Introduction

In the realm of investing, options trading offers traders the tantalizing potential for exceptional returns. However, it’s crucial to understand the associated costs, as fees can significantly impact your profitability. Among the leading brokerage firms, TD Ameritrade stands out as a popular choice for options traders. In this article, we will embark on a deep dive into TD Ameritrade’s options trading fees, providing you with the knowledge you need to make informed decisions and maximize your trading performance.

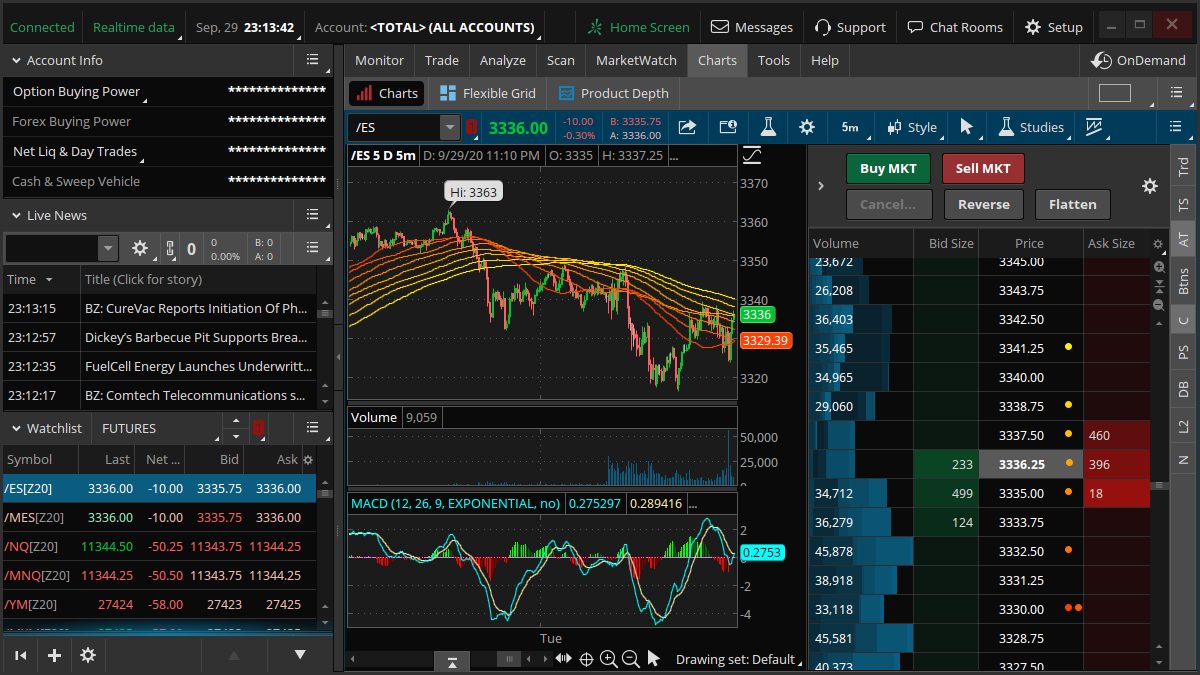

Image: www.forexsfxgroup.com

Understanding Options Trading Costs

Options trading involves two fundamental types of fees: options contracts fees and brokerage commissions. Options contracts fees, also known as premiums, represent the price you pay to acquire an options contract. The premium depends on factors such as the underlying asset’s price, volatility, time to expiration, and the type of option you are buying (call or put).

Brokerage commissions are charged by the brokerage firm for executing your trade. These commissions typically take the form of a flat fee per contract, usually ranging from $0.65 to $0.75 per contract. TD Ameritrade’s brokerage commissions are competitive compared to other industry leaders.

TD Ameritrade’s Options Trading Fee Structure

TD Ameritrade employs a straightforward and transparent fee structure for options trading. The basic commission structure for a single-leg option trade is as follows:

- $0.65 per contract for options trades with premiums below $0.05

- $0.75 per contract for options trades with premiums of $0.05 or higher

Additional fees may apply for certain types of options trading strategies, such as spreads or combinations. It’s always wise to consult TD Ameritrade’s fee schedule for a comprehensive understanding of all applicable charges.

Expert Insights and Actionable Tips

Seasoned options traders advise aspiring traders to consider the following strategies to mitigate fees:

-

Choose options with higher premiums. While options with higher premiums come with a corresponding higher cost, they also offer greater potential for returns and can offset the impact of fees.

-

Opt for multi-leg strategies. Spreads and combinations involve buying and selling multiple options contracts simultaneously. While these strategies can be more complex, they can also reduce overall fees.

-

Maximize trading volume. TD Ameritrade offers volume discounts for traders who execute a high number of trades per month. By consolidating your trading activity with TD Ameritrade, you can unlock discounted fees.

Image: forextraders.guide

Td Ameritrade Fees For Options Trading

Image: pulse2.com

Conclusion

Understanding TD Ameritrade’s options trading fees is paramount for optimizing your trading experience. By familiarizing yourself with the fee structure and implementing prudent strategies, you can minimize expenses and enhance your potential for profitability. Always remember to consult TD Ameritrade’s fee schedule for the most up-to-date and comprehensive information. With the right knowledge and a disciplined approach, you can navigate the world of options trading confidently and efficiently.