Venturing into the realm of cryptocurrencies is an exhilarating endeavor, but navigating its complexities can be daunting. Options trading in cryptocurrency emerges as a sophisticated tool that empowers traders to explore a wider range of opportunities within this volatile market. Understanding the nuances of options trading is imperative to harness its potential effectively.

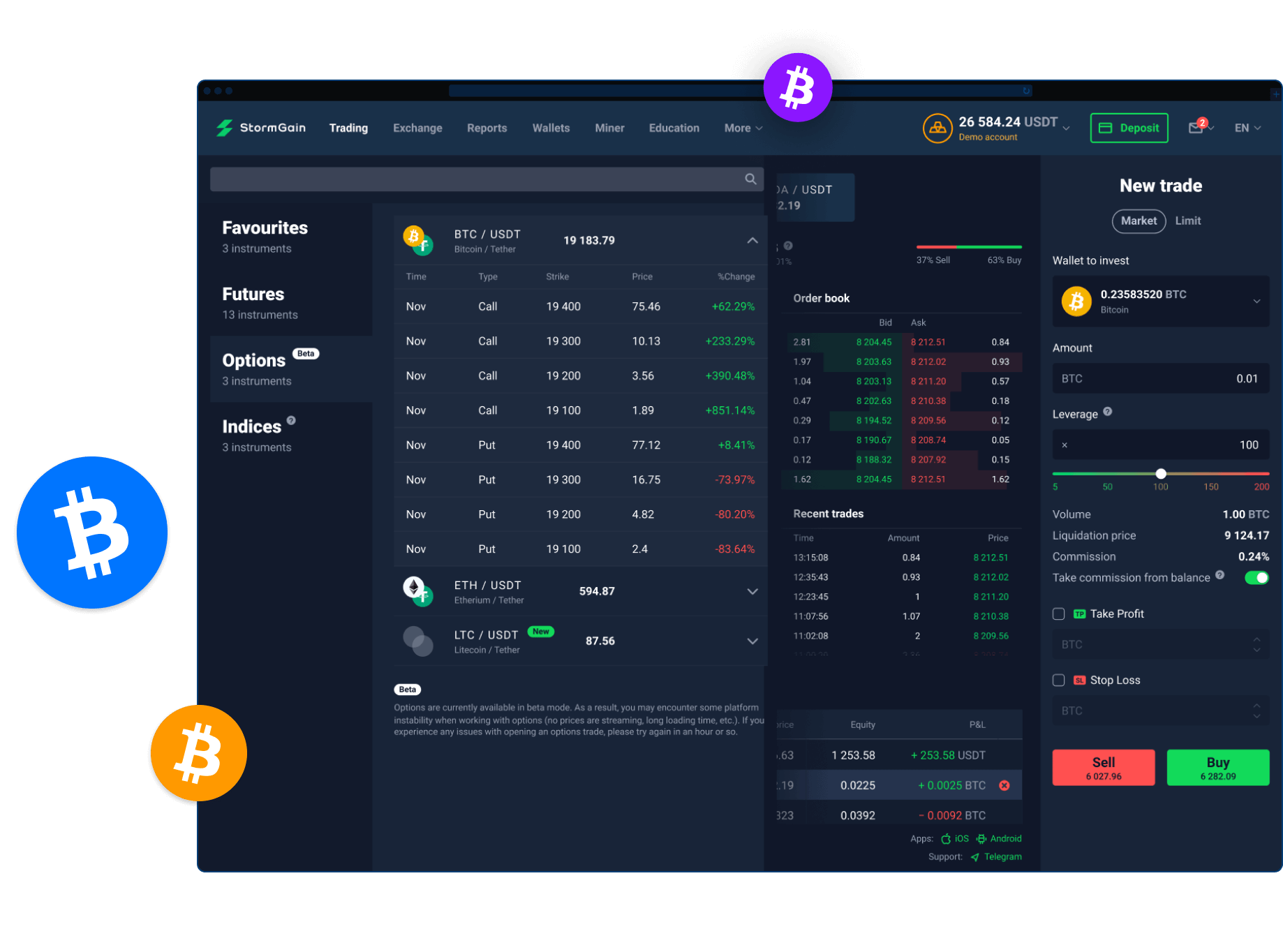

Image: stormgain.com

Deciphering Options Trading in Crypto: A Comprehensive Guide

1. Unveiling the Essence of Options Contracts

Options contracts, at their core, represent agreements that grant buyers the right, not the obligation, to either buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). In the context of cryptocurrency, these contracts facilitate sophisticated trading strategies, enabling traders to speculate on price movements without directly owning the underlying coin.

2. Delving into the Mechanics of Options Trading

Engaging in options trading necessitates a discerning understanding of its mechanisms. Call options confer the right to purchase the specified cryptocurrency at the strike price, while put options convey the right to sell. The premium is the price paid upfront to acquire an option contract, representing the cost of exercising this right. Its value fluctuates based on factors like volatility, time to expiration, and the underlying cryptocurrency’s price.

Image: freewallet.org

3. Unveiling the Dynamics of Options Pricing

Evaluating the value of options contracts is a crucial aspect of successful trading. Several factors influence their pricing, including the time remaining until expiration (time decay), implied volatility, and the price of the underlying cryptocurrency. Understanding these dynamics empowers traders to make informed decisions about purchasing or selling options.

Navigating the Crypto Options Landscape: Current Trends and Developments

The crypto options market is experiencing rapid evolution, with new developments constantly reshaping its landscape. Decentralized exchanges (DEXs) are gaining traction, offering innovative options trading options that leverage blockchain technology. Moreover, tailored options contracts emerge, catering to specific market conditions and trading strategies. Staying abreast of these advancements is crucial for traders to capitalize on the latest opportunities.

Mastering Options Trading: Tips and Expert Advice

Venturing into options trading demands a strategic approach to optimize returns. Seasoned traders recommend practicing with paper trading platforms, enabling traders to simulate trading strategies without risking capital. Additionally, thoroughly researching market trends, studying historical data, and seeking guidance from experienced mentors are invaluable practices for enhancing trading acumen.

Expanding Your Crypto Options Trading Skills

Mastering options trading in cryptocurrency requires ongoing education and skill development. Engaging in online forums, attending webinars, and consulting reputable resources can significantly enhance your understanding. Staying informed on industry updates and regulatory changes is also crucial for making well-informed trading decisions.

Frequently Asked Questions: Demystifying Options Trading in Crypto

Q: How do options differ from futures contracts?

A: Options provide buyers the right, but not the obligation, to execute a trade, while futures contracts impose an obligation to buy or sell the underlying asset.

Q: What are the risks associated with options trading?

A: Options trading carries the risk of losing the premium paid to purchase the contract if it expires worthless. Additionally, price movements contrary to the trader’s expectations can result in significant losses.

Q: How do I determine which options trading strategy is suitable for me?

A: Selecting an appropriate options trading strategy depends on your risk tolerance, time horizon, and market outlook. Consult with experienced traders and conduct thorough research to identify the strategy that aligns with your goals.

What Is Options Trading Crypto

Image: nairametrics.com

Conclusion: Embracing the Potential of Options Trading in Crypto

Options trading in cryptocurrency offers a sophisticated approach to capitalizing on market fluctuations. By understanding the fundamentals of options contracts, navigating the latest trends, and implementing effective trading strategies, you can unlock the true potential of this dynamic market. Embark on the journey of options trading in crypto today and seize the opportunities that this ever-evolving landscape presents.

Are you eager to delve deeper into the world of crypto options trading? Share your thoughts and experiences in the comments below!