Introduction

In today’s dynamic financial landscape, self-directed futures and options trading empowers investors with the freedom and potential to augment their returns. Unlike traditional investment vehicles, these strategies offer a greater degree of control and the ability to customize trades to suit individual objectives. Understanding the intricacies of these instruments can unlock the gateway to enhanced financial growth and resilience.

Image: pyqudow.web.fc2.com

This comprehensive guide delves into the world of self-directed futures and options trading, providing a detailed analysis of the underlying concepts, strategies, and potential rewards. Written in a clear and engaging style, it equips readers with the knowledge and tools to confidently navigate the intricacies of these markets, enabling them to make informed decisions and maximize their investment outcomes.

Understanding Futures and Options

Futures contracts are legally binding agreements to buy or sell a specific quantity of an underlying asset at a predetermined price on a specified future date. They enable investors to lock in prices and mitigate market risk, providing protection against adverse price fluctuations. Options contracts, on the other hand, confer the right, but not the obligation, to buy or sell an underlying asset at a set price within a certain time frame. These instruments offer investors the flexibility to speculate on price movements or hedge against potential losses.

Advantages of Self-Directed Trading

Self-directed futures and options trading offers numerous advantages that traditional investment options may not provide. Firstly, it empowers traders with greater control over their financial destiny, allowing them to execute trades based on their own insights and convictions. Secondly, these markets offer higher levels of liquidity, enabling traders to enter and exit positions swiftly with minimal slippage. Thirdly, the potential for leverage can amplify profits, though it is crucial to manage risk effectively. Lastly, futures and options can be utilized for a variety of strategies, including hedging, income generation, and asset diversification.

Basics of Futures Trading

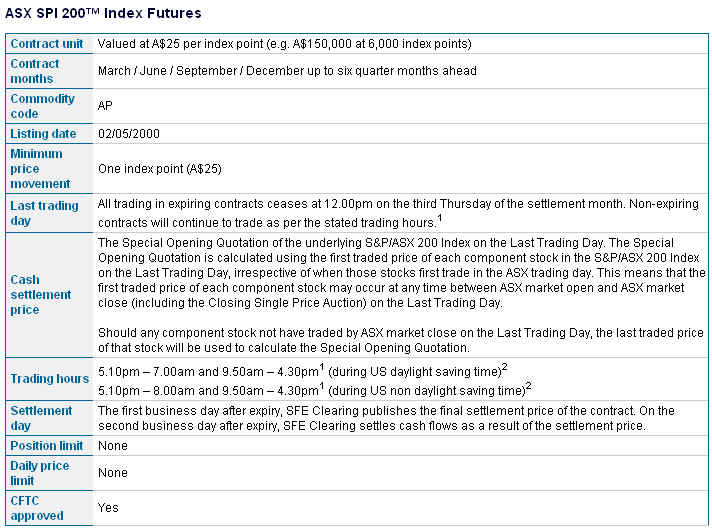

Futures contracts are standardized agreements traded on designated exchanges, with each contract representing a specific quantity of an underlying asset. Traders can buy or sell futures contracts based on their market outlook. If the price of the underlying asset moves in a favorable direction, traders can realize profits by selling or covering their positions at a higher price. Conversely, if the price moves against their positions, traders may incur losses.

Image: www.pinterest.com

Options Trading Strategies

Options contracts provide traders with a broader range of strategies to achieve their investment goals. Calls confer the right to buy, while puts confer the right to sell an underlying asset at a predefined price. Traders can employ a variety of strategies, such as buying or selling calls or puts, or combining them in sophisticated spreads, to profit from price movements or protect their portfolios.

Risk Management in Futures and Options Trading

Managing risk effectively is paramount to successful futures and options trading. Traders should carefully consider their risk tolerance and implement appropriate risk management strategies, such as setting stop-loss orders, position sizing, and diversification. Risk management helps maintain a healthy balance between reward and risk, minimizing potential losses while preserving capital.

Self-Directed Futures And Options Trading

Image: www.pinterest.com

Conclusion

Self-directed futures and options trading offers investors a powerful tool to actively manage their financial futures. By understanding the underlying concepts, strategies, and potential rewards, traders can unlock the power of these markets and enhance their financial prowess. However, it is crucial to approach these markets with a sound understanding of the risks involved and a commitment to prudent risk management. By embracing the principles outlined in this comprehensive guide, investors can confidently navigate the complexities of futures and options trading, positioning themselves for financial success in the dynamic world of investing.