How to Decipher the Volatility Chart for Informed Option Trading Calls

Image: mac.x0.com

Introduction

In the realm of option trading, volatility charts serve as essential navigation tools, guiding traders through the turbulent waters of market fluctuations. Understanding how to decipher these charts is paramount for making informed calls that can enhance your trading strategy. In this comprehensive guide, we unravel the secrets of volatility charts and empower you to harness their insights for profitable trades.

Understanding Volatility

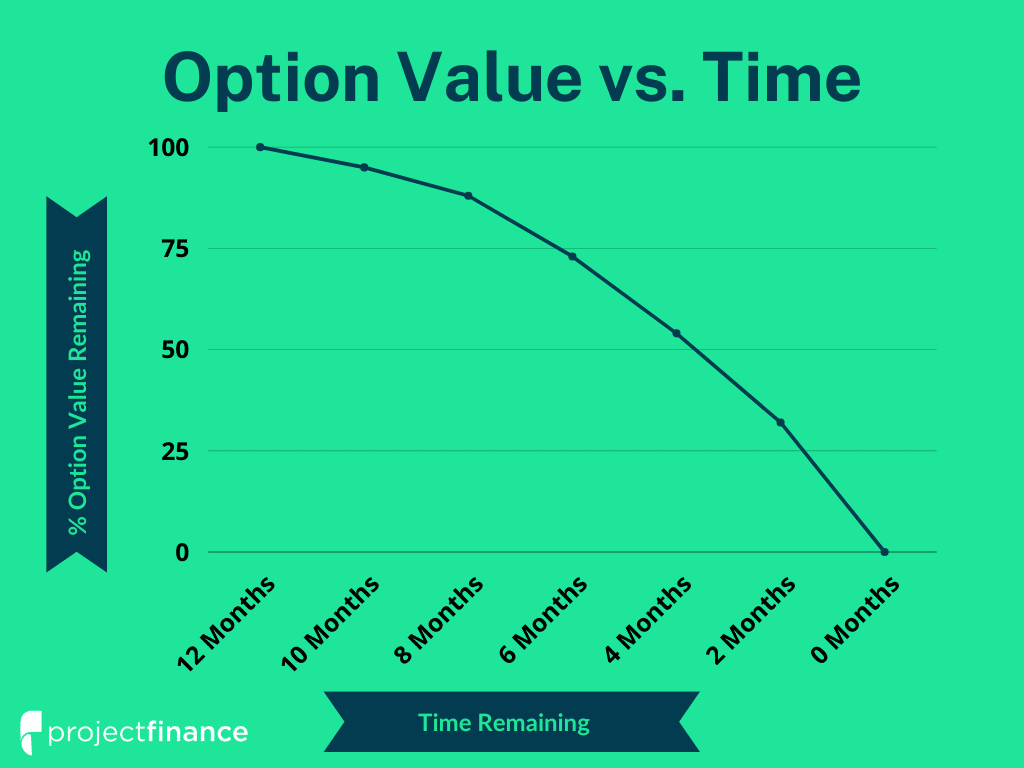

Volatility measures the extent of price fluctuations within an asset over a specific period. In option trading, volatility is a crucial factor as it directly impacts the value of options contracts. High volatility indicates significant price swings, while low volatility suggests a more stable market.

The Volatility Chart

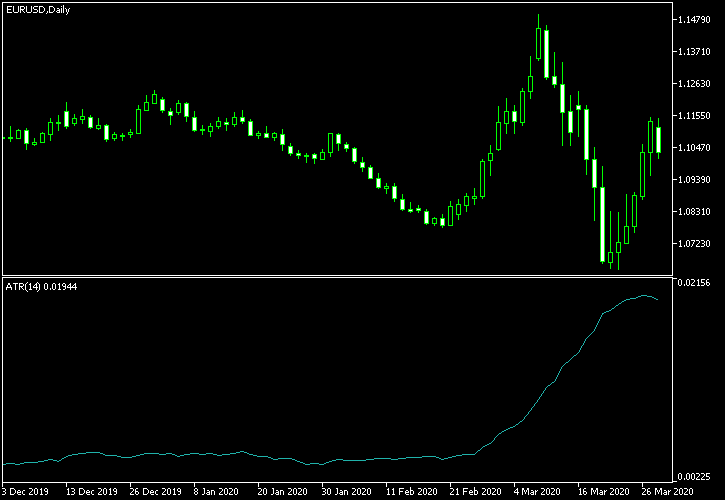

A volatility chart graphically represents the historical volatility of an asset calculated using statistical models. It often takes the form of a line graph, with time plotted on the horizontal axis and volatility on the vertical axis.

Interpreting the Chart

-

Volatility Levels: The primary takeaway from a volatility chart is the range of values it indicates, known as volatility levels. High volatility is represented by peaks on the graph, indicating substantial price movements. Conversely, low volatility is depicted by troughs, indicating a lull in market activity.

-

Trends: Volatility charts often reveal trends, which are sustained periods of elevated or subdued volatility. Upward trends suggest an increase in price fluctuations, potentially creating profitable opportunities for traders. Downward trends signal a decrease in volatility, potentially indicating a more cautious trading approach.

-

Historical Data: Volatility charts provide valuable historical data that traders can analyze to identify patterns and make informed decisions. By observing past volatility levels and their impact on option prices, traders can develop a better understanding of market behavior and potential trading opportunities.

-

Implied Volatility: Volatility charts also incorporate implied volatility, which represents the market’s prediction of future volatility based on current option prices. Higher implied volatility suggests that the market anticipates significant price movements, potentially leading to higher option premiums. Lower implied volatility indicates a perceived stability, resulting in lower option premiums.

Applying Volatility Insights

-

Long Option Trades: High implied volatility (often seen during market rallies) can benefit traders selling options. By selling calls or puts at a higher price, traders can capitalize on the inflated premiums and potential market downturns.

-

Short Option Trades: Low implied volatility (often seen during market consolidation) can be advantageous for traders buying options. By purchasing calls or puts at a lower price, traders can profit from a potential increase in volatility and subsequent price fluctuations.

Conclusion

Mastering the intricacies of volatility charts is a game-changer for option traders. By deciphering the information they provide, traders can gain valuable insights into market dynamics and make informed decisions that can elevate their trading strategies. Remember to conduct thorough research, analyze historical data, and consider market trends to develop a comprehensive understanding of the markets. Harnessing the power of volatility charts will empower you to navigate the complexities of option trading with confidence and potentially reap substantial rewards.

Image: www.victoriana.com

How To Read A Volatility Chart For Option Trading Call

Image: cafeforexvn.com