Delving into the dynamic realm of financial markets, let us embark on a journey to unravel the intricacies of listed equity options and their cessation of trading. Understanding this crucial aspect will empower traders with a profound grasp of the intricacies involved in these investment vehicles and adequately equip them for informed decision-making.

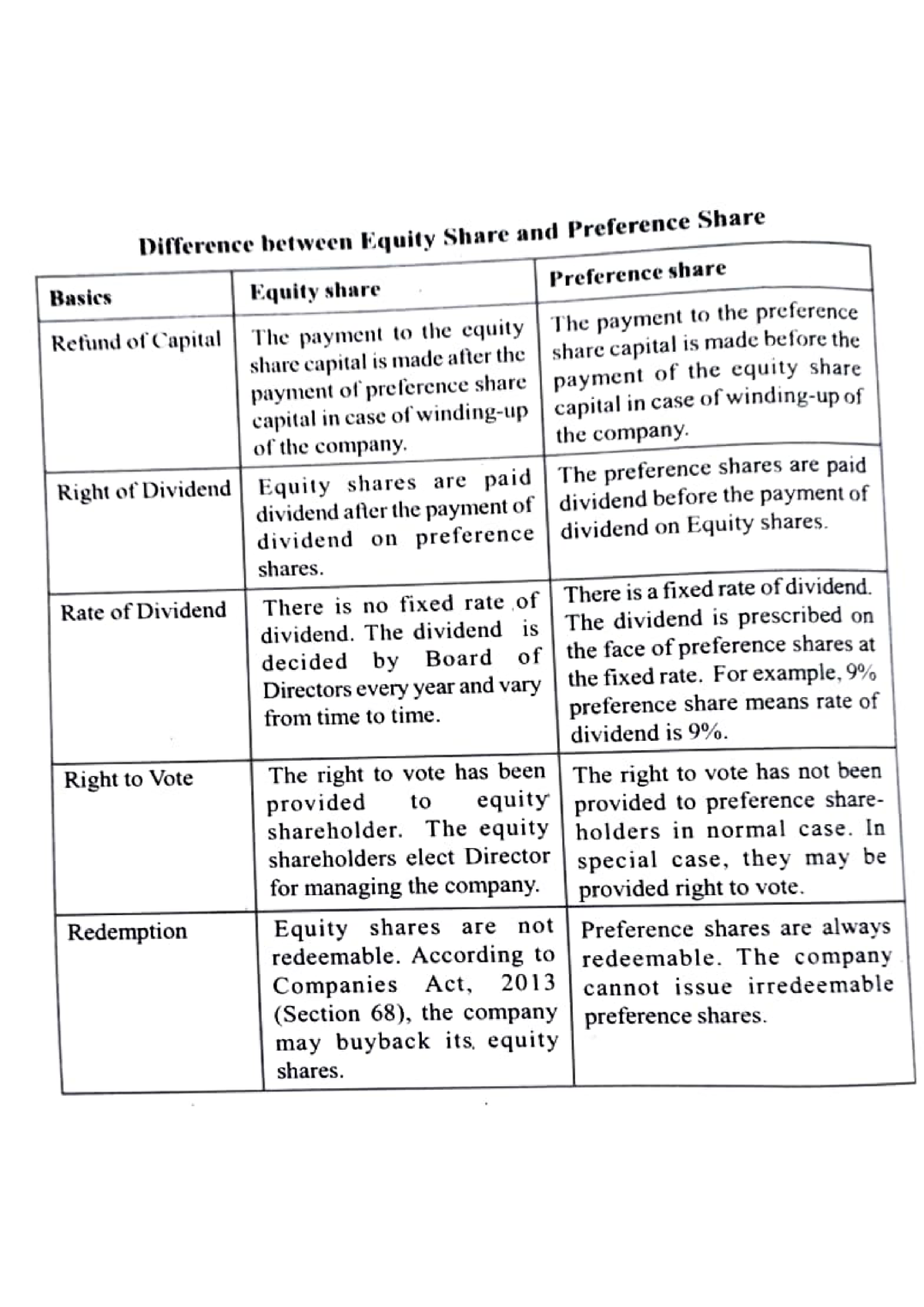

Image: www.studocu.com

Equity options, derivatives representing the right but not the obligation to buy or sell an underlying security at a predetermined price on or before a specific date, play a pivotal role in managing financial risk and enhancing portfolio returns. However, these instruments do not exist perpetually, and their trading may cease under certain circumstances.

Reasons for Cessation of Trading Listed Equity Options

Several factors can trigger the cessation of trading for listed equity options. Let us delve into each of these catalysts:

Consequences of Trading Cessation

The cessation of trading for listed equity options carries significant implications for market participants. It’s essential to comprehend these consequences:

Expert Insights and Best Practices for Option Trading

To gain deeper insights, we consulted with a seasoned financial advisor who shared valuable advice:

Know Your Options: Familiarity with different equity option types and their characteristics is paramount. Understand the potential risks and rewards associated with each contract.

Monitor Trading Information: Stay informed about the trading status of equity options, including expiration dates and any regulatory or exchange announcements.

Set Trading Strategies: Develop a trading strategy aligned with your financial goals and tolerance for risk. Consider factors such as market conditions, investment horizon, and potential for profit and loss.

Manage Risk Effectively: Employ prudent risk management techniques, such as diversification, position sizing, and setting stop-loss orders to mitigate potential losses.

Seek Professional Advice: Consult with a qualified financial advisor or broker who can provide tailored guidance and support based on your individual circumstances.

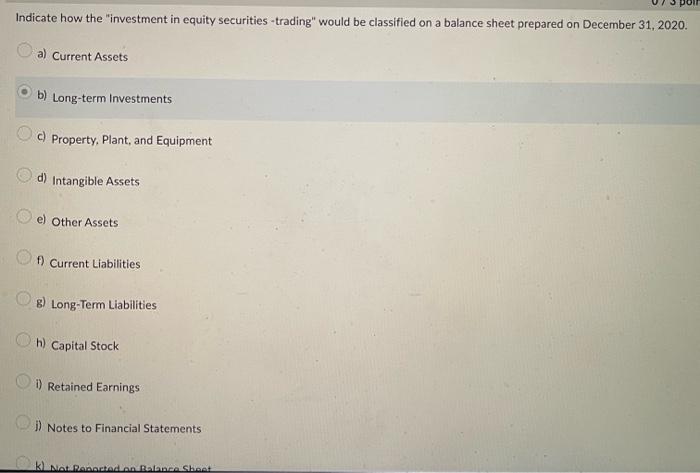

Image: www.chegg.com

Sie Quizlet Listed Equity Options Cease Trading At

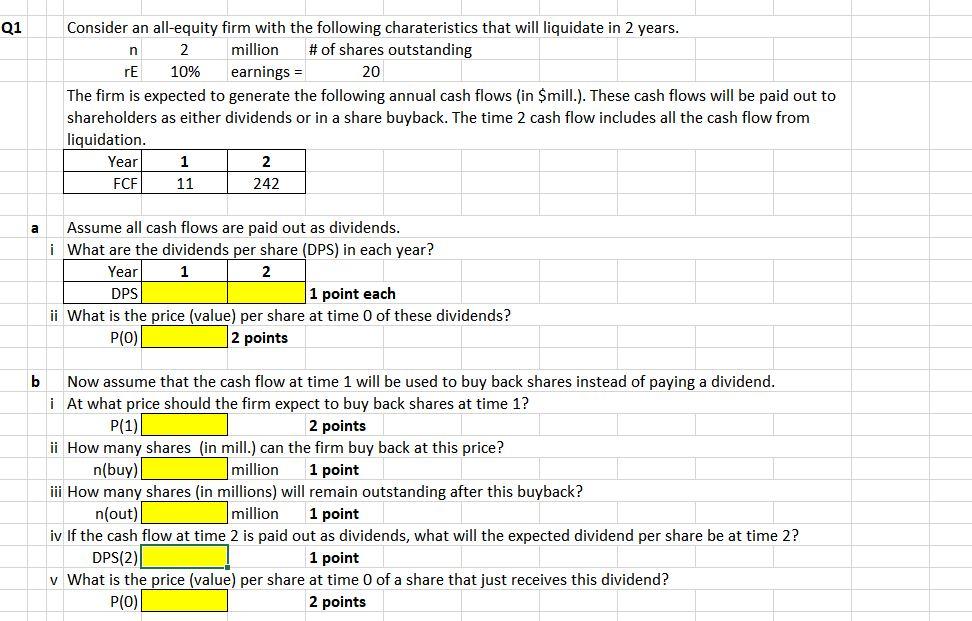

Image: www.chegg.com

Conclusion

Navigating the world of listed equity options requires a comprehensive understanding of the factors that can lead to their cessation of trading. By grasping the reasons behind trading cessations and their implications, traders can make informed decisions, manage risk effectively, and maximize their chances of success in this dynamic financial market.

Remember, knowledge and preparedness are vital when venturing into the realm of equity options. Embrace continuous learning, seek expert advice when needed, and trade with prudence to harness the potential benefits of these financial instruments while mitigating associated risks.