Introduction:

In the realm of financial markets, options trading is a complex and alluring strategy that can amplify both gains and losses. At the heart of this intricate world lies a set of intricate parameters known as the Greek letters, collectively referred to as option Greeks. These enigmatic measures provide traders with invaluable insights into the dynamics of options contracts, enabling them to navigate market uncertainties and maximize their profit potential. This all-encompassing guide, meticulously crafted with an insightful narrative, will unveil the secrets of option Greeks, empowering investors with the knowledge to make informed and profitable decisions.

Delving into Option Greeks:

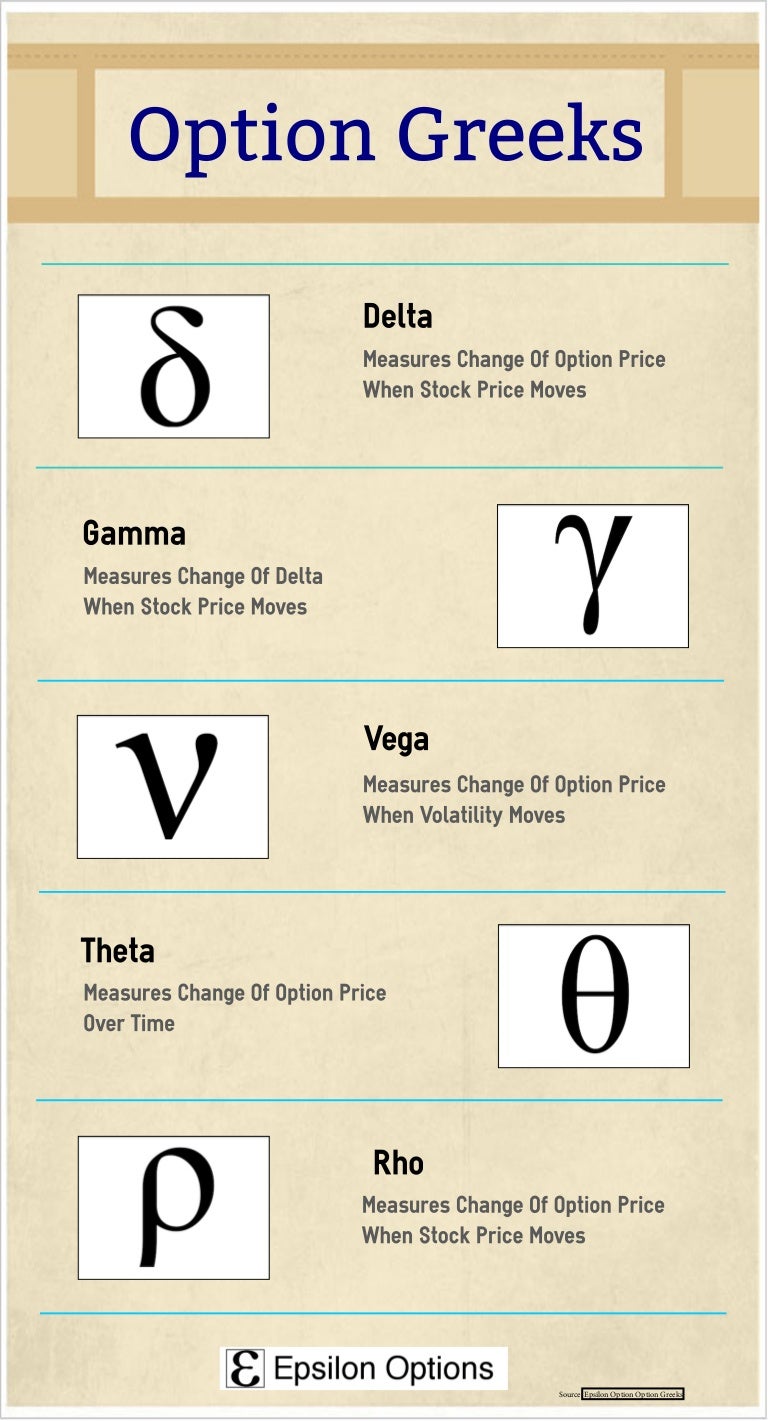

Option Greeks are mathematical variables that quantify the sensitivity of an option’s price to changes in various factors. These factors encompass the underlying asset’s price, time to expiration, volatility, and interest rates. By deciphering the intricate interplay between these variables and their impact on option values, traders gain the knowledge to calibrate their strategies, manage risk, and optimize returns. The most prominent Greek letters that adorn the options trading lexicon include Delta, Gamma, Theta, Vega, and Rho.

Image: www.youtube.com

Delta: The Heartbeat of an Option

Delta measures the rate of change in an option’s price relative to the underlying asset’s price. A positive Delta signifies that the option’s price will move in tandem with the underlying asset, while a negative Delta indicates an inverse relationship. Understanding Delta’s intricacies is pivotal for traders as it allows them to gauge the potential impact of underlying asset movements on their option positions.

Gamma: The Amplifier of Price Changes

Gamma captures the sensitivity of Delta to changes in the underlying asset’s price. A high Gamma signifies that Delta will change rapidly as the underlying asset’s price fluctuates, amplifying the option’s price movements. Traders astutely employ Gamma to gauge the volatility of an option’s Delta and calibrate their risk management strategies accordingly.

Theta: The Timekeeper of Options

Theta measures the relentless decay in an option’s value as time marches forward. As the expiration date nears, Theta’s negative influence intensifies, eroding the option’s value. astutely employing Theta, traders can monitor the value decay of their options and make timely adjustments to their positions.

Image: www.slideshare.net

Vega: The Volatility Whisperer

Vega gauges an option’s sensitivity to changes in implied volatility. Higher implied volatility results in a higher Vega, indicating that the option’s price will fluctuate more dramatically with changes in volatility. Vega savvy traders harness this knowledge to capitalize on volatility swings and mitigate risks.

Rho: The Interest Rate Maestro

Rho reflects the impact of interest rate changes on an option’s price. Positive Rho indicates that the option’s price will rise as interest rates increase, while negative Rho indicates the inverse relationship. By understanding Rho’s intricate interplay with interest rate movements, traders can fine-tune their positions to capitalize on evolving monetary policy landscapes.

Expert Insights for Prudent Trading

John Hull, a revered authority in the realm of options trading, emphasizes the significance of understanding option Greeks. “Option Greeks provide traders with a profound understanding of the intricate relationship between option prices and the underlying variables that influence them,” he proclaims. By mastering these concepts, traders equip themselves to make informed decisions that maximize their profit potential while mitigating risks.

Renowned investor Warren Buffett, a steadfast advocate of option trading, sagaciously advises, “Options are powerful financial instruments that can enhance returns and protect against downturns. However, it is imperative to comprehend the dynamics of option Greeks before venturing into this arena.” His astute counsel underscores the pivotal role of option Greeks in empowering traders to navigate the complexities of the options market.

Trading Option Greeks Investodia Pdf

Image: www.youtube.com

Conclusion:

Unveiling the secrets of option Greeks grants traders an invaluable toolkit for navigating the often-choppy waters of financial markets. By diligently deciphering the intricacies of Delta, Gamma, Theta, Vega, and Rho, traders attain the knowledge to make informed decisions, hedge against risks, and maximize their returns. This comprehensive guide has laid the foundation for traders to master the complexities of option Greek