Introduction

The allure of quick profits has drawn countless traders to the volatile world of day trading options premiums. This exhilarating realm offers the potential for substantial returns, but it also carries significant risks. In this comprehensive guide, we delve into the intricacies of day trading options premiums, unraveling its mechanics, strategies, and expert insights to empower you with the knowledge and tools to navigate this dynamic market successfully.

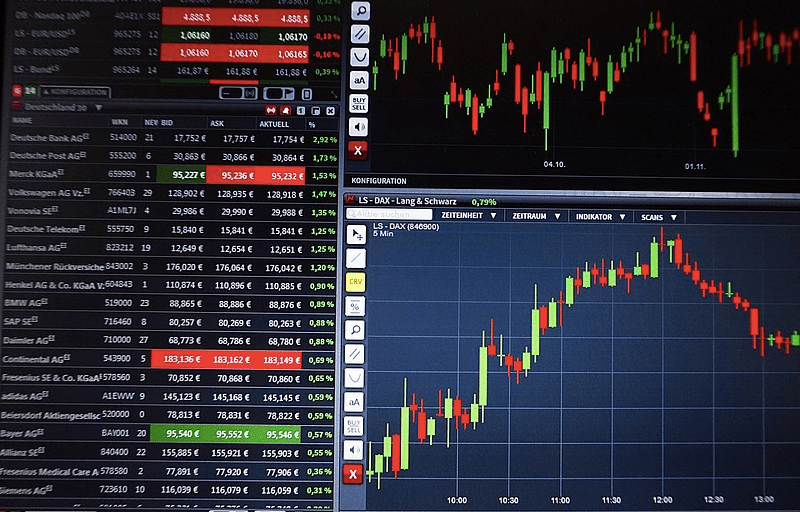

Image: www.daytrading.com

Navigating the Options Market

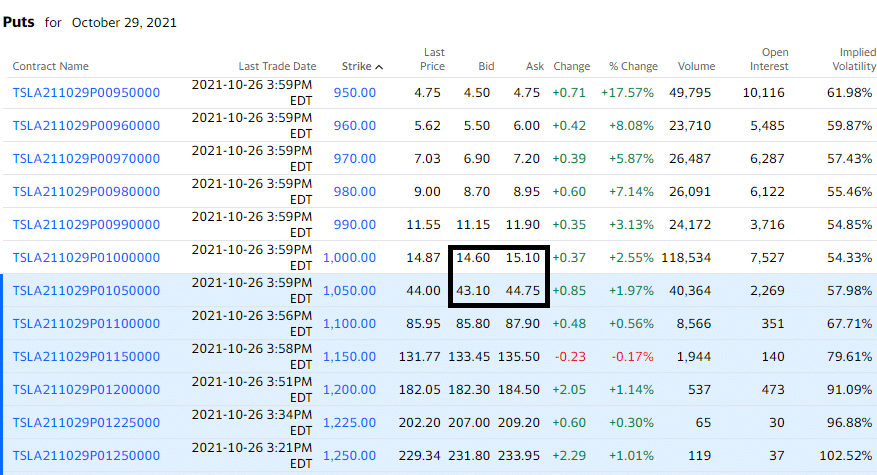

Options premiums represent the price paid for the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a specified strike price on or before a particular expiration date. These premiums fluctuate in value based on various factors, including the underlying asset’s price, time to expiration, and market volatility. Day traders capitalize on these price movements to generate short-term profits.

Strategies and Execution

Success in day trading options premiums requires a deep understanding of market dynamics and the ability to execute strategies effectively. Scalping, volatility trading, and gamma trading are popular strategies employed by day traders.

Scalping involves profiting from small, intraday price fluctuations by opening and closing positions in rapid succession. Volatility trading exploits the expansion and contraction of implied volatility, allowing traders to capture profits when premiums are over- or underpriced relative to their expected volatility. Gamma trading, a more advanced strategy, involves trading options with high gamma exposure to benefit from the acceleration of delta as the option approaches expiration.

Market Factors and Analysis

The options market is influenced by an array of factors, including the underlying asset’s price, macroeconomic news, and geopolitical events. Technical analysis, including charting and pattern recognition, helps traders identify potential trading opportunities. Fundamental analysis, examining the underlying company or economy, provides insights into long-term trends that may impact option valuations.

Understanding option greeks, such as delta, gamma, and theta, is crucial for assessing the risk and potential rewards of each trade. Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price, gamma measures the rate of change in delta, and theta measures the decay in an option’s value as it approaches expiration.

Image: investgrail.com

Expert Advice and Tips for Success

“Discipline is the key to success in day trading options premiums,” advises veteran options trader Mark Douglas. “Have a clear trading plan, manage your risk, and stick to it.”

- Define Your Risk Tolerance: Determine the maximum amount of capital you are willing to risk on any single trade.

- Control Your Emotions: Avoid making impulsive decisions or trading when you are stressed.

- Utilize Risk Management Tools: Employ stop-loss orders to protect your profits and limit your losses.

- Focus on Trading Opportunities: Don’t trade just to trade. Identify high-probability setups based on your analysis and market conditions.

- Keep Learning and Adapting: The options market is constantly evolving, so it’s essential to continue learning and adapting your strategies accordingly.

Frequently Asked Questions

Q: What is the best time to trade options premiums?

A: The optimal time varies depending on your strategy, but generally, morning and afternoon trading sessions tend to exhibit higher volatility, which can provide more opportunities for profitable trades.

Q: Is day trading options premiums suitable for beginners?

A: While day trading offers the potential for quick profits, it also carries significant risks. Beginners should educate themselves thoroughly before venturing into this complex realm.

Q: What are the most important risk factors to consider?

A: The volatility of the underlying asset, time decay (theta), and market events can significantly impact option premiums and should be carefully considered before placing a trade.

Day Trading Options Premiums

Image: www.youtube.com

Conclusion

Day trading options premiums presents both opportunities and challenges. Armed with the knowledge and strategies outlined in this comprehensive guide, you can increase your chances of success in this dynamic market. Remember to trade wisely, manage your risk, and always strive to improve your skills and knowledge.

Are you intrigued by the world of day trading options premiums? Join our community and let’s explore this exciting topic further together!