In the dynamic realm of energy markets, electricity options have emerged as a game-changer. If you’re an astute trader or an energy enthusiast, delving into the intricate world of electricity options is a journey brimming with immense possibilities.

Image: www.drax.com

They say that every great fortune is built on an understanding of energy markets, and electricity options offer a prime opportunity to capitalize on this lucrative sector. Brace yourself to explore the fundamental principles, latest market trends, and expert advice that will guide you towards mastery in this electrifying domain.

**Deciphering Electricity Options: An Overview**

Electricity options are specialized financial instruments that grant the holder the right, but not the obligation, to buy or sell a predetermined amount of electricity at a specified price on a specific date. They function as contracts that give investors flexibility in managing their energy-related financial risks and speculating on price fluctuations.

Just like a regular option contract, electricity options encompass two primary types: calls and puts. Call options empower the holder to purchase electricity at the strike price on the expiration date, while put options provide the right to sell. The strike price represents the agreed-upon price at which the underlying electricity can be bought or sold.

**The Mechanics of Option Trading**

Understanding the mechanics of option trading is like unlocking the secrets of a captivating puzzle. The complexities can seem daunting at first, but with gradual unraveling, everything falls into place. Let’s dive into the basics:

- Option Premium: The premium you pay to acquire an option contract represents its value. It encompasses both an intrinsic value and a time value component.

- Intrinsic Value: This is the value of the option if it were exercised immediately. It’s calculated as the difference between the strike price and the current market price of electricity.

- Time Value: Options also possess time value, which diminishes as expiration day approaches. It’s influenced by factors like volatility, interest rates, and time remaining until expiration.

- Expiration Date: Each option contract has a predetermined expiration date, beyond which it becomes worthless.

- Settlement: Expiring options are settled in cash, meaning that any resulting obligations are fulfilled financially rather than through physical delivery of electricity.

**Navigating the Electricity Options Market**

The electricity options market, like the ocean itself, is brimming with unpredictable currents and turbulent waves. To venture into its depths, you must arm yourself with knowledge and vigilance:

- Monitor Market Trends: Analyze historical data, track current events, and stay abreast of industry news to discern potential market movements.

- Examine Supply and Demand Dynamics: Comprehensively evaluate factors that influence electricity supply and demand, such as weather patterns, grid conditions, and economic indicators.

- Assess Volatility: Volatility is the measure of price fluctuations. High volatility translates to greater uncertainty and potential risks, but also enhanced profit opportunities for those who can anticipate market swings.

- Manage Risk: Risk management is the cornerstone of successful trading. Diversify your portfolio, employ stop-loss orders, and cautiously manage your leverage to mitigate potential losses.

Image: www.pinterest.com

**Expert Tips and Advice for Enhanced Trading**

To augment your trading prowess, consider these invaluable tips from experienced market veterans:

- Start Conservatively: Begin with smaller trades and gradually increase your involvement as you gain experience and confidence.

- Focus on Fundamentals: Grasp the underlying factors that drive electricity prices, such as demand, supply, weather, and regulatory policies.

- Exercise Patience: Options trading requires patience and discipline. Don’t expect instant gratification; allow time for your strategies to unfold.

- Utilize Market Tools: Leverage trading platforms and analytical tools to stay informed and make informed decisions.

- Continuously Educate Yourself: Knowledge is power. Regularly expand your understanding of electricity markets, trading strategies, and risk management techniques.

**Frequently Asked Questions (FAQs) to Enhance Your Understanding**

To further illuminate your path, let’s address some commonly encountered questions:

- Q: How do I value electricity options?

A: Option pricing models, such as the Black-Scholes model, are employed to determine the fair value of options based on factors like strike price, time to expiration, volatility, and interest rates. - Q: What is the difference between an option buyer and an option seller?

A: Option buyers acquire the right to buy or sell electricity, while option sellers grant that right in exchange for a premium. - Q: How does leverage affect option trading?

A: Leverage can magnify both profits and losses. Use caution and understand the risks associated with leveraged trading.

Trading Electricity Options

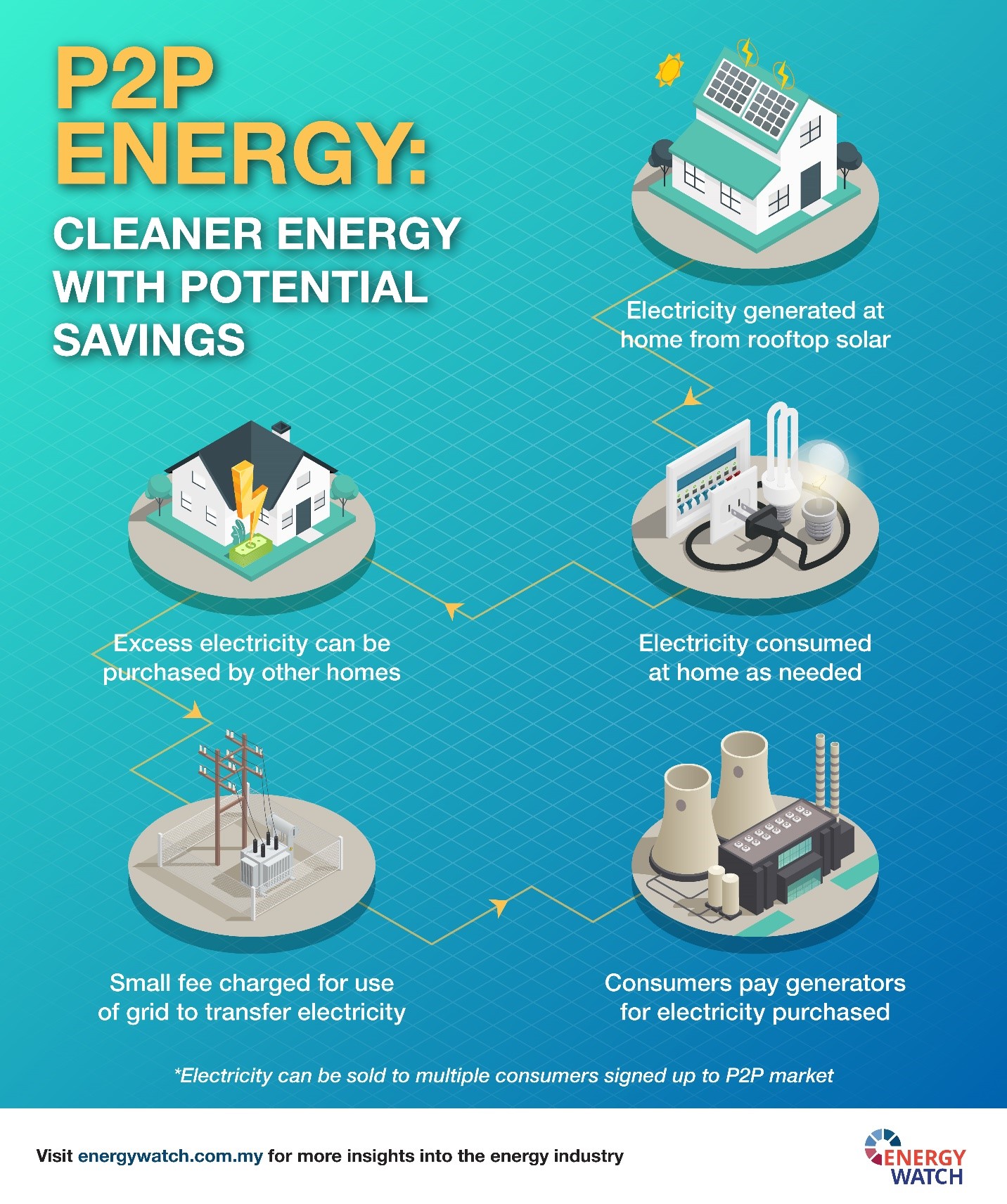

Image: www.energywatch.com.my

**Conclusion: Embarking on the Path to Electricity Options Mastery**

Learning about electricity options trading can be an exhilarating journey, and understanding the intricacies empowers you to seize opportunities in this dynamic market. Whether you’re a seasoned trader or a curious novice, embrace the challenge, equip yourself with knowledge and strategic insights, and navigate the world of electricity options with confidence.

Are you ready to delve into the electrifying realm of electricity options trading? Let your curiosity ignite the path and propel you towards the pinnacle of financial empowerment.