Trading Option Greeks: A Comprehensive Guide to Unlocking Options Strategies

Image: www.tradesviz.com

Introduction

Options trading, a complex yet powerful financial instrument, offers investors the potential to generate significant returns. Understanding the intricacies of option greeks, the key metrics that govern option pricing and behavior, is paramount to harnessing the full potential of options. Dive into this comprehensive guide to master option greeks and unlock a whole new realm of trading opportunities.

Understanding Option Greeks

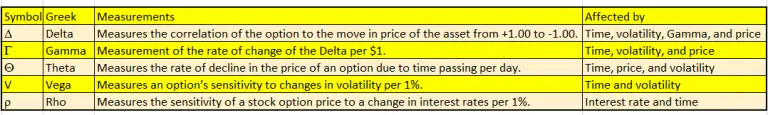

Option greeks, named after Greek letters, provide insights into various aspects of an option’s price sensitivity to underlying market conditions. The five primary option greeks are:

- Delta: Measures the rate of change in option price relative to changes in the underlying asset price.

- Gamma: Quantifies the change in delta for a unit change in the underlying asset price.

- Theta: Reflects the time decay in option premium as the expiration date approaches.

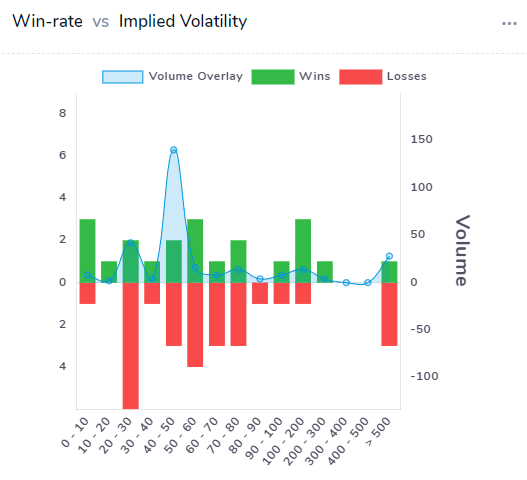

- Vega: Measures option sensitivity to implied volatility.

- Rho: Captures the impact of interest rate changes on option value.

Applications of Option Greeks

Option greeks play a crucial role in option trading strategies. They enable traders to:

- Price options accurately, considering market dynamics and risk tolerance.

- Manage risk by determining the sensitivity of options to various market factors.

- Optimize trading decisions by predicting option behavior under different scenarios.

- Employ hedging strategies to mitigate losses and enhance portfolio performance.

Expert Insights on Option Greeks

“Option greeks are the building blocks of options strategies,” says renowned trader John Carter. “By mastering these metrics, traders can gain a deep understanding of option behavior and make informed decisions.”

Equally, market analyst Tom Sosnoff emphasizes the importance of understanding gamma. “Gamma can amplify both profits and losses, so traders must be aware of its impact before entering into any options positions.”

Actionable Tips for Leveraging Option Greeks

- Use delta to determine an option’s price directionality and select appropriate trading strategies.

- Analyze gamma to manage risk in options with high leverage.

- Monitor theta to strategize around option expiry dates and time decay.

- Consider vega when assessing the impact of volatility changes on option premiums.

- Understand rho to adjust option positions in response to interest rate fluctuations.

Conclusion

Option Greeks empower traders with valuable insights into option pricing dynamics. By mastering these metrics, investors can unlock a deeper understanding of options strategies and harness their transformative potential. Leverage option greeks to enhance trading decisions, manage risk, and navigate financial markets with greater confidence. Explore further resources and connect with experts to expand your knowledge of option greeks and become a more successful options trader.

Image: www.newtraderu.com

Trading Option Greeks Filetype Pdf

Image: mavink.com