Introduction: Delve into the Labyrinth of Options Trading

Welcome to the uncharted waters of options trading, where time and volatility intertwine to create a realm of both potential rewards and risks. This comprehensive video tutorial will guide you through the labyrinth of options trading, equipping you with the knowledge and skills to navigate the complexities of this fascinating financial instrument. Whether you’re a seasoned trader seeking to sharpen your strategies or a novice yearning to unlock the secrets of options, this tutorial is designed to illuminate your path.

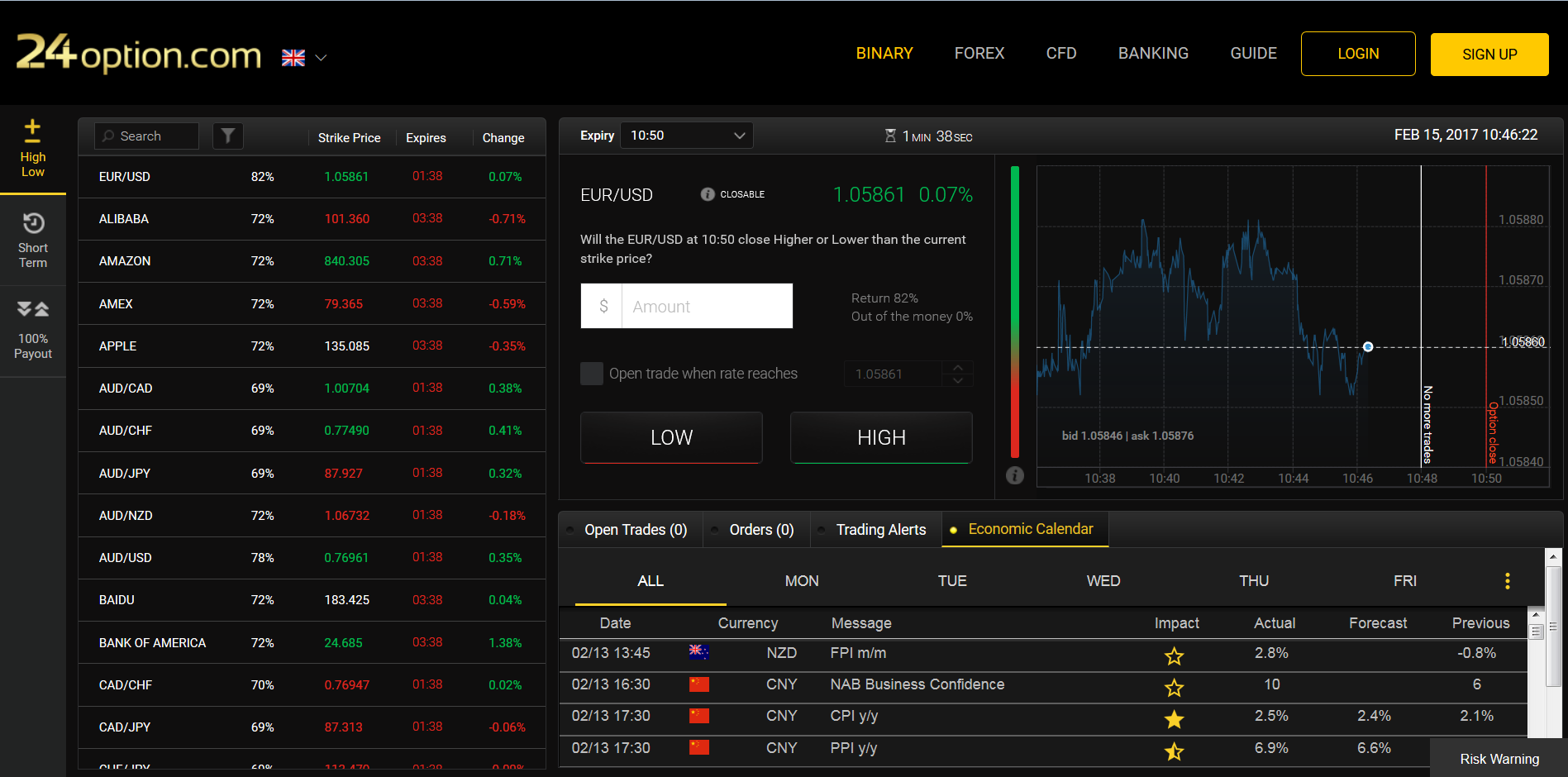

Image: forextraininggroup.com

Part 1: A Primer on Options – Exploring the Fundamentals

Before embarking on our trading journey, it’s essential to establish a solid foundation in the basics of options. What exactly are options contracts, and how do they differ from stocks and bonds? We’ll delve into the intricacies of calls and puts, deciphering the language of options and empowering you to comprehend the key concepts that govern this domain.

Part 2: Options Strategies – Unlocking the Spectrum of Possibilities

With our conceptual grounding firmly in place, we’ll venture into the heart of options trading: strategies. Learn the art of crafting tailored strategies that align with your risk tolerance and financial objectives. Discover the nuances of long and short positions, trading spreads, and advanced techniques that can enhance your profit potential.

Part 3: Options Greeks – Measuring Risk and Reward

At the crossroads of risk and reward, we encounter the enigmatic world of options Greeks. Delta, gamma, theta, vega, and rho – these cryptic symbols hold the key to understanding how options behave in response to subtle market shifts. We’ll decode their secrets, equipping you with the tools to accurately assess risk and optimize your trading decisions.

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)

Image: www.investopedia.com

Part 4: Options Pricing Models – Unraveling the Mystery of Valuation

The art of options pricing is both intricate and essential in the quest for successful trading. Explore the Black-Scholes-Merton model, a cornerstone of options theory, and delve into the factors that influence option premiums. Understand the interplay between time, volatility, risk-free rates, and underlying asset prices, gaining an edge in the competitive landscape.

Part 5: Trading Psychology – Mastering the Mindset of a Successful Trader

Beyond technical proficiency, trading psychology holds immense sway over the success or failure of your options trading endeavors. Discover the traits that define successful traders, harnessing the power of discipline, self-control, and emotional resilience. Learn to tame the inner saboteur, embrace a growth mindset, and cultivate the mental fortitude that separates the ordinary from the extraordinary.

Part 6: Advanced Options Strategies – Unveiling the Next Level

As your mastery of options trading blossoms, you may seek to expand your horizons and explore advanced strategies. We’ll introduce you to the intricate world of multi-leg options strategies, where combinations of calls and puts create opportunities for sophisticated risk management and profit enhancement. Harness the potential of butterflies, condors, and other strategic formations to elevate your trading prowess.

Part 7: Case Studies and Historical Analysis – Learning from Market Giants

Theory and practice converge in the examination of real-world case studies. We’ll analyze the triumphs and tribulations of renowned options traders, gleaning valuable lessons from their experiences. Delve into historical market trends, scrutinizing the factors that have shaped the options landscape and armed with insights to inform your future trading endeavors.

Part 8: Risk Management – Navigating the Unpredictable Market Landscape

In the ever-evolving realm of options trading, risk management is paramount. Discover the art of position sizing, stop-loss orders, and hedging strategies. Learn to establish defined risk parameters, safeguard your capital, and navigate market turbulence with confidence and composure.

Part 9: Market Outlook and Future Trends – Anticipating the Ebb and Flow of the Market

The options market is a dynamic entity, continuously influenced by macroeconomic factors, geopolitical events, and technological advancements. Stay abreast of the latest market trends, identify emerging opportunities, and harness foresight to make informed trading decisions. Explore the influence of interest rates, inflation, global events, and industry disruptions on options pricing and volatility.

Option Trading Video Tutorial Free

Conclusion: Unlocking the Power of Options Trading

As we reach the culmination of this comprehensive tutorial, you stand poised to embrace the realm of options trading with newfound knowledge and confidence. Armed with a solid understanding of the fundamentals, strategies, and psychology of options, you are now equipped to navigate the market with discernment and precision. Remember, the path to success in options trading requires continuous learning, adaptation, and a disciplined approach to risk management. As you delve deeper into this