The world of options trading can be daunting, particularly when navigating the intricacies of pricing structures. Two prevalent models are cost per contract and flat fee pricing, each offering distinct advantages and drawbacks for traders. This article will delve into these pricing models, helping you make informed decisions about which best aligns with your trading strategy.

![TD Ameritrade Review [2024] - Top Choice For US Traders](https://www.compareforexbrokers.com/wp-content/uploads/2020/09/TD-Ameritrade-Options.png)

Image: www.compareforexbrokers.com

Understanding Options Trading

Options are derivative instruments that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a specific date (expiration date). When trading options, traders pay a premium to the seller in exchange for this flexibility. The premium acts as the price of the contract, influenced by factors such as the underlying asset’s price, time to expiration, volatility, and interest rates.

Cost Per Contract Pricing

As its name suggests, cost per contract pricing charges a set fee for each options contract traded. This fee remains constant regardless of the contract’s volume or underlying asset price. For instance, if a trader buys two call options with a premium of $1 per contract, they will pay a total of $2 in premiums.

Advantages of Cost Per Contract Pricing:

- Simplicity and Predictability: The cost per contract is transparent, making it straightforward to calculate trading costs.

- Lower Costs for Small Trades: For small trades involving a few contracts, cost per contract pricing can be more cost-effective than flat fee pricing.

Image: www.warriortrading.com

Disadvantages of Cost Per Contract Pricing:

- Higher Costs for Larger Trades: As the number of contracts traded increases, the total cost can become prohibitively expensive, especially for large option blocks.

- Limited Scaling Potential: The cost per contract pricing model does not incentivize volume discounts or tiered pricing, potentially hindering scalability for frequent traders.

Flat Fee Pricing

Flat fee pricing, also known as a monthly or subscription model, charges a fixed monthly or annual fee that allows traders to trade an unlimited number of options contracts within that period. The fee does not vary based on the volume of contracts traded or the underlying asset’s price.

Advantages of Flat Fee Pricing:

- Cost Savings for High-Volume Traders: For traders with a consistently high volume of options trades, flat fee pricing can lead to significant cost savings.

- Unlimited Trading: Traders are not limited by per-contract fees, allowing them to execute as many trades as desired within the subscription period.

- Incentivizes Scalability: Flat fee pricing encourages traders to increase their trading volume, fostering scalability for profitable strategies.

Disadvantages of Flat Fee Pricing:

- Higher Costs for Occasional Traders: Traders with infrequent trading activity may find the flat fee to be an unnecessary expense, resulting in higher trading costs.

- Complexity in Calculating Costs: Estimating the true cost per contract under flat fee pricing can be challenging, especially for traders with variable trading volumes.

Which Pricing Model is Right for You?

The optimal pricing model for options trading depends on your trading habits, budget constraints, and risk tolerance. Consider the following factors when making a decision:

- Trading Volume: Traders with high trade volumes will benefit from flat fee pricing, while occasional traders may prefer cost per contract pricing.

- Risk Tolerance: The potential for large losses should be factored into your pricing model decision. Flat fee pricing can mitigate the risks associated with high-volume trading.

- Budget: The fixed fee nature of flat fee pricing provides stability for monthly expenses, while cost per contract pricing can fluctuate based on trading activity.

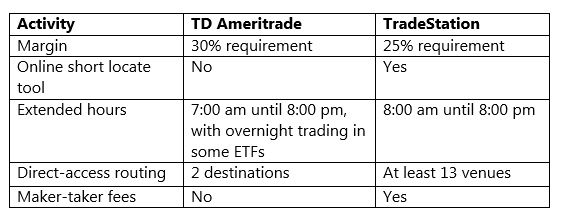

Td Ameritrade Options Trading Cost Per Contract Verses Flat Fee

Image: toughnickel.com

Conclusion

Both cost per contract and flat fee pricing models have their merits, catering to different trading needs and risk appetites. Whether you are a seasoned options trader or just starting out, understanding the nuances of these pricing structures is essential for optimizing your trading strategy and maximizing profitability. By carefully considering your trading habits and financial objectives, you can choose the pricing model that best suits your needs and sets you up for success in the dynamic world of options trading.