Introduction

In the dynamic and ever-evolving financial landscape, options trading has emerged as a powerful tool for investors to navigate market uncertainty, hedge against risk, and amplify their returns. Options trading strategies are complex yet intriguing, providing numerous possibilities for skilled traders to capitalize on market movements. In this comprehensive guide, we delve into the world of options trading strategies in India, empowering investors with the knowledge and insights to unlock the potential of this transformative financial instrument.

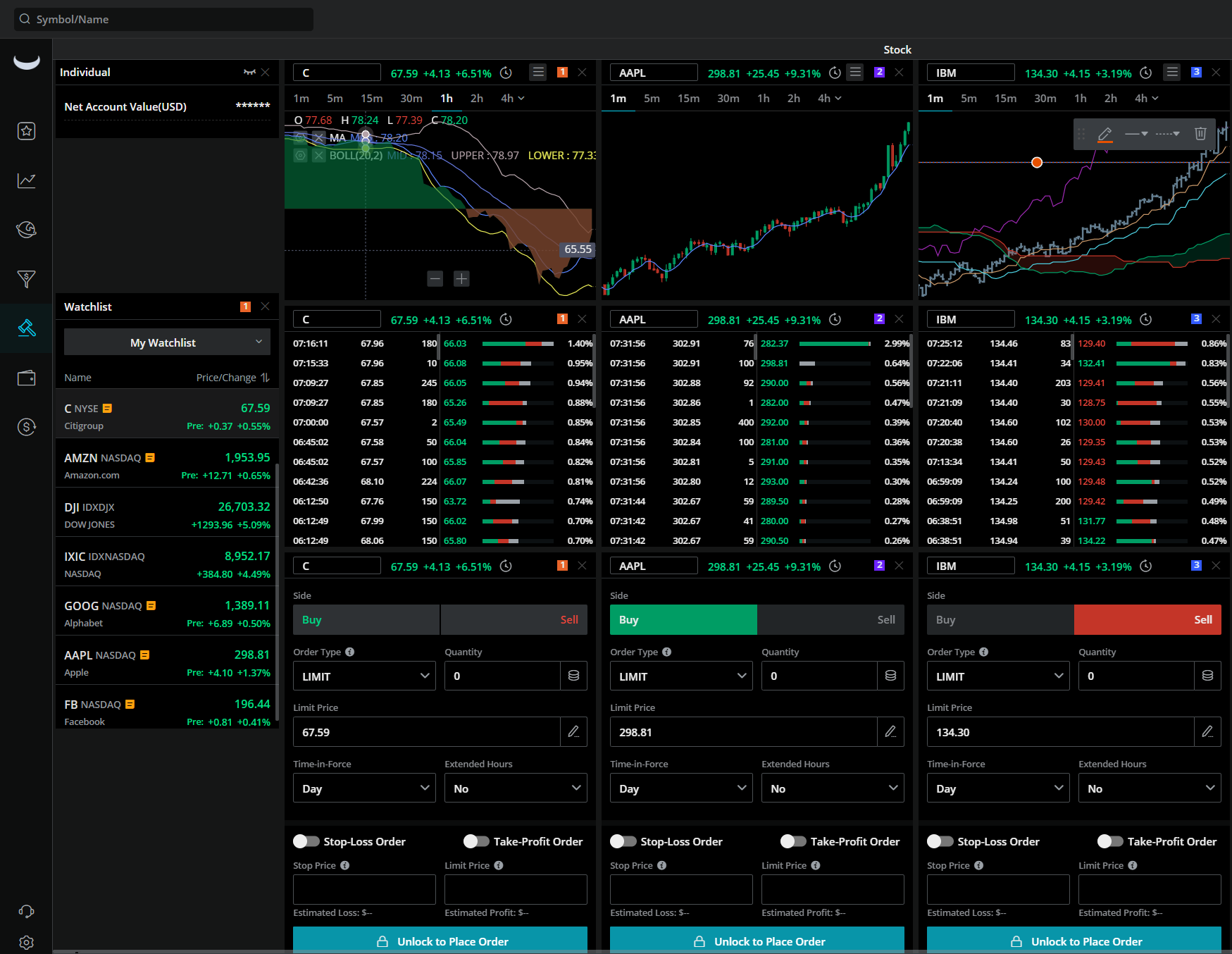

Image: www.stockbrokers.com

Options are derivative instruments that derive their value from underlying assets such as stocks, commodities, or currencies. They grant the holder the right, but not the obligation, to buy or sell the underlying asset at a predetermined price (the strike price) on a specified date (the expiration date). By incorporating options into their investment strategies, traders can enhance their flexibility, manage risk, and potentially generate substantial returns.

Types of Options and Strategies

Options fall into two primary categories: calls and puts. Call options provide the right to buy the underlying asset, while put options offer the right to sell. Traders can employ various strategies based on their market outlook and risk tolerance. Some popular options trading strategies include:

- Covered Call: Involves selling covered call options against stocks owned by the trader, generating additional income while hedging against potential declines.

- Cash-Secured Put: Similar to covered calls, but involves selling cash-secured put options, providing a potential source of income and an obligation to buy the underlying asset if the option is exercised.

- Bull Call Spread: Involves buying a call option at a lower strike price and selling a call option at a higher strike price, creating a bullish position with limited risk and potential for unlimited profits.

- Bear Put Spread: Similar to a bull call spread, but creates a bearish position with limited risk and potential for unlimited profits.

- Iron Condor: A neutral strategy involving selling both a call and a put option at a higher strike price and buying a call and a put option at a lower strike price, creating a range-bound position.

Selecting a Broker and Trading Platform

Choosing the right broker and trading platform is crucial for successful options trading in India. Investors should consider factors such as brokerage fees, trading fees, platform capabilities, customer support, and reputation. Some reputable options trading brokers in India include HDFC Securities, ICICI Direct, and Kotak Securities.

Managing Risk

Risk management is paramount in options trading. Volatility, leverage, and time decay can significantly impact profit and loss. Traders should develop robust risk management strategies, including proper position sizing, setting stop-loss orders, and understanding implied volatility. It’s advisable to trade within one’s financial means and never risk more than one can afford to lose.

Image: www.ira-reviews.com

Strategies for Different Market Conditions

Effective options trading involves adapting strategies to different market conditions. In bullish markets, strategies such as long calls, bull call spreads, and covered calls can be suitable. Bearish markets favor strategies like short puts, bear put spreads, and cash-secured puts. Neutral or volatile markets may present opportunities for iron condors or straddle strategies.

Advantages and Disadvantages of Options Trading

Options trading offers several advantages, including flexibility, leverage, income generation, and diversification. However, it also comes with disadvantages such as complex strategies, limited time value, and the potential for substantial losses. Potential traders should thoroughly evaluate their investment objectives, risk tolerance, and financial situation before engaging in options trading.

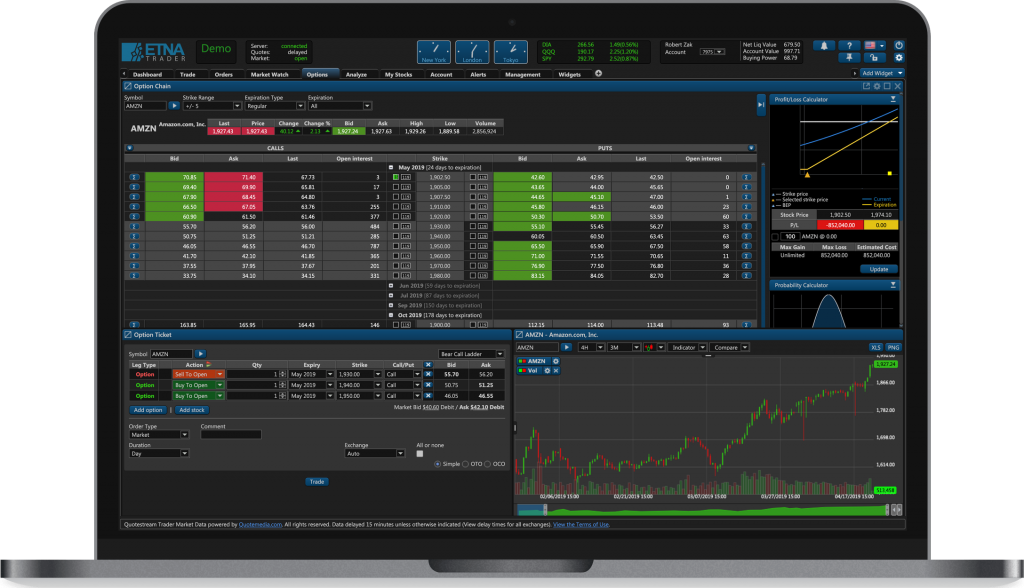

Options Trading Strategies Software India

Image: www.etnasoft.com

Conclusion

Options trading strategies in India provide investors with a powerful suite of tools to navigate market conditions, enhance returns, and manage risk. By understanding the different options strategies, selecting a reliable broker, implementing prudent risk management, and adapting to market conditions, investors can harness the potential of options trading to achieve their financial goals. Remember, education and continuous learning are key to successful options trading. Seek guidance from experienced professionals, stay updated on market trends, and always trade with caution to unlock the transformative benefits of options trading in the Indian market.