Introduction

As a budding oil trader, I was intrigued by the allure of the complex and volatile world of oil futures. The concept of using contracts to speculate on the future price of oil seemed both alluring and intimidating. In this comprehensive guide, I will delve into the intricacies of oil futures trading, unraveling its potential rewards and risks while providing actionable tips to navigate this dynamic market.

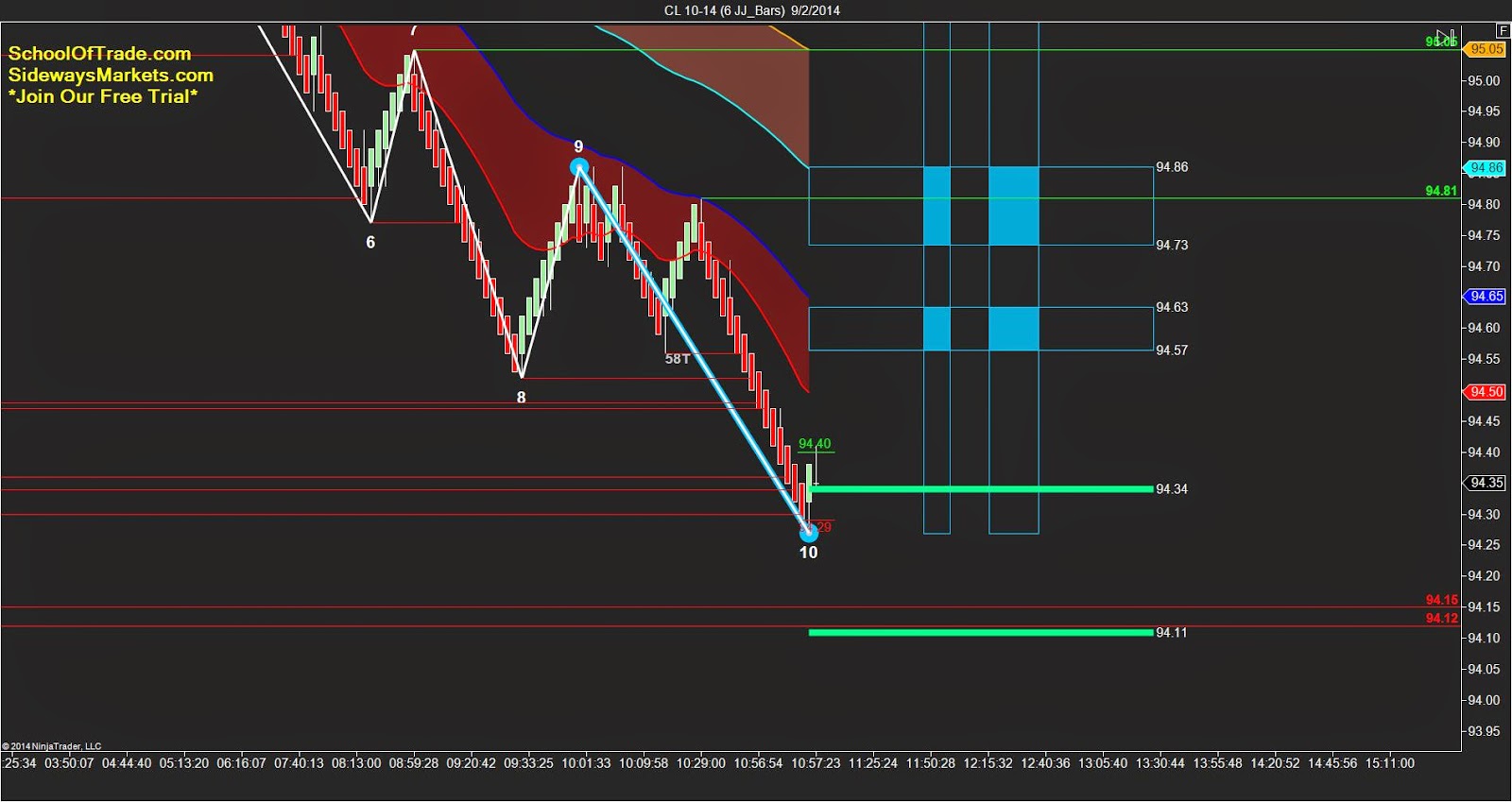

Image: www.sidewaysmarkets.com

What Are Oil Futures?

Oil futures are standardized contracts that represent an obligation to buy or sell a specific quantity of oil at a set price on a future date. These contracts trade on designated exchanges, such as the New York Mercantile Exchange (NYMEX), providing a marketplace for hedging and speculation.

The Role of Futures in Oil Trading

Futures contracts play a crucial role in oil trading by providing multiple benefits:

- Hedging: Producers, refiners, and other stakeholders use futures to lock in prices and protect against price volatility.

- Speculation: Traders speculate on the future price of oil, potentially reaping substantial profits if predictions align with market movements.

- Price Discovery: Futures prices reflect market expectations, providing valuable insights into future supply and demand.

Unveiling the Dynamics of Oil Futures Contracts

To grasp the essence of oil futures trading, it’s essential to dissect the key elements of these contracts:

Image: xelenew.web.fc2.com

Contract Size and Specifications

An oil futures contract represents 1,000 barrels of oil. Each contract corresponds to a specific oil grade, such as West Texas Intermediate (WTI) or Brent, and delivery dates vary from near-term to several months in the future.

Pricing and Settlement

Futures contracts are priced in dollars per barrel, and their value fluctuates based on market supply and demand. Settlement occurs on the contract’s expiration date, with physical delivery of the oil or a cash settlement based on the underlying benchmark price.

Understanding Oil Futures Trading Strategies

Traders employ diverse strategies in the oil futures market, ranging from hedging to speculative trading:

Hedging Strategies

Producers and refiners employ hedging strategies to minimize the impact of price fluctuations. They buy futures contracts at today’s price to ensure a minimum sales price for future production.

Speculative Trading Strategies

Speculative traders bet on future oil prices by buying or selling futures contracts. They profit if market movements align with their predictions and incur losses if the market moves against them.

The Current Landscape of Oil Futures Trading

The oil futures market continues to evolve, fueled by technological advancements and geopolitical factors:

Technological Advancements

Electronic trading platforms and automated execution have transformed oil futures trading. Traders now enjoy greater transparency, speed, and liquidity in the marketplace.

Geopolitical Influences

Global events, such as political instability, natural disasters, and trade disputes, can significantly impact oil prices and, by extension, the oil futures market.

Tips and Expert Advice for Navigating Oil Futures

Seasoned traders offer invaluable advice for success in the oil futures market:

Diligent Research and Analysis

Thorough research and market analysis are paramount. Monitor oil industry news, supply and demand data, and economic indicators to make informed trading decisions.

Risk Management

Risk management is critical. Determine your risk tolerance and trade only within those boundaries. Use stop-loss orders to limit potential losses.

Trading Psychology

Trading psychology plays a crucial role. Control emotions, avoid overtrading, and stick to your strategy even amidst market fluctuations.

Frequently Asked Questions (FAQ) on Oil Futures Trading

Q: How much capital do I need to start oil futures trading?

A: Initial capital requirements vary depending on the broker, but typically range from $5,000 to $25,000.

Q: What are the advantages of oil futures trading?

A: Futures trading offers opportunities for hedging, speculation, and price discovery. It also provides leverage, allowing traders to control large amounts of oil with a relatively small investment.

Q: What are the risks of oil futures trading?

A: Oil futures trading involves significant risk due to market volatility, geopolitical events, and other factors. Losses can exceed the initial investment.

Options Trading Oil Futures

Image: www.sidewaysmarkets.com

Conclusion

The world of oil futures trading presents both opportunities and challenges. With a comprehensive understanding of contract specifications, trading strategies, and risk management techniques, aspiring traders can navigate this dynamic market. Embark on the journey of oil futures trading with a thirst for knowledge, calculated risk-taking, and a commitment to ongoing learning.

Are you ready to explore the captivating world of oil futures trading and harness its potential for profit and hedging? Share your thoughts and experiences in the comments below.