In the tumultuous realm of financial markets, option strategies offer nimble investors the potential to navigate uncertainty and capture profits even in volatile environments. Among these strategies, straddle option trading stands out for its ability to generate returns from both rising and falling prices.

Image: boomingbulls.com

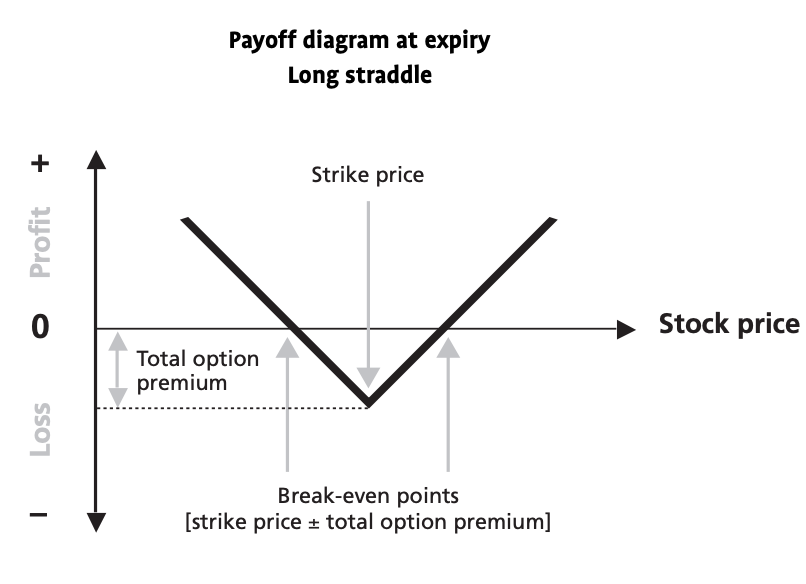

Simply put, a straddle involves simultaneously buying both a call and a put option with the same strike price and expiration date. This creates a neutral position, allowing traders to profit from a significant price movement in either direction.

Harnessing the Power of Volatility

The allure of straddle option trading lies in its ability to exploit market volatility. When uncertainty reigns supreme, the premiums of both calls and puts tend to soar. By purchasing both options, traders lock in the potential for profits regardless of the direction the underlying asset takes.

This strategy is particularly effective during earnings announcements, news events, or geopolitical crises, where prices can fluctuate wildly. Traders can capture returns by accurately predicting the magnitude of the price movement, even if they cannot forecast the exact direction.

Navigating the Market Landscape

To execute a successful straddle option trade, traders must carefully consider several factors:

- Underlying Asset: Identify instruments with high volatility or anticipated market-moving events.

- Strike Price: Set the strike price slightly away from the current market price to account for potential price movement.

- Expiration Date: Choose an expiration date that aligns with the anticipated duration of the price swing.

Expert Guidance for Straddle Option Traders

Seasoned traders emphasize the importance of risk management and discipline in straddle option trading. Here are some expert tips:

- Define Risk Threshold: Establish clear limits for potential losses before entering the trade.

- Monitor Position Closely: Track market conditions and be prepared to adjust or exit positions as volatility subsides.

- Maximize Potential: Consider using leverage to amplify profits, but remember that it also increases risk.

Image: www.adigitalblogger.com

FAQs on Straddle Option Trading

Q: What is the purpose of a straddle option trade?

A: To profit from significant price movements in either direction while maintaining a neutral position.

Q: Is straddle option trading suitable for all investors?

A: It’s more appropriate for experienced traders with a higher risk tolerance and a good understanding of market volatility.

Straddle Option Trading

Image: optionalpha.com

Conclusion

Straddle option trading offers investors a powerful tool for navigating uncertain markets and capturing profits. By harnessing market volatility and executing trades with precision, traders can reap rewards while mitigating risk. Remember, the path to success in straddle option trading lies in sound strategy, disciplined trading, and a deep understanding of market dynamics.

If you find this article informative and would like to delve deeper into the world of straddle option trading, we encourage you to explore additional resources, connect with experienced traders, and continue to educate yourself in this captivating field.