Options trading is as old as the stock market itself. The first recorded option trade was in 1688 in Amsterdam, but it wasn’t until the 1970s that options trading really took off. In the 1980s and 1990s, options trading volume exploded, and by the early 2000s, options volume was at an all-time high.

Image: udilisavu.web.fc2.com

Subtitle: The Rise of Index Options

One of the major factors that contributed to the growth of options trading volume was the introduction of index options. Index options are options contracts that are based on the value of a stock index, such as the S&P 500. Index options were first introduced in 1983, and they quickly became popular because they allowed investors to hedge their portfolios against market risk.

The increased popularity of index options led to a corresponding increase in options volume. In the early 2000s, options volume on the Chicago Mercantile Exchange (CME) reached record highs. The CME is the largest options exchange in the world, by volume and number of contracts traded.

Subtitle: The Decline of Options Trading Volume

However, in the years since the financial crisis of 2008, options trading volume has declined significantly. There are a number of factors that have contributed to this decline, including increased regulation, the rise of electronic trading, and the increased popularity of exchange-traded funds (ETFs).

Increased regulation has made it more expensive and difficult to trade options. The Dodd-Frank Wall Street Reform and Consumer Protection Act, which was passed in 2010, imposes a number of new regulations on options trading. These regulations include increased margin requirements, stricter clearing rules, and a new requirement for brokers to provide investors with more information about options trading.

The rise of electronic trading has also contributed to the decline in options volume. Electronic trading platforms make it easier for investors to trade options, and they have also led to a decrease in the cost of trading. This has made it more difficult for traditional options brokers to compete.

Finally, the increased popularity of ETFs has also led to a decline in options volume. ETFs are baskets of stocks that are traded on exchanges like stocks. Because ETFs are diversified, they have lower risk than individual stocks. As a result, many investors are choosing to invest in ETFs instead of options.

Tips and Expert Advice for Options Traders

If you’re interested in trading options, there are a few things you should keep in mind. First, it’s important to educate yourself about options trading. There are a number of resources available online and at your local library that can help you learn the basics of options trading.

Second, it’s important to choose the right options strategy for your needs. There are a number of different options strategies available, and each one has its own advantages and disadvantages. It’s important to choose a strategy that is right for your risk tolerance and investment goals.

Third, it’s important to manage your risk carefully. If you don’t manage your risk carefully, you can lose a lot of money trading options. There are a number of ways to manage your risk, such as using stop-loss orders and position sizing.

Image: cryptopotato.com

FAQs on Options Trading

Q: What is an options contract?

A: An options contract is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price (the strike price) on or before a specified date (the expiration date).

Q: What are the different types of options contracts?

A: There are two types of options contracts: calls and puts. A call option gives the buyer the right to buy an underlying asset at a specified price on or before a specified date. A put option gives the buyer the right to sell an underlying asset at a specified price on or before a specified date.

Q: What are the risks of options trading?

A: There are a number of risks associated with options trading, including the risk of losing the entire investment, the risk of unlimited losses, and the risk of early exercise.

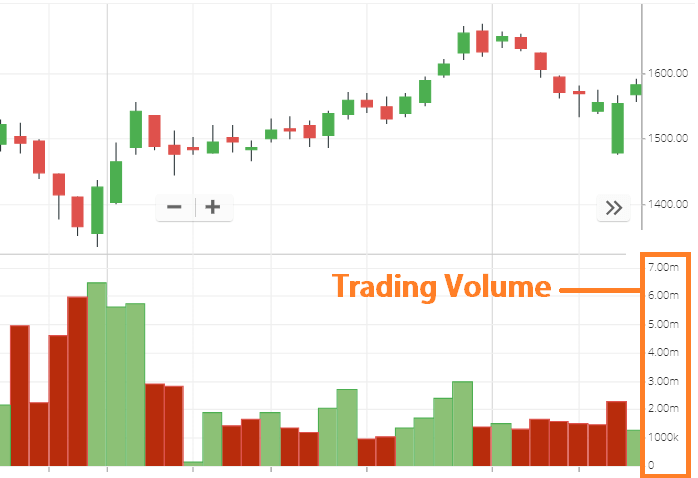

Options Trading Volume History

Image: earnfo.com

Conclusion

Options trading can be a complex and risky business, but it can also be a very rewarding one. If you decide to trade options, it’s important to do your research, choose the right options strategy for your needs, and manage your risk carefully.

Would you like to know more about the history or options trading volume?