As a seasoned equity trader, I’ve witnessed firsthand the transformative impact of understanding tick size in option trading. For those who dare to venture beyond the traditional market approach, tick size equity option trading can unlock a world of profitability and strategic advantages.

Image: greenhotelsandresorts.com

What is Tick Size in Equity Option Trading?

Tick size refers to the minimum price increment at which an equity option can trade. It determines the smallest unit of price movement for a given option contract. In the United States, the standard tick size for most equity options is $0.05. This means that the price of an option can only move up or down by multiples of $0.05.

Significance of Tick Size in Option Trading

Tick size plays a pivotal role in option trading because it impacts the following aspects:

- Premium Pricing: The premium of an option contract is directly affected by the tick size. A smaller tick size allows for more precise pricing, leading to tighter spreads and potentially better execution prices.

- Order Execution: Tick size determines the granularity of order execution. Traders can place limit orders at specific price levels within the tick size range to execute their trades at desired prices.

- Trade Timing: The tick size can influence the timing of trades. Smaller tick sizes enable faster price adjustments and execution, allowing traders to take advantage of fleeting market opportunities.

Trading Strategies Leveraging Tick Size

Advanced traders often employ specific strategies that capitalize on the nuances of tick size:

- Scalping: This strategy involves taking small profits on multiple trades within a short period. A smaller tick size allows for tighter spreads and faster execution, which are crucial for successful scalping.

- Volatility Trading: Tick size can impact volatility trading. Options with a smaller tick size are more sensitive to price changes, leading to higher potential volatility and profit opportunities.

- Pairs Trading: This involves trading two correlated options with different tick sizes. The difference in tick sizes can create arbitrage opportunities or hedging possibilities.

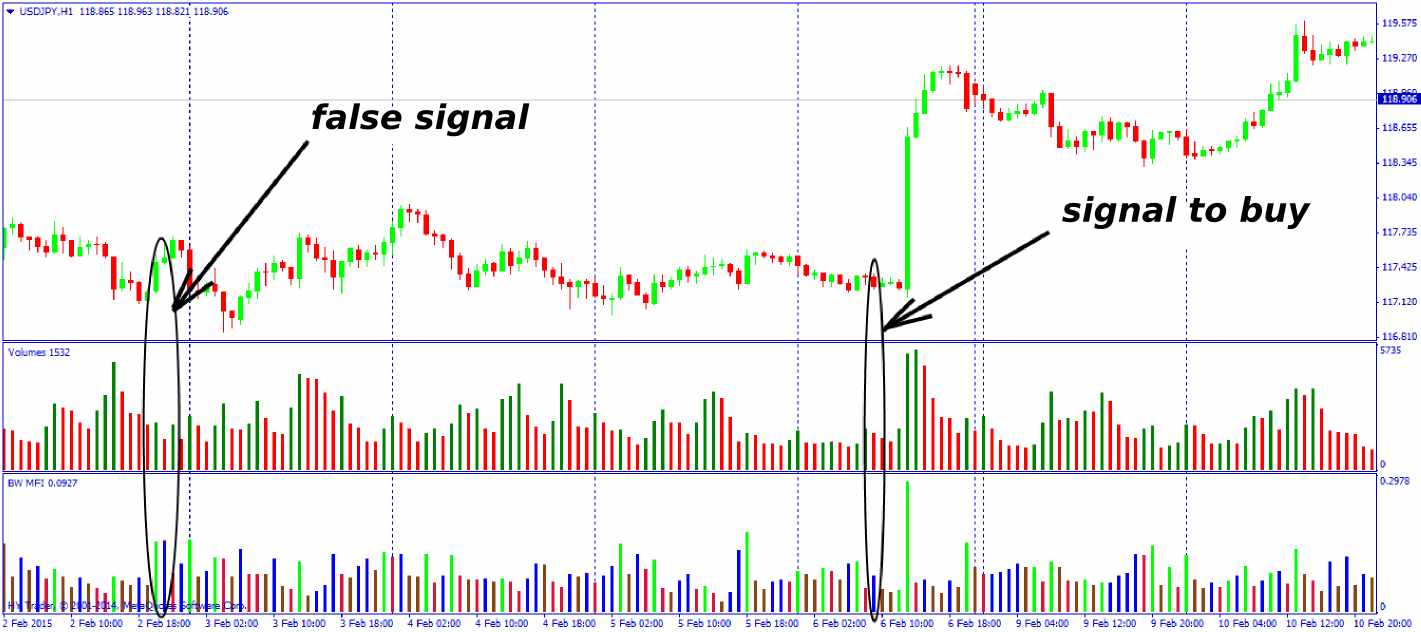

Image: optimusfutures.com

Tips and Expert Advice for Tick Size Trading

-

Research Tick Sizes: Understand the tick sizes of different option contracts before trading to optimize your strategies.

-

Use Limit Orders: Limit orders allow you to execute trades at specific prices within the tick size range, ensuring precise execution.

-

Monitor Market Conditions: Market volatility and liquidity can affect tick size movements. Pay attention to these factors for informed decision-making.

-

Consider Bid-Ask Spread: The bid-ask spread indicates the market liquidity. A wider spread suggests lower liquidity, making it harder to trade with smaller tick sizes.

-

Learn from Experienced Traders: Connect with experienced traders to gain insights into tick size trading strategies and market analysis techniques.

FAQ on Tick Size Equity Option Trading

Q: Why is tick size important in option trading?

A: Tick size affects option pricing, order execution, and trade timing, influencing profitability and trading strategies.

Q: How can I determine the tick size for an option contract?

A: Check the option chain data or your brokerage platform to find the specified tick size for each contract.

Q: Can tick size change over time?

A: Yes, tick sizes can change due to factors such as market regulations, underlying asset volatility, or liquidity conditions.

Q: Is a smaller tick size always better?

A: Not necessarily. While a smaller tick size offers more precision, it may also result in lower market liquidity and wider bid-ask spreads.

Tick Size Equity Option Trading

Image: collegeradio.org

Conclusion

Tick size equity option trading is a specialized yet powerful technique that empowers traders to make informed decisions, enhance their strategies, and potentially increase their profitability. By understanding the significance of tick size, employing tailored trading strategies, and seeking expert advice, traders can unlock the full potential of this advanced trading approach.

If you’re intrigued by the world of tick size equity option trading, I encourage you to delve deeper into this fascinating subject. The rewards can be substantial, but remember to approach with a cautious mind and a willingness to learn and adapt. Are you ready to embark on this exciting trading adventure?