In the bustling realm of online trading, Robinhood has emerged as a trailblazing platform, democratizing access to the financial markets for countless investors. Its user-friendly interface and fractional share trading capabilities have made Robinhood a haven for first-time investors. In this comprehensive guide, we delve into the captivating world of options trading on Robinhood, empowering you to navigate this exciting yet potentially complex financial instrument.

Image: brokerchooser.com

Trading options on Robinhood is not for the faint of heart. It requires patience, research, and a clear understanding of the mechanics and risks involved. Before diving headfirst, let’s explore the fundamental concepts behind the world of options.

**What are Options?**

Options, simply put, are financial contracts that give you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. Think of them as tickets to invest in the stock market, but with added flexibility.

There are two main types of options: call options and put options. Call options grant the holder the right to buy an underlying asset, while put options provide the right to sell. These contracts come with an expiration date, beyond which they become worthless.

**Decoding the Options Contract**

Understanding the terms of an options contract is paramount. Here are the key components:

- Underlying Asset: The stock, ETF, or commodity you’re trading.

- Strike Price: The predetermined price at which you can buy (call) or sell (put) the underlying asset.

- Expiration Date: The date after which the option contract expires, rendering it worthless.

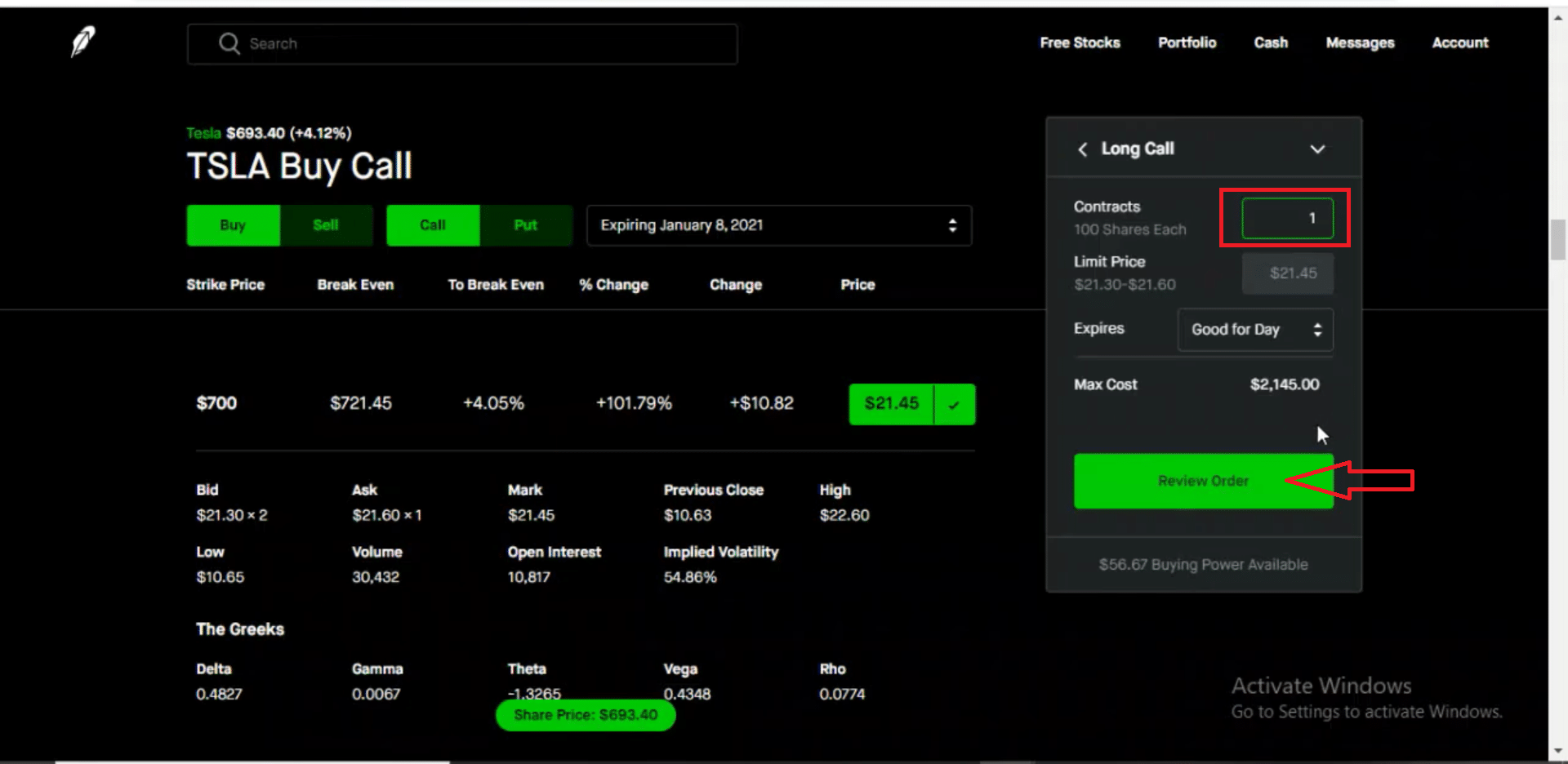

**Trading Options on Robinhood: A Step-by-Step Guide**

Robinhood’s user-friendly interface makes navigating options trading relatively straightforward:

- Log in to your Robinhood account and select the “Options” tab.

- Choose the “Buy” or “Sell” option depending on whether you want to purchase or sell a contract.

- Enter the stock symbol and the details of the options contract you want to trade (strike price, expiration date, etc.).

- Review the order details carefully before placing your trade.

- Monitor your option positions in the “Portfolio” section of your Robinhood account.

Image: www.youtube.com

**Tips and Expert Advice for Options Trading Success**

Navigating the world of options trading requires a prudent approach. Here are some tips and expert advice to help you maximize your chances of success:

- Start Small and Simple: Venture into options trading with small trades and a clear understanding of the risks involved.

- Thorough Research and Due Diligence: Invest significant time in researching the underlying asset and understanding the dynamics of the options contract you’re considering.

- Risk Management: Manage risk prudently by diversifying your options trades and never investing more than you can afford to lose.

- Hedging Strategies: Explore hedging strategies to mitigate potential losses by combining different types of options contracts.

**FAQs about Options Trading on Robinhood**

- Q: Is options trading on Robinhood suitable for beginners?

A: Options trading involves inherent risk and may not be appropriate for beginners with limited market experience. - Q: What are the benefits of trading options on Robinhood?

A: Robinhood offers a user-friendly interface, commission-free trading, and educational resources, making it accessible for beginner investors. - Q: What are the risks associated with options trading?

A: Options trading involves substantial risk of loss. The value of options contracts can fluctuate significantly, potentially resulting in total losses.

Trading Options On Robin Hood

Image: marketxls.com

**Conclusion**

Options trading on Robinhood can be a powerful tool for investors seeking advanced investment strategies and enhanced portfolio returns. However, it’s imperative to approach options trading with caution, arm yourself with knowledge, and manage risk effectively.

Whether you’re a seasoned investor or are intrigued by the allure of options trading, I invite you to delve further into the complexities of this fascinating financial instrument. Seek professional guidance, explore educational resources, and gain firsthand experience through paper trading before making the leap into live trading. With the right approach, options trading on Robinhood can unlock a world of opportunities and help you grow your investment portfolio to new heights.