Welcome to the realm of Nasdaq options trading, where you hold the power to leverage market fluctuations and potentially multiply your profits. In this comprehensive guide, we will delve into the intricacies of options trading, equipping you with the knowledge and strategies to navigate this dynamic and rewarding financial landscape.

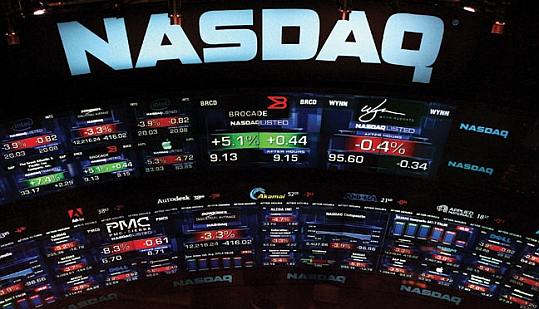

Image: www.dailyfx.com

Before embarking on our journey, let’s take a moment to reflect on the Nasdaq’s rich history. Established in 1971, it has emerged as a technological powerhouse, serving as a hub for tech giants such as Microsoft, Apple, and Amazon. Nasdaq’s options market, a derivative of its underlying stocks, has become an integral part of the financial ecosystem, providing investors with a unique opportunity to participate in the growth of the world’s leading technology companies.

Nasdaq Options: An Overview

In the realm of options trading, you have the flexibility to Buy or Sell contracts representing a particular stock at a fixed price within a predetermined time frame. Unlike traditional stock trading, options grant you the right, not the obligation, to execute a transaction. This feature allows you to speculate on the future price movements of a stock without committing to a full purchase or sale.

Options are classified into two primary types – Calls and Puts. Call options convey the right to buy the stock at a predetermined “strike price” before a specified “expiration date.” Conversely, Put options provide the right to sell at the strike price by the expiration date. The interplay of these contracts enables traders to make informed decisions based on market forecasts and risk tolerance.

Navigating Options Contracts

To master Nasdaq options trading, it’s crucial to understand how these contracts are structured. Each contract represents 100 shares of the underlying stock. For instance, if you purchase a Call option for Apple (AAPL) with a strike price of $150 and an expiration date of January 2024, you gain the right to buy 100 shares of AAPL at $150 per share anytime before the contract’s expiry.

The price you pay for an options contract is known as the “premium.” This premium represents the sum of the intrinsic value (the potential profit if you were to exercise the option immediately) and the time value (the price you pay for the right to exercise the option in the future).

Understanding Nasdaq Options Strategies

Seasoned options traders employ a diverse range of strategies to maximize their profits and manage risk, depending on their market outlook and risk appetite. Here are a few fundamental strategies:

Image: roulettetrader.com

Buying Calls

When you anticipate a stock price to rise, buying a Call option allows you to capitalize on the upside potential while limiting your risk to the premium paid. This strategy becomes particularly lucrative if the stock price surges beyond the strike price.

Selling Calls (Covered Call)

If you own the underlying stock and believe its price will stay within a certain range, you can sell (or write) a Covered Call. By selling a Call option against your stock holdings, you collect an upfront premium in exchange for the obligation to sell those shares at the strike price if the price climbs above it. This strategy can generate income while limiting your upside potential.

Tips and Expert Advice for Successful Nasdaq Options Trading

To excel in Nasdaq options trading, it’s imperative to heed the advice of seasoned experts. Here are some valuable tips to enhance your trading journey:

Due Diligence and Risk Management

Before venturing into options trading, conduct thorough research, comprehending the potential rewards and risks involved. Always allocate only the capital you can afford to lose, mitigating the impact of potential adverse market movements.

Time Decay

Options contracts have a limited lifespan. As the expiration date approaches, the time value of the option erodes. This means that the value of the contract decreases over time, even if the underlying stock price remains unchanged. Be mindful of this time decay and adjust your trading strategies accordingly.

Frequently Asked Questions on Nasdaq Options Trading

Q: What is the minimum capital required to trade Nasdaq options?

A: Capital requirements for options trading vary depending on the brokerage firm and the options contracts being traded.

Q: Can I trade Nasdaq options without owning the underlying stock?

A: Yes, you can trade Nasdaq options without owning the underlying stock by buying or selling Call and Put options.

Nasdaq Options Trading Guide

Image: www.dailyfx.com

Conclusion

Nasdaq options trading presents a compelling opportunity to tap into the growth potential of the world’s leading technology companies. By understanding the fundamentals, employing effective strategies, and seeking expert advice, you can maximize your chances of success in this dynamic and rewarding market.

However, it’s important to note that options trading involves substantial risk and should only be undertaken with a clear understanding of the risks involved. If the topic interests you, I highly encourage you to explore our website for more in-depth resources and insights.