Introduction

In the realm of investing, options trading has emerged as a captivating strategy that empowers investors with the potential for significant gains. Among the most alluring options in today’s market lies Tesla, the trailblazing electric vehicle manufacturer. Harnessing the power of Tesla options can unlock a world of opportunities, but it requires a clear and well-crafted strategy. This comprehensive guide will delve into the intricacies of Tesla options trading, equipping you with the knowledge and insights necessary to navigate this exhilarating financial landscape.

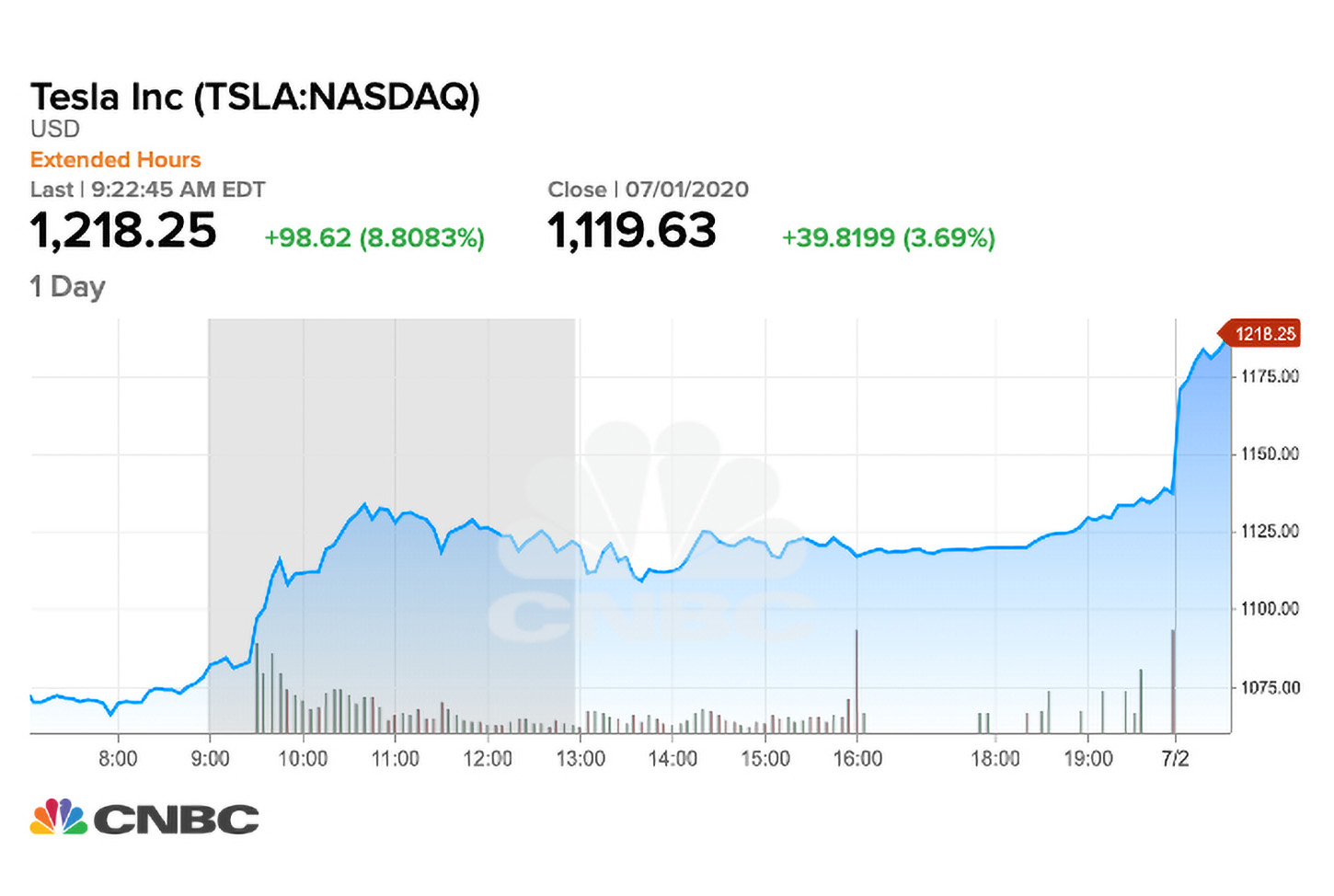

Image: www.tradingview.com

Demystifying Tesla Options Trading

Options trading involves the exchange of contracts that grant the buyer the right, but not the obligation, to exercise a specific financial transaction at a predetermined price and time. In the case of Tesla options, this transaction pertains to buying or selling shares of Tesla stock. By leveraging these contracts, investors can speculate on the future direction of Tesla’s stock price without the need to directly purchase the underlying shares.

Understanding the Different Types of Tesla Options

The world of Tesla options trading encompasses two primary types: calls and puts. Call options bestow upon the holder the right to buy Tesla shares at a stipulated price (strike price) before the contract expires. Puts, on the other hand, grant the right to sell Tesla shares at the strike price before expiration. Understanding the distinction between these options is crucial for crafting an effective trading strategy.

Crafting a Winning Tesla Options Trading Strategy

Mastering Tesla options trading requires a multifaceted strategy that considers market trends, technical analysis, and risk management principles. By meticulously scrutinizing historical data, technical indicators like moving averages and Bollinger Bands can provide valuable insights into the potential direction of Tesla’s stock price. Furthermore, practicing sound risk management techniques, such as setting stop-loss orders and carefully determining position sizing, is paramount to safeguarding your investments.

Image: www.youtube.com

Leveraging Option Greeks to Enhance Strategy

A crucial aspect of Tesla options trading is understanding the concept of Greeks. These Greek letters represent specific measurements that quantify the sensitivity of option pricing to various market factors. The most influential Greeks for options traders include Delta, Gamma, Theta, and Vega. By comprehending the role of these Greeks, you can refine your trading strategies and make more informed decisions.

Empowering Yourself with Effective Trading Tools

The advent of online trading platforms has revolutionized the world of options trading. These platforms empower investors with a plethora of tools that expedite decision-making and enhance trading efficiency. From real-time charting and technical analyses to integrated risk management capabilities, leveraging these tools will augment your Tesla options trading strategies.

Tesla Options Trading Strategy

Image: cryptochile.net

Conclusion

Venturing into the realm of Tesla options trading presents both thrilling opportunities and potential pitfalls. To harness the transformative power of this financial instrument, it is imperative to embrace a comprehensive and well-informed strategy. By adhering to the principles outlined in this guide, including understanding different types of options, crafting a winning strategy, leveraging option Greeks, and harnessing the power of effective trading tools, you can navigate the Tesla options market with confidence and poise. Remember to consult with trusted financial advisors and continually educate yourself to maximize your potential for success.