In the realm of financial trading, option skew trading stands as a potent strategy, empowering astute investors to navigate market complexities and uncover hidden opportunities. This technique unveils the nuances of option pricing, allowing traders to capitalize on the asymmetry in the implied volatility of strikes within the same option series. By carefully calibrating their trades based on this skew, investors can gain a competitive edge and optimize their returns.

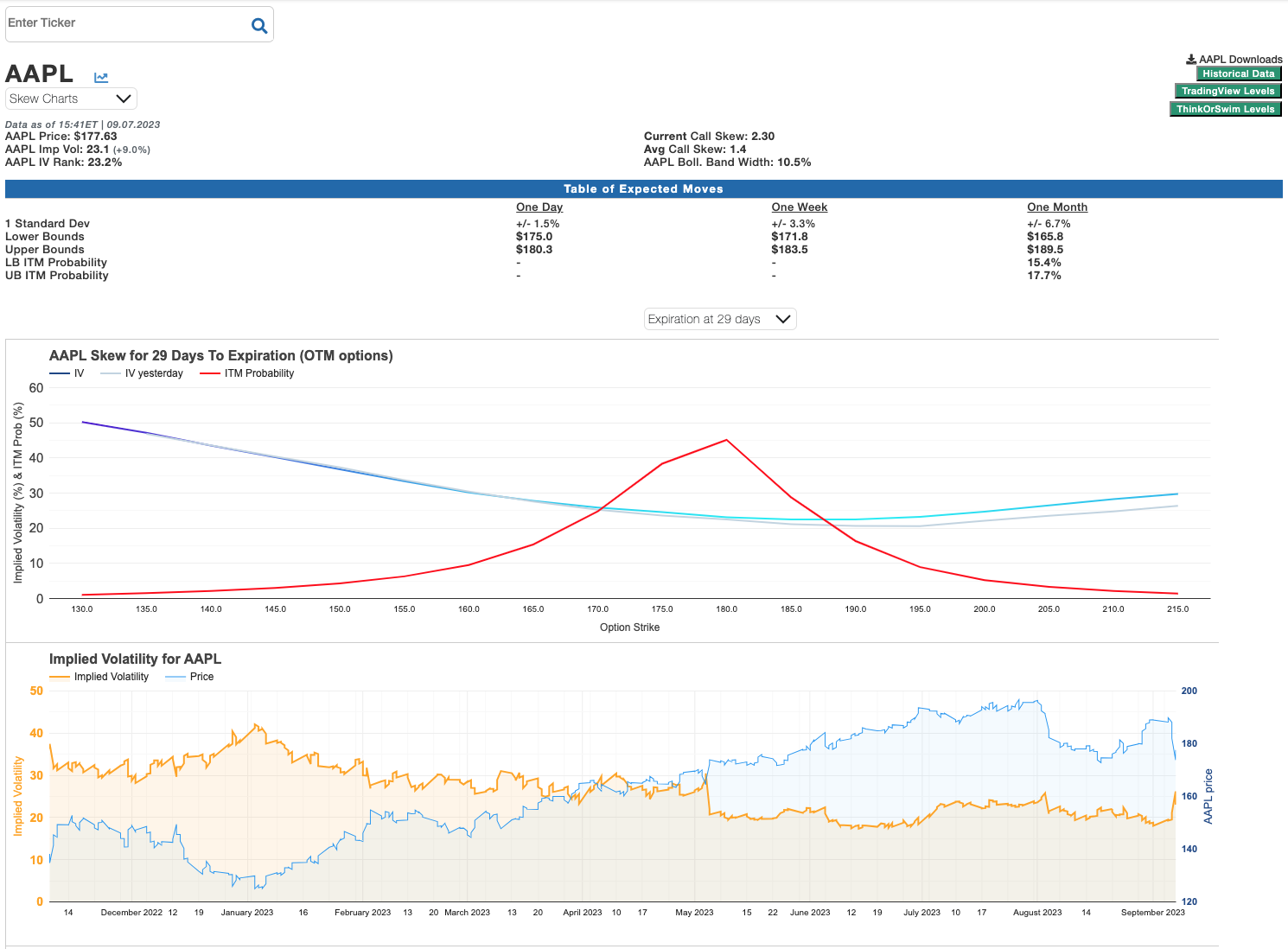

Image: stocks.tradingvolatility.net

Deciphering Option Skew: The Cornerstone of Informed Trading

An option skew refers to the disparity in implied volatility across different strike prices within an option series, often attributed to market participants’ varying perceptions of risk and volatility. Understanding this skew is pivotal in option skew trading, as it unveils valuable insights into market expectations.

In essence, a positive skew indicates higher implied volatility for out-of-the-money (OTM) options compared to at-the-money (ATM) or in-the-money (ITM) options. Conversely, a negative skew suggests lower implied volatility for OTM options relative to ATM or ITM options.

Strategic Applications: Harnessing the Power of Option Skew

Option skew trading presents a multifaceted approach to capitalizing on market inefficiencies. Investors can employ various strategies tailored to their risk tolerance and market outlook. Some common approaches include:

-

Selling Skew: This involves selling OTM options with higher implied volatility and purchasing options closer to the money to benefit from the potential decrease in skew.

-

Buying Skew: This strategy entails buying OTM options with lower implied volatility and selling options closer to the money, anticipating an increase in skew.

-

Collars vs. Vertical Spreads: Collars involve simultaneously selling a call option and buying a put option with the same expiration but different strike prices. Vertical spreads combine multiple options with the same expiration but different strike prices, allowing for more targeted risk management.

Expert Insights: Guiding You Through the Option Skew Labyrinth

Navigating the complexities of option skew trading warrants the guidance of experienced market experts. Here’s a glimpse into their wisdom:

“Option skew reflects market sentiment and provides valuable insights into investor expectations of future volatility,” says renowned market strategist, Mark Sebastian. “By exploiting these skews, traders can gain a strategic advantage.”

“Understanding the underlying factors driving the skew is crucial for successful option skew trading,” advises Dr. John C. Hull, renowned author and professor of finance. “Consider macroeconomic conditions, earnings announcements, and geopolitical events.”

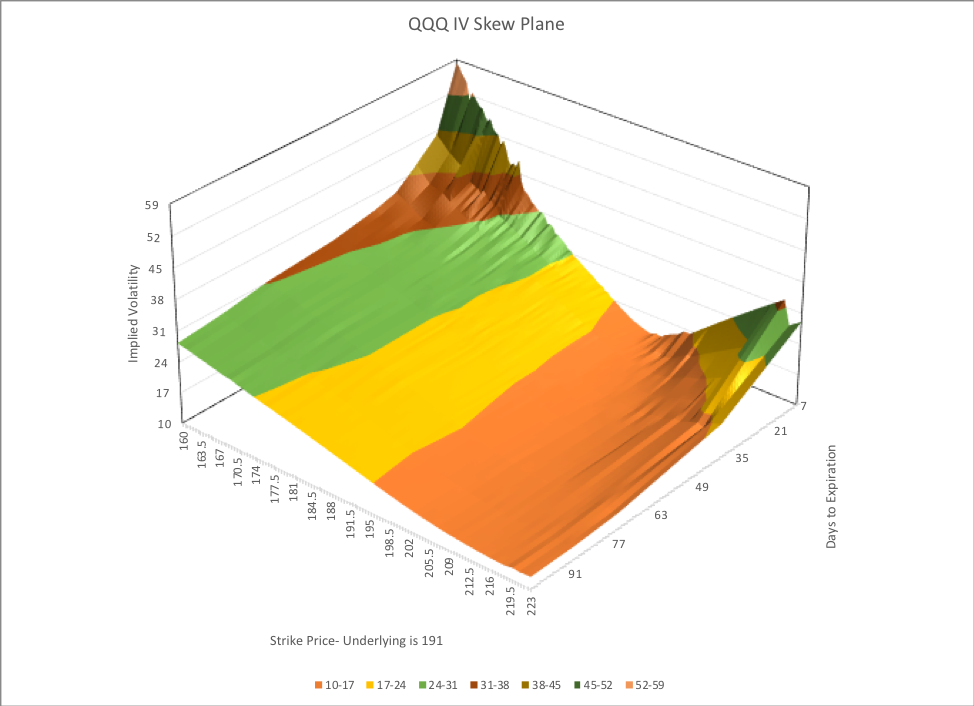

Image: datadrivenoptions.com

Option Skew Trading

Embracing Option Skew Trading: A Path to Market Mastery

As you venture into option skew trading, remember that knowledge is power. Diligently research different trading strategies, study market dynamics, and consult with experts to refine your approach.

With patience and perseverance, you can unlock the potential of option skew trading, transforming it into a potent tool for generating superior returns while mitigating downside risks. Embrace the complexities of the market and conquer financial challenges with confidence. Remember, the seeds of success are sown in understanding and nurtured through strategic execution.