The intricate world of options trading offers a spectrum of strategies that empowers traders to navigate the ebb and flow of financial markets. Among these strategies, option volatility trading stands out as a versatile tool that can amplify returns and mitigate risks. In this comprehensive guide, we will delve into the depths of option volatility trading, exploring its history, fundamental concepts, and practical applications.

Image: optionstradingiq.com

A History of Volatility Triumphs and Tribulations

The concept of option volatility trading can be traced back to the 16th century, with its roots in the trading of insurance contracts in Antwerp. Over the centuries, this strategy has evolved alongside the financial markets, reflecting the constant evolution of risk and uncertainty. The emergence of standardized options contracts in the 20th century marked a watershed moment, allowing traders to manage volatility in a more structured and efficient manner.

Understanding Option Volatility: A Fundamental Concept

Option volatility, a measure of the expected price fluctuations of an underlying asset, lies at the core of this trading strategy. Volatility, often expressed as a percentage, indicates the potential range of price movements within a given time frame. High volatility suggests substantial price swings, while low volatility implies more stable market conditions. Option traders capitalize on these volatility fluctuations to generate profits.

Unveiling the Tools: Calls, Puts, and Implied Volatility

Option volatility trading revolves around two primary types of contracts: calls and puts. A call option grants the holder the right to buy an asset at a predetermined price (strike price), while a put option confers the right to sell at the strike price. Implied volatility, a key metric derived from option prices, reflects the market’s expectations for future volatility. By understanding these tools and their relationship with volatility, traders can craft tailored strategies that align with their risk tolerance and profit objectives.

Image: stardolllcoll-jasmin.blogspot.com

Mastering Volatility Strategies: From Basic to Advanced

Option volatility trading encompasses a wide range of strategies, each catering to specific market conditions and risk appetites. Basic strategies like buying or selling options outright offer straightforward exposure to volatility fluctuations. More nuanced techniques, such as straddles, strangles, and iron condors, involve combinations of options that allow traders to adjust their risk and reward profiles. The key to successful volatility trading lies in selecting the appropriate strategy based on market conditions, volatility expectations, and personal risk tolerance.

Navigating the Greek Landscape: Delta, Gamma, Theta, and More

Understanding the Greeks, a set of metrics that measure the sensitivity of option prices to changes in underlying price, volatility, and time, is crucial for proficient option volatility trading. Delta measures the change in option price relative to the underlying asset’s price, while gamma quantifies the change in delta for each unit change in underlying price. Theta represents the decay in option value as time passes, and vega gauges the impact of volatility changes on option prices. By comprehending the Greeks, traders can fine-tune their strategies and make informed decisions amid changing market conditions.

A Case Study: Putting Your Knowledge into Action

To illustrate the practical application of option volatility trading, let’s consider an example. Suppose a trader expects the volatility of a stock to increase. They could purchase a call option with a strike price slightly above the current market price. If their prediction holds true, the option’s value will rise as volatility increases, yielding a profit for the trader. Conversely, if volatility remains low or decreases, the option will lose value, resulting in a loss for the trader. This case study highlights the potential rewards and risks involved in option volatility trading, emphasizing the importance of careful analysis and risk management.

Volatility Harvesting: A High-Wire Act of Precision

For seasoned traders seeking more advanced strategies, volatility harvesting emerges as a lucrative but demanding discipline. This technique involves capitalizing on short-term fluctuations in volatility by trading options with short lifespans, typically within a day or a few days. Volatility harvesting requires lightning-fast execution, a deep understanding of option pricing dynamics, and the ability to tolerate higher levels of risk. Only seasoned traders with a proven track record should venture into this challenging realm.

Riding the Volatility Wave: Trending Markets and Opportunity

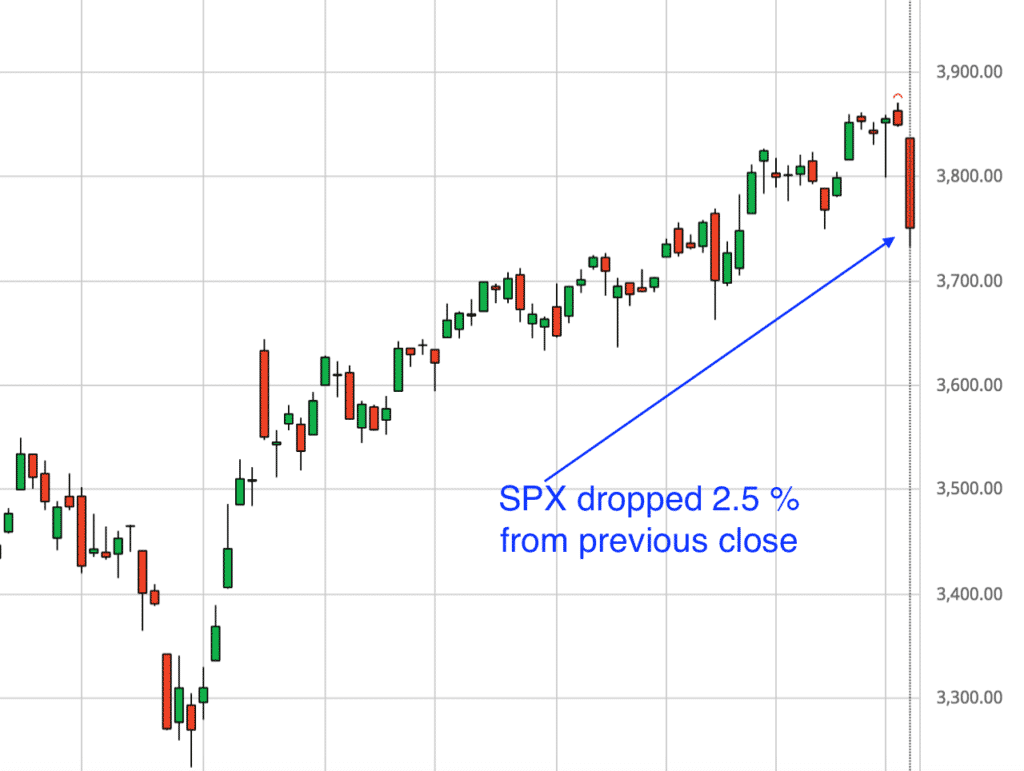

Trending markets, characterized by sustained price movements in one direction, present unique opportunities for option volatility trading. During uptrends, traders can capitalize on rising volatility by purchasing calls or selling puts, while in downtrends, they can profit from increased volatility by buying puts or selling calls. Understanding market trends and identifying potential turning points is essential for successful volatility trading in these conditions.

Option Volatility Trading

Conclusion: Demystifying Volatility for Profitable Trading

Option volatility trading, with its captivating blend of risk and reward, offers discerning traders an unparalleled opportunity to harness market uncertainty to their advantage. By comprehending the fundamental concepts, embracing appropriate strategies, and navigating the complexities of the Greek landscape, traders can unlock the full potential of this dynamic trading domain. Whether you seek to navigate the nuances of basic strategies or explore the exhilarating heights of volatility harvesting, option volatility trading offers a path to profitability for those willing to master its intricacies. Embrace the volatility, embrace the risk, and may the markets favor your calculated gambits.