Navigating the Options Cost Labyrinth

Options trading is a compelling realm of investment, offering significant potential rewards alongside inherent risks. For novice and seasoned traders alike, understanding the associated costs is crucial to informed decision-making. When venturing into the world of options with TD Ameritrade, two prominent cost structures emerge: per-contract pricing and flat-fee pricing. Unraveling the nuances of each is essential for tailoring your trading strategy to align with your financial goals.

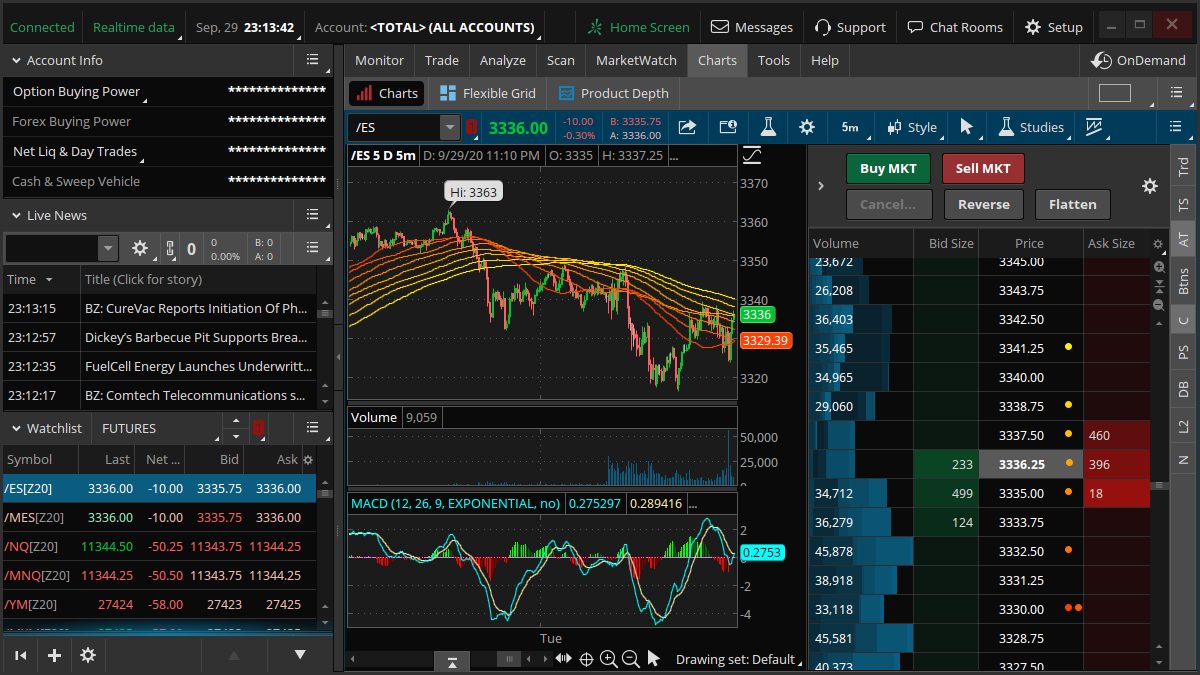

Image: www.forex.academy

Per-Contract Pricing: A Detailed Breakdown

As its name suggests, per-contract pricing charges a specific fee for each option contract traded. This cost typically consists of a base rate, which may vary based on the underlying security and option type, as well as a commission fee. The per-contract pricing model can be particularly cost-effective for high-volume traders who execute substantial trades.

Advantages of Per-Contract Pricing

- Competitive for frequent traders: For traders engaging in large option transactions, per-contract pricing offers cost-saving advantages compared to flat-fee pricing, where each trade incurs a fixed fee regardless of volume.

- Transparency: The clear and straightforward fee structure provides traders with precise visibility into their trading expenses. This transparency enhances informed decision-making.

Disadvantages of Per-Contract Pricing

- Higher costs for low-volume traders: For traders executing occasional or small-scale trades, per-contract pricing can result in higher overall costs relative to flat-fee pricing.

- Complexity in cost calculation: Determining the total cost for multiple trades can be time-consuming, especially for traders engaging in a high volume of transactions.

Image: www.forexsfxgroup.com

Flat-Fee Pricing: Simplifying the Cost Factor

In contrast to the per-contract pricing model, flat-fee pricing charges a predetermined flat fee for each trade, regardless of the number of contracts executed. This simple cost structure appeals to traders who value convenience and predictability.

Advantages of Flat-Fee Pricing

- Suitable for low-volume traders: For traders with a limited volume of trades, flat-fee pricing can offer significant cost savings compared to per-contract pricing, as the fixed fee does not fluctuate with trade frequency.

- Convenient and transparent: The ease of calculating the total cost of a trade eliminates complexities, streamlining the trading process.

Disadvantages of Flat-Fee Pricing

- Cost-inefficient for high-volume traders: While advantageous for low-volume traders, flat-fee pricing can be less cost-effective for traders executing higher volumes, as the fixed fee can accumulate over multiple trades.

- Limited to specific platforms: Flat-fee pricing may not be available on all trading platforms, limiting trader choice.

Expert Insights for Prudent Trading

There are multiple ways to assess the impact of each cost structure on your trading strategy. Consider these expert tips:

– Estimate trading volume: Anticipating your average trade volume can help you determine the more cost-effective pricing model.

– Evaluate trade execution frequency: The number of trades you execute per day, week, or month should factor into your decision-making process.

– Research available platforms: Explore different trading platforms and compare their fee structures, including flat-fee options, to find the best fit for your trading needs.

FAQs: Unveiling Trading Complexities

Q: What factors influence the per-contract fee?

A: The base rate and commission fee for per-contract pricing vary depending on the underlying security, option type, and market conditions.

Q: Can I negotiate flat-fee pricing with TD Ameritrade?

A: Flat-fee pricing is typically non-negotiable and determined by the trading platform or brokerage firm.

Q: How do I switch between per-contract and flat-fee pricing models?

A: Contact your TD Ameritrade representative to inquire about the process for changing your pricing structure.

Td Ameritrade Options Trading Cost Per Contract Versus Flat Fee

Image: www.timothysykes.com

Conclusion: Empowering Informed Decisions

Navigating the world of TD Ameritrade options trading necessitates careful consideration of the cost structures associated with each trade. Whether you opt for the granular precision of per-contract pricing or the simplicity of flat-fee pricing, informed decision-making ensures that you optimize your trading strategies for financial success.

If the TD Ameritrade flat fee vs. per contract pricing dilemma resonates with you, we encourage you to share your experiences or questions in the comments section below. Join the discussion and let’s collectively navigate the complexities of options trading while minimizing cost implications.