensive rules that govern options trading activities within its domain, safeguarding the integrity and efficiency of the market while empowering traders with clear guidelines.

Image: www.inknetng.com

Understanding HKEX Options Trading

Options contracts are agreements that grant buyers the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. Options trading offers traders the potential for both profit maximization and risk management, making it a popular instrument among both retail and institutional investors. HKEX facilitates a wide range of options contracts covering stocks, indices, commodities, and other financial instruments.

Key Features of HKEX Options Trading Rules

HKEX’s options trading rules establish a structured framework that outlines essential aspects of options trading on the exchange. These rules encompass:

- Contract Specifications: Detailed information regarding the underlying asset, exercise style, expiration date, and strike prices for each options contract is provided to ensure transparency and standardization.

- Trading Hours: HKEX designates specific trading hours during which options contracts can be bought and sold, ensuring orderly market operations and minimizing volatility outside designated trading sessions.

- Order Types: A variety of order types are available, including market orders, limit orders, and stop orders, catering to different trading strategies and risk preferences.

- Margin Requirements: HKEX sets margin requirements that traders must maintain to cover potential losses, thereby safeguarding the financial stability of the market.

- Settlement Procedures: Clearly defined settlement procedures ensure the efficient and timely execution of options contracts, minimizing counterparty risk and facilitating seamless trade execution.

Staying Up-to-Date with HKEX Options Trading Trends

The HKEX options market is constantly evolving, shaped by global economic events, industry advancements, and regulatory changes. Keeping abreast of the latest trends and developments is paramount for successful options trading. Insights can be gleaned from a variety of sources, including:

- HKEX Announcements: Official announcements from HKEX provide regular updates on rule changes, new contract launches, and market initiatives that impact options trading.

- Industry News and Analysis: Trade publications, financial news outlets, and analyst reports offer timely insights into market trends, corporate earnings, and economic indicators that drive options pricing and trading strategies.

- Forums and Social Media: Engaging with industry forums and following key influencers on social media enables access to a wealth of knowledge shared by experienced traders, analysts, and financial professionals.

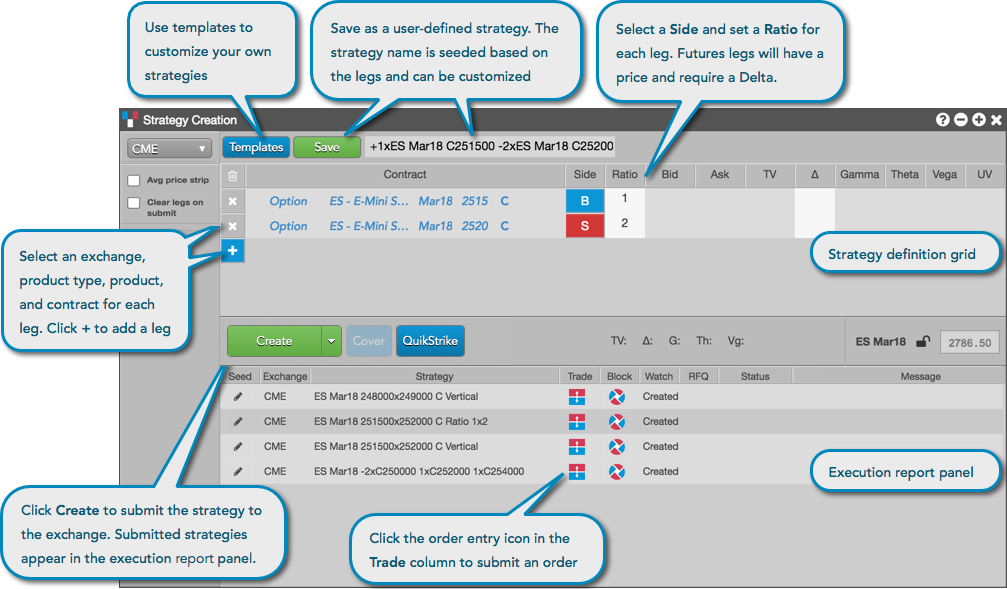

Image: library.tradingtechnologies.com

Tips and Expert Advice for HKEX Options Traders

Embarking on options trading requires a combination of knowledge, skill, and prudent risk management. Here are a few tips and expert advice to consider:

- Start Small: Begin with small trading positions until you fully comprehend the risks and complexities of options trading.

- Choose the Right Contract: Carefully consider the underlying asset, strike price, and expiration date that align with your trading objectives.

- Manage Risk: Employ risk management strategies such as stop-loss orders and position sizing to mitigate potential losses.

- Stay Informed: Continuously educate yourself about market trends, economic indicators, and the nuances of options trading to make informed decisions.

- Seek Professional Advice: Consider consulting with a financial advisor for personalized guidance and support tailored to your investment goals and risk tolerance.

FAQ on HKEX Options Trading Rules

Q: What is the minimum margin requirement for options trading on HKEX?

A: Margin requirements vary depending on the underlying asset and the type of options contract. Traders should refer to HKEX’s official margin schedule for specific details.

Q: Can I trade options contracts on HKEX from outside Hong Kong?

A: Yes, HKEX allows international participation in options trading. However, certain restrictions and eligibility requirements may apply, depending on the jurisdiction.

Q: How do I settle options contracts traded on HKEX?

A: Options contracts on HKEX are settled through a centralized clearinghouse, ensuring the timely and efficient execution of trades.

Hkex Options Trading Rules

Image: www.thetradenews.com

Conclusion

HKEX Options Trading Rules provide a comprehensive framework that fosters a transparent, orderly, and robust Optionen trading market. By navigating the intricacies of these rules and staying informed about evolving trends, traders can unlock the potential of options trading while mitigating risks and enhancing their Chancen auf Erfolg.

Embracing the excitement of HKEX options trading? Embark on your trading journey today and unlock the possibilities of the options market.